Sensex surges 835 points, Nifty reclaims 11K; Nifty IT up over 3% on Friday

The Indian stock market ended over 2 per cent higher on Friday due to across-the-board buying.

The S&P BSE Sensex ended 835 points, or 2.28 per cent higher at 37,389 levels with all the 30 constituents ending in the green. Bajaj Finserv (up 6.6 per cent) was the top gainer on the index, followed by HCL Tech (up over 5 per cent), and Bharti Airtel (up 5 per cent).

NSE’s Nifty, meanwhile, reclaimed the crucial 11,000 level to settle at 11,050, up 245 points, or 2.26 per cent. India VIX dropped nearly 12 per cent to 20.76 levels.

On a weekly basis, both Sensex and Nifty declined nearly 4 per cent.

All the Nifty sectoral indices ended in the green, led by Nifty IT and FMCG indexes, both up nearly 3.5 per cent, each.

In the broader market, the S&P BSE MidCap index gained around 3 per cent to 14,337 levels while the S&P BSE SmallCap index added 2.31 per cent to 14,496 levels.

IT stocks rallied in the trade post Accenture’s Q4FY20 earnings. While the company missed estimates for fourth-quarter sales and projected current-quarter revenue below Wall Street expectations, strong traction in the outsourcing business, strong order bookings, and encouraging management commentary were the key positives from the industry’s standpoint. Nifty IT ended nearly 3.5 per cent higher at 19,629 levels.

GMR Infrastructure gained over 11 per cent to Rs 23.55 on the BSE after the company said the GMR Group would divest its entire 51 per cent stake in Kakinada SEZ to reduce debt.

Shares of Granules India ended over 4 per cent higher at Rs 376 on the BSE after US health regulator USFDA gave its approval for Naproxen Sodium and Diphenhydramine Hydrochloride Tablets, 220 mg/25 mg (OTC).

Shares of Vakrangee hit the upper circuit of 10 per cent at Rs 27.10 on the BSE on Friday, after the Reserve Bank of India (RBI) granted in-principle authorisation to set-up and operate Bharat Bill Payment Operating Unit (BBPOU).

Shares of Camlin Fine surges 11% in one week after it starts production at Dahej unit. The company will produce Hydroquinone and Catechol, key raw materials for the business, at the lowest cost in the world at the Dahej facility, which shall benefit margins.

Shares of Cipla surged 5 per cent to Rs 772 on the BSE in the intra-day trade on Friday after the company said it has received US Food & Drug Administration (USFDA) approval for the generic version of Biogens Tecfidera (Dimethyl Fumarate) DR capsules in the US. The drug, indicated for the treatment of relapsing forms of multiple sclerosis, had annual US sales of US$3.8 billion as per IQVIA MAT July 2020.

Shares of Prince Pipes and Fittings were at Rs 260 — their highest level since listing — up 8 per cent on the BSE in the intra-day trade on Friday. In the past four months the stock of the plastic products maker has zoomed 242 per cent from a level of Rs 75.90, as compared to 20 per cent rise in the S&P BSE Sensex. Prince Pipes and Fittings had made a tepid debut at the bourses on December 30, 2019. The stock got listed at Rs 160, an 11 per cent discount to its issue price of Rs 178.

Shares of Advanced Enzyme Technologies rallied 8 per cent to Rs 295 on the National Stock Exchange (NSE) in the early morning trade on Friday after foreign portfolio investor (FPI) bought nearly 4 per cent stake in the company via open market. The stock of the agricultural products company was trading at its fresh 52-week high and has soared 30 per cent in the past two trading days.

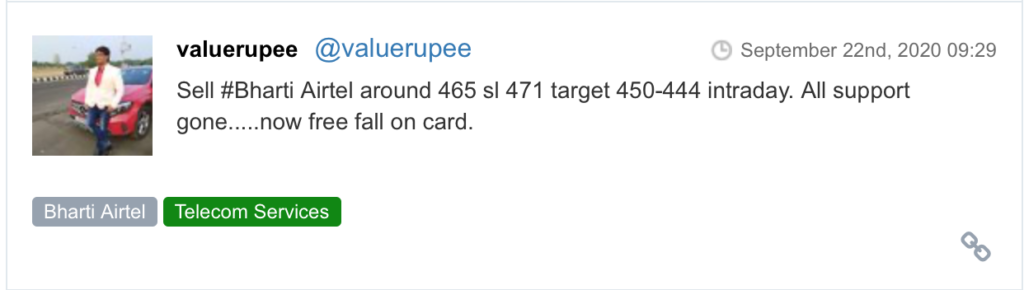

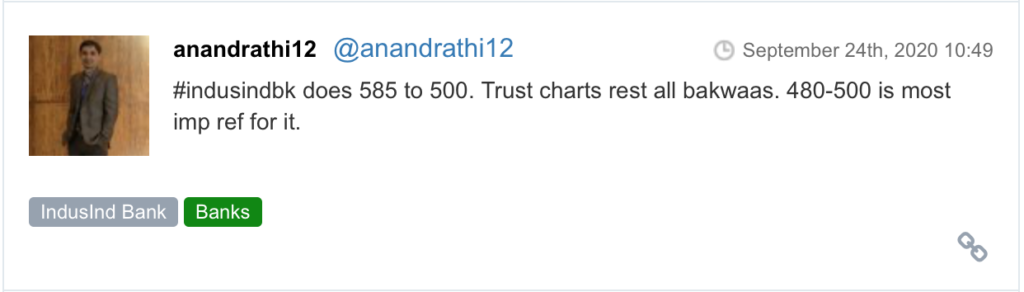

Here are some picks from the week gone by.