Sensex gyrates 376 points, ends 66 points down; Sun Pharma zooms 10%, Tech M 7%

Domestic equities witnessed sharp profit booking in the fag end of the session as European stocks slipped in early trade and US stock futures hinted at a muted start on Wall Street later today.

After ruling higher for better part of the day, domestic equities witnessed sharp profit booking in the fag end of the session as European stocks slipped in early trade and US stock futures hinted at a muted start on Wall Street later today.

Concerns about the fast-spreading Delta variant and regulatory actions in China dragged the pan-European STOXX 600 index down 0.5 per cent while Dow Jones Futures were quoting 100 points, or 0.3 per cent, lower. Nasdaq Future, meanwhile, tumbled 1.1 per cent and those linked to S&P500 declined 0.6 per cent. Earlier in Asia, Nikkei skidded 2 per cent, and Kospi and Hang Seng erased over 1 per cent each.

Against this backdrop, the frontline S&P BSE Sensex gyrated 376 points in intra-day trade and ended 66 points, or 0.13 per cent, lower at 52,587 levels dragged by Bajaj Finance (down 2.5 per cent), Bajaj Finance, SBI, Tata Steel, Titan, Asian Paints, Axis Bank, IndusInd Bank, and Nestle India.

It’s NSE counterpart, Nifty50, shut shop at 15,763 levels, down 15 points or 0.1 per cent. The broader markets, however, outperformed with the BSE MidCap and SmallCap indices zooming 0.52 per cent an 0.69 per cent, respectively.

Sun Pharma rallied 9%, hits over 4-year high on strong June quarter results. The company reported better-than-expected consolidated sales from operations at Rs 9,669 crore, a growth of 29 per cent over Q1 last year and 14 per cent over Q4 last year. Analysts had expected 19.5 per cent YoY revenue growth for the quarter. The strong revenue growth was mainly due to 39 per cent YoY jump in domestic formulations to Rs 3,308 crore and 35 per cent YoY rise in the US formations to Rs 2,800 crore.

Laurus Labs rebounded 9% from the day’s low after 3 straight sessions of decline. On Thursday, Laurus Labs reported 31.1 per cent year-on-year (YoY) growth in revenue at Rs 1,278.5 crore, mainly driven by 95 per cent YoY jump in CRAMS (contract research & manufacturing services) business to Rs 195 crore and strong traction in formulations to Rs 521 crore with growth of 48 per cent YoY. Net profit grew 40 per cent YoY at Rs 241 crore.

Shares of Garware Hi-Tech Films were locked in the 5 per cent upper circuit band, at Rs 1,058.40 on the BSE on Friday, after investor Ashish Kacholia bought nearly one per cent additional stake in the commodity chemicals company via open market on Thursday. On July 29, 2021, Ashish Rameshchandra Kacholia purchased 141,871 equity shares, representing 0.61 per cent equity of Garware Hi-Tech Films, at a price of Rs 1,005 per share through bulk deal on the BSE.

Shares of Ashok Leyland edged higher by 10 per cent to Rs 137.45 on the BSE in intra-day trade on Friday on the back of heavy volumes after the commercial vehicle (CV) major lined up its electric vehicle (EV) road map on Wednesday. The stock Hinduja Group Company was trading close to its 52-week high level of Rs 138.85 touched on February 4, 2021.

Tech Mahindra surged 8.5%, hits new high as Q1 profit beats estimates. The consolidated revenue from operations in Q1FY22 grew 11.98 per cent YoY at Rs 10,198 crore. The company had posted revenue of Rs 9,106 crore in the same period a year ago. Sequentially, the figure rose by 4.8 per cent from Rs 9,730 crore posted in the preceding quarter, led mainly by 4.5 per cent QoQ growth in Enterprise revenues and 2.9 per cent QoQ growth in communications.

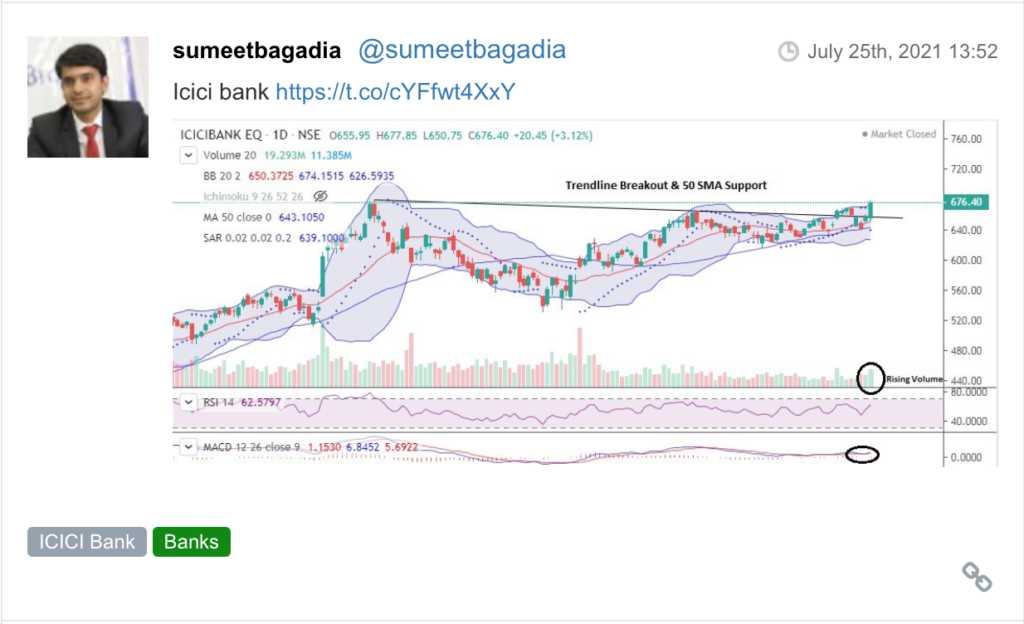

Here are some picks from the week gone by.