Sensex ends at fresh closing peak of 48,782, up 689 points; Nifty at 14,347

Earnings optimism and positive global cues fuelled a broad-based rally in the markets with benchmark indices settling over a per cent higher on Friday. IT stocks led from the front and contributed nearly half of Sensex’s 600-point gains today. Reliance Industries, Maruti Suzuki, HDFC Bank, and L&T provided the remaining fillip to the BSE barometer.

The S&P BSE Sensex notched 689 points, or 1.43 per cent, to end at fresh closing peak of 48,782.5. The index hit a new lifetime high of 48,854.34 levels earlier in the day. The Sensex index gained 2 per cent during the week and clocked the longest stretch of weekly gains since 2009.

Maruti Suzuki jumped 6 per cent and remained the top Sensex gainer, followed by Tech Mahindra, up 5 per cent. The IT company today entered the elite Rs 1-trillion market capitalisation club, becoming the fifth IT firm to achieve the feat. At close, its m-cap was Rs 1.01 trillion.

That apart, Tata Consultancy Services (TCS) hit a record high of Rs 3,127.55 apiece in the intra-day trade and closed 3 per cent higher ahead of the announcement of Q3FY21 results. The IT firm’s revenue in constant currency (CC) terms is expected to rise in the range of 2.4-4 per cent on quarter-on-quarter (QoQ) basis while it may grow between 3-4.5 per cent in dollar revenue.

The broader Nifty50 too, ended at fresh closing peak of 14,347, closing 210 points or 1.48 per cent higher on the NSE. 41 of the 50 constituents ended the day in the green. The index touched lifetime high of 14,367 in noon deals today. For the week, the index was up 2.3 per cent.

In the mid-cap space, S&P BSE MidCap index, though underperformed the frontline index, settled 1 per cent higher at 19,138.7 level after hitting a record peak of 19,161 earlier in the day, and clocked a 5-per cent weekly gain. The S&P BSE SmallCap index, on the other hand, ended at 18,908.59 levels, up 0.72 per cent.

Shares of agri-related companies, including agrochemicals and fertilisers, were in focus as demand for the procurement of fertilizers has been promising due to surplus reservoirs levels, record-high Kharif crop sowing and plentiful rainfall during the monsoon season. Among individual stocks, Fertilizers & Chemicals Travancore (FACT) and Madras Fertilizers were locked at 20 per cent upper circuit limits at Rs 76.05 and Rs 25.65, respectively. These stocks are also quoting at their 52-week high levels.

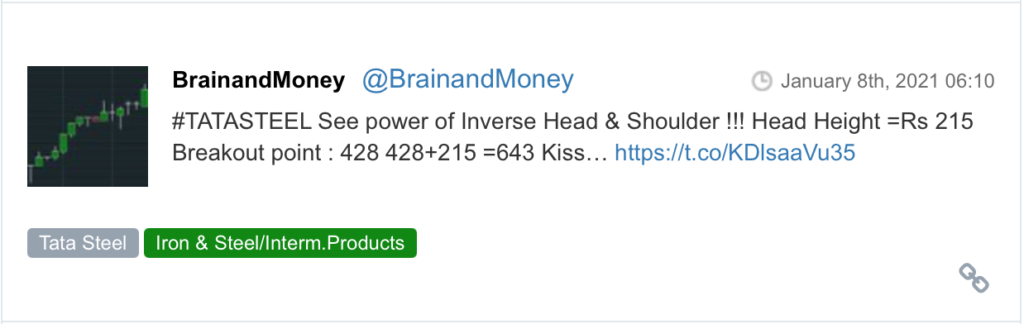

After years of underperformance, iron ore miner NMDC’s (formerly National Mineral Development Corporation) stock price is up 55 per cent since the beginning of October 2019, against a 24 per cent rally in the Sensex during the period. After its recent rally, the stock is back to its year-ago levels, even as the Sensex is up 16 per cent in the last 12 months.

Shares of Mahindra & Mahindra (M&M) hit a 52-week high of Rs 768.75, up 3 per cent, on the BSE in intra-day trade on Friday after the company announced price increase for its personal & commercial range of vehicles from today, January 8, 2021, due to rise in input costs. The stock surpassed its previous high of Rs 764.10, touched on December 8, 2020. The price will increase by around 1.9 per cent, resulting in an increase of Rs 4,500 – Rs 40,000, depending on the model and variant, M&M said in a press release.

Shares of poultry breeder Venky’s (India) and feed producer Godrej Agrovet are down as much as 7 per cent and 2 per cent, respectively, in the last three trading sessions (even as the Sensex was flat) amid reports of fresh concerns over the outbreak of avian influenza (also known as bird flu).

Shares of Strides Pharma fell 3 per cent to Rs 939, down 6 per cent from its early morning high on the BSE on Friday after Aditya Puri joined as advisor to the Strides Group & Director of Stelis Biopharma. The drug maker’s stock hit a 52-week high of Rs 1,000 in intra-day trade today. In the past six months, the stock has zoomed 130 per cent, as compared to 33 per cent rally in the S&P BSE Sensex.

Shares of Sun Pharmaceutical Industries rose 3 per cent to hit an over two-year high of Rs 619 on the BSE in intra-day trade on Friday on expectations of steady earnings visibility. The pharmaceutical company’s stock was trading at its highest level since October 2018. The board of directors of Sun Pharma are scheduled to meet on January 29, 2021 to consider and approve the financial results of the company for the quarter ended December 31, 2020 (Q3FY21).

Shares of Biocon climbed 2 per cent to Rs 466 on the BSE on Friday after the company announced that the board of its subsidiary Biocon Biologics has approved a primary equity investment by Abu Dhabi based ADQ, one of the region’s largest holding companies.

Here are some picks from the week gone by.