Indices rally for 5th straight day, Sensex up 553 pts; RIL, financials gain

Extending their gaining streak into the fifth straight session, the benchmark indices ended over 1 per cent higher on Friday, lifted mainly by index heavyweight Reliance Industries and financials. Further, firm global cues, too, boosted investor sentiment.

The S&P BSE Sensex added 553 points, or 1.34 per cent to settle at 41,893 levels and the Nifty50 index ended above the crucial 12,250 level at 12,264, up 143 points, or 1.18 per cent.

On a weekly basis, Sensex gained 5.75 per cent while Nifty added 5.33 per cent.

Reliance Industries today ended nearly 4 per cent higher at Rs 2,029 on the BSE after the conglomerate said that Saudi Arabia’s Public Investment Fund will invest Rs 9,555 crore for a 2.04 per cent equity stake in Reliance Retail.

In the broader market, the S&P BSE MidCap index rose 0.36 per cent while the S&P BSE SmallCap index ended 0.54 per cent higher.

On the sectoral front, Nifty Bank rallied 486 points, or 1.85 per cent to 26,799 levels while Nifty IT gained 0.5 per cent. Nifty Pharma, on the other hand, lost 0.7 per cent.

Financials extend rally; IndusInd, Shriram Transport surge over 20% in 1 week. CSB Bank, Spandana Sphoorty Financial, Indiabulls Housing Finance, RBL Bank, Shriram Transport Finance and Manappuram Finance from the S&P BSE Finance index were up more than 5 per cent on the BSE. Bajaj Finserv, IndusInd Bank, DCB Bank, CreditAccess Grameen and Muthoot Finance were up between 3 per cent and 5 per cent.

HDFC Bank stock hits record high, advances 25% in three months. The stock of the private sector lender has outperformed the market by surging 10 per cent in the past week, as compared to a 5.6 per cent rise in the S&P BSE Sensex. In the past three months, it has rallied 25 per cent, against a 10 per cent gain in the benchmark index.

Shares of SBI Cards and Payment Services were up 3 per cent at Rs 855 on the BSE on Friday, gaining 4 per cent in the past two trading days after the company said it has launched credit cards in partnership with the digital payment platform Paytm. The stock was trading higher for the fifth straight days and up 7 per cent during the week, as compared to a 5 per cent rise in the S&P BSE Sensex.

Jindal Stainless (Hisar) gains 10% in 2 days on healthy volume growth in Q2. The company said the remarkable turnaround of the auto sector, both in passenger vehicles and two-wheeler segments, aided sales volumes during the quarter. With a revival in construction activities, and a boost from the company’s co-branding program, the decorative pipes and tubes segment received further fillip, it said.

Shares of Apollo Pipes were trading higher for the fifth straight day, up 14 per cent to Rs 593.70 on the BSE in intra-day trade on Friday on the expectation of better demand outlook. The stock of the plastic products firm hit a 52-week high today, thus surging 29 per cent in the past week post-September quarter (Q2FY21) results. In comparison, the S&P BSE Sensex was up 5 per cent during the week.

Shares of Dalmia Bharat surged 6% and hit a 52-week high on strong Q2 results. The company reported an increase of 40 per cent YoY in EBITDA/T at Rs 1,457 due to a conscious and continuous containment of both variable & fixed costs. Cement EBITDA margin increased 900 basis points to 30 per cent during the quarter.

Shares of Berger Paints rallied as much as 4.4 per cent to hit an all-time high of Rs 675.45 apiece on the BSE on Friday, a day after the company reported an increase of 13.55 per cent in its consolidated net profit at Rs 221.05 crore for the quarter ended September 2020. The company had posted a net profit of Rs 194.66 crore in the year-ago period.

Shares of Reliance Industries (RIL) rose 3 per cent to Rs 2,013.75 on the BSE on Friday after the company said that Saudi Arabia’s Public Investment Fund (PIF) will invest Rs 9,555 crore ($1.29 billion) for 2.04 per cent equity stake in its retail arm. “This investment values Reliance Retail Ventures (RRVL) at a pre-money equity value of Rs 4.587 trillion ($62.4 billion). This investment would further strengthen PIF’s presence in India’s dynamic economy and promising retail market segment,” RIL said in media release.

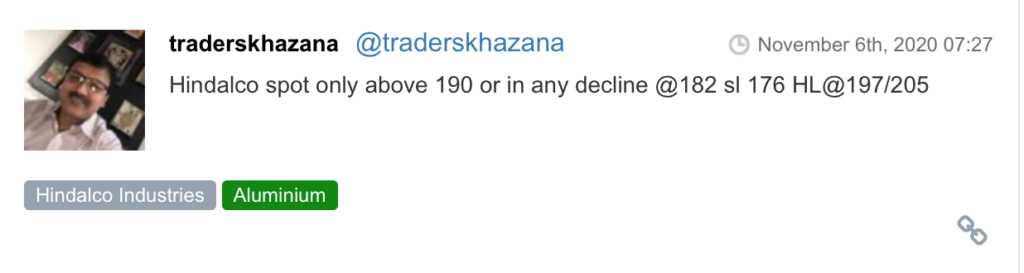

Here are some picks from the week gone by.