Sensex ends 117 points up, logs best weekly gain in 10 months; SBI jumps 11%

Stellar December quarter results by State Bank of India (SBI) and a status-quo in policy rates by the Reserve Bank of India (RBI) kept markets afloat on Friday even as mild profit-booking amid heightened volatility trimmed gains at higher levels.

In the early deals, the benchmark S&P BSE Sensex surpassed the 51,000-mark on the BSE for the first time and hit a fresh record high of 51,073. The index, however, erased gains partially and ended 117 points, or 0.23 per cent, higher at 50,732 levels.

SBI (up 11.3 per cent) was the top gainer on the index as analysts raised their targets on the stock post better-than-expected December quarter results. Global brokerage CLSA, for instance, has set a target price of Rs 560 on the lender’s stock. READ MORE

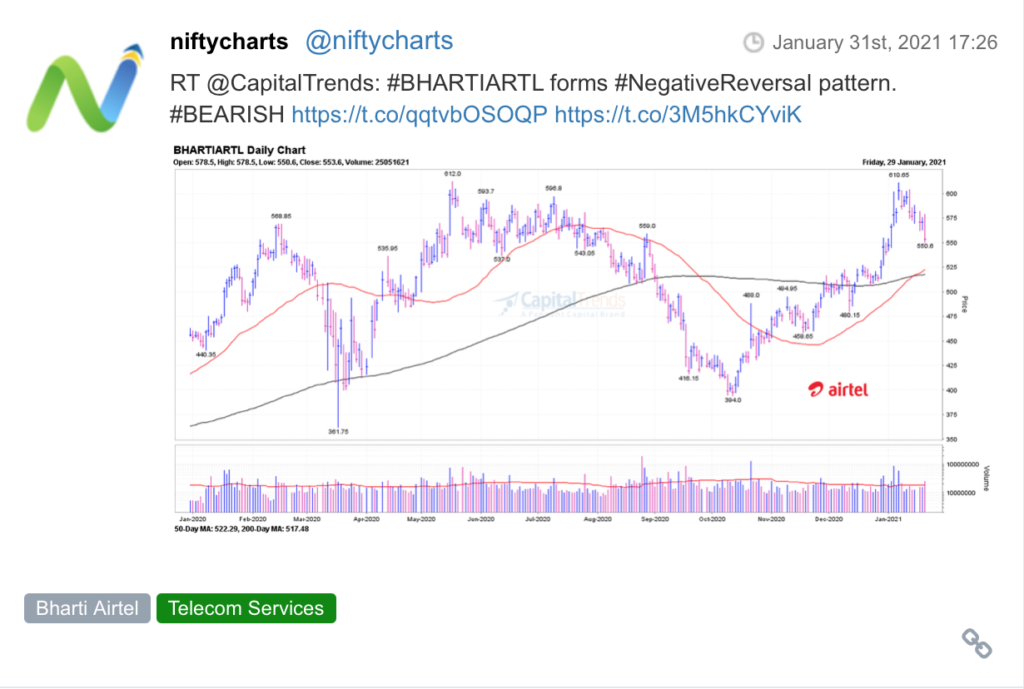

Kotak Mahindra Bank, UltraTech Cement, Dr Reddy’s Labs, ITC, HUL, and HDFC Bank, all up between 1 per cent and 4 per cent, were the other top gainers on the index. On the downside, Axis Bank (down 3 per cent), Bharti Airtel, ICICI Bank, Maruti Suzuki, TCS, and HCL Tech were the top laggards on the index.

On the other hand, Nifty50 index surpassed the psychological 15,000-mark and hit a record high of 15,015 levels. At close, the index was at 14,924 levels, up 29 points or 0.19 per cent.

The broader markets, however, came under selling pressure. The S&P BSE MidCap and SmallCap indices ended 0.93 per cent and 0.28 per cent lower, respectively.

On the sectoral front, the Nifty Auto an the IT indices ended 1 per cent lower each, while the Nifty PSU Bank index advanced 4 per cent on the NSE.

RBI monetary policy – Earlier today, the RBI kept the repo rate unchanged at 4 per cent and maintained the policy stance as ‘accomodative’ in its bi-monthly monetary policy meeting. Besides, it projected the GDP growth of 10.5 per cent in FY22 for India while projection for CPI-based inflation was revised to 5.2 per cent for Q4FY21. RBI governor Shaktikanta Das also announced normalisaton of CRR which, he said, would open up space for a variety of market operations to inject additional liquidity. Furthermore, absence of any concrete measures as expected by a set of bond traders weighed on the yields with 10-yr Gsec yields jumping 8bps from 6.07 per cent to 6.15 per cent.

In another development, Das announced direct online participation by retail investors in Government securities in both primary and secondary market is a big initiative which will broaden the investor base.

Shares of PSP Projects advanced 12 per cent to Rs 499 in intra-day trade on the BSE on Friday after the company said it has received an additional work order worth Rs 236 crore (including GST) for an institutional project at Gujarat.

Shares of Zee Entertainment Enterprises (ZEE) dipped 15 per cent to Rs 212 on the BSE in the intra-day trade on Friday on profit booking as investors worried about shrinking operating profit margin. The stock has slipped 19 per cent from its 52-week high level of Rs 216 touched on Thursday, February 4.

Shares of ITC extended their rally to the fifth straight day on Friday as the stock jumped 4 per cent to hit a fresh 52-week high of Rs 239 on the BSE in intra-day trade. The stock has surged 18 per cent in the past five trading days as there was no material announcement in the Budget that would significantly impact any of the consumer stocks. ITC had hit an intra-day high of Rs 239.25 on previous year Budget day, February 1, 2020.

Here are some picks from the week gone by.