Sensex ends choppy day 42 points up; Asian Paints jumps 8%, Tata Steel down 4%

Domestic equity markets traded within a narrow range on Friday, fluctuating between gains and losses, as a slew of downgrades in the GDP growth forecasts for FY22 along with a slowdown in the vaccination programme amid supply crunch kept investors indecisive about the market direction.

India recorded over 343,000 fresh Covid-19 infections on Friday, taking the caseload tally to a little over 24 million. According to a government official, two billion doses of Covid-19 vaccines will be made available in the country between August and December, enough to vaccinate the entire population. This comes after Delhi, Maharashtra and Karnataka decided to suspend the vaccination for people in the 18-44 age group till further orders amid an acute shortage of vaccines.

However, favourable global cues helped the indices to limit losses. In Europe, the pan-European STOXX 600 index rose 0.3 per cent, with banks and retail stocks leading the gains, following a healthy session in Asia.

Against this backdrop, the BSE barometer of 30-shares culminated the session at 48,732.5 levels, adding 42 points or 0.09 per cent. During the choppy session, the index hit a high and low of 48,899 and 48,473, respectively.

On the NSE, the broader 50-share index defended the 14,650-mark to settle at 14,678 levels, down 19 points or 0.13 per cent.

Overall, 21 of the 30 shares on the Sensex and 34 of the 50 constituents of the Nifty ended the day in the red. Coal India, Hindalco, Tata Steel, Tata Motors, Grasim, and IndusInd Bank on the Nifty and M&M, SBI, ONGC, Dr Reddy’s Labs, and NTPC on the Sensex ended the day as top laggards.

On a weekly basis, both, the Sensex and the Nifty50 indices slipped around 1 per cent each.

On the upside, Asian Paints, UPL, ITC, Nestle India, L&T, HUL, Britannia, PowerGrid, and Reliance Industries were the combined top gainers of the day.

Profit-taking in the broader markets was sharper than benchmarks. The S&P BSE MidCap and SmallCap indices lost 1.2 per cent each.

Sectorally, the Nifty Metal index nursed the steepest loss of around 4 per cent, followed the Nifty Realty index, down 3 per cent and the Nifty PSU Bank and Auto indices, down 2 per cent each. On the upside, only Nifty FMCG index ended in the green, up 2 per cent.

ITC recorded the sharpest intra-day gain in over three months as the stock was up over 4%. At 02:20 pm, the stock of the cigarettes, tobacco products company was trading 4.4 per cent higher at Rs 212.20, as compared to 0.03 per cent decline in the benchmark S&P BSE Sensex. The trading volumes on the counter more-than-doubled with a combined 55.38 million equity shares changing hands on the BSE and NSE.

Shares of Prince Pipes and Fittings hit a new high of Rs 659.75, surging 15 per cent on the BSE in the intra-day trade on Friday, after the company reported a 246 per cent year on year (YoY) jump in its profit after tax (PAT) at Rs 97 crore for the fourth quarter of FY21 (Q4FY21) on the back of strong revenue growth. The company, engaged in integrated piping solutions & multi polymer manufacturers with seven strategically located plants across the country, had posted PAT of Rs 28 crore in the year-ago quarter.

Shares of Lupin were down 4 per cent to Rs 1,165.95 on the BSE in the intra-day trade on Friday on profit booking after the company’s consolidated sales declined 0.8 per cent year on year (YoY) to Rs 3,759 crore for the quarter ended March 31, 2021 (Q4FY21), led by a YoY decline in US and in API (active pharmaceutical ingredient) sales. The pharmaceutical company had posted sales of Rs 3,791 crore in the corresponding period of FY20.

Shares of mid-tier information technology (IT) firm Mphasis slipped 1.8 per cent in Friday’s intra-day deals on the BSE to Rs 1,764 apiece after the company reported a muted set of numbers in March quarter of fiscal year 2020-21 (Q4FY21). At 11:00 AM, the stock was quoting 1.2 per cent down at Rs 1,776 per share on the BSE as against a 0.09 per cent rise in the benchmark S&P BSE Sensex. The S&P BSE IT index, meanwhile, eased 0.74 per cent.

Shares of HG Infra Engineering soared 19% on robust March quarter results. The company’s revenue during the quarter under review increased 65 per cent to Rs 1,027.8 crore from Rs 622.9 crore in the corresponding quarter of previous year, clearly reflecting the sharp pickup in execution. Earnings before interest, taxes, depreciation and amortization (EBITDA) grew by 64 per cent YoY to Rs 166.5 crore from Rs 101.40 crore in the year-ago quarter.

Asian Paints shares surged 11% on strong revenue growth in Q4. The company’s profit after tax (PAT) during the quarter under review increased by 81 per cent YoY to Rs 870 crore. Earnings before interest, taxes, depreciation and amortization (EBITDA) grew by 53.4 per cent YoY to Rs 1,318 crore. On the margin front, while no price hike in Q4 weighed on gross margins (down around 266 basis points (bps) YoY), savings in employee and other costs to the tune of 100 bps and 290 bps YoY, respectively, led to a 127 bps YoY increase in EBITDA margin.

Shares of UPL hit a new high of Rs 728.80, up 5 per cent, on the BSE in intra-day trade on Friday after the company reported a healthy 72 per cent year-on-year (YoY) jump in its consolidated net profit at Rs 1,065 crore on the back of strong operational performance. The global provider of sustainable agriculture products and solutions had posted a profit of Rs 617 crore in the year-ago quarter.

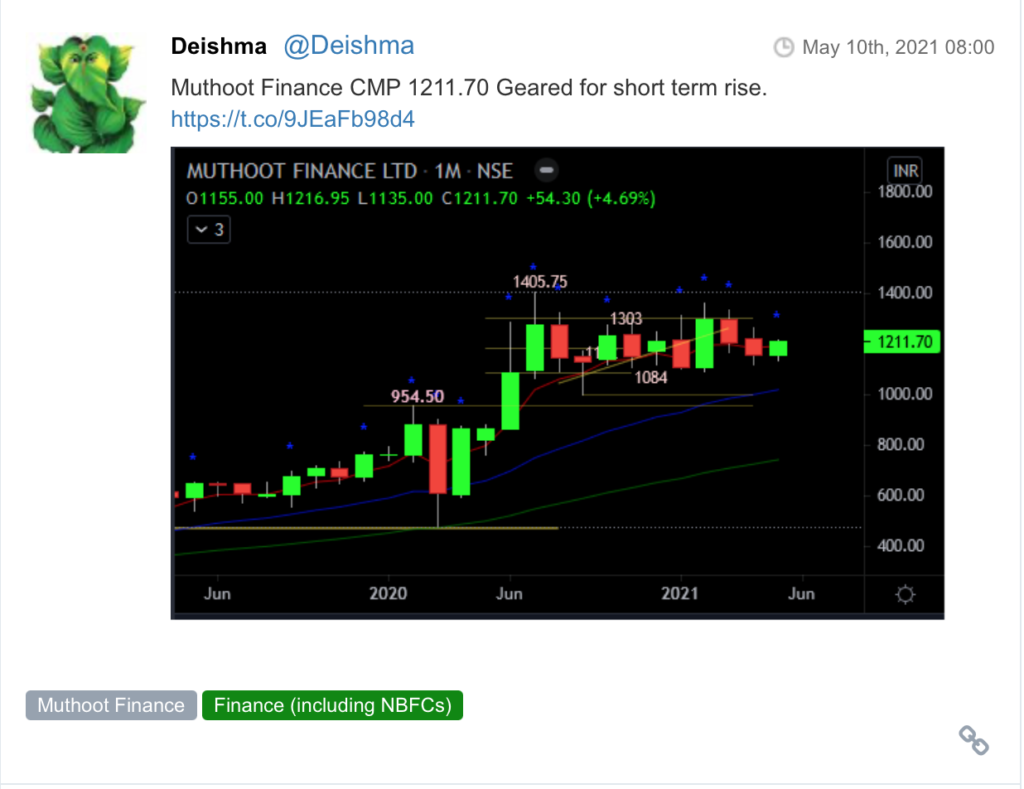

Here are some picks from the week gone by.