Sensex ends 134 points lower, Nifty settles at 11,505; Nifty Pharma jumps 5%

Erasing all their morning gains, the benchmark indices ended in the negative territory on Friday due to selling in the financial counters.

The S&P BSE Sensex ended 134 points, or 0.34 per cent lower at 38,846 with HDFC Bank (down over 2 per cent) being the biggest loser and Bharti Airtel (up around 4 per cent) the top gainer. HDFC Bank, HDFC, Infosys, and Hindustan Unilever (HUL) were among the major contributors to the index’s loss.

NSE’s Nifty settled at 11,505, up 11 points, or 0.10 per cent. India VIX fell nearly a per cent to 19.93 levels.

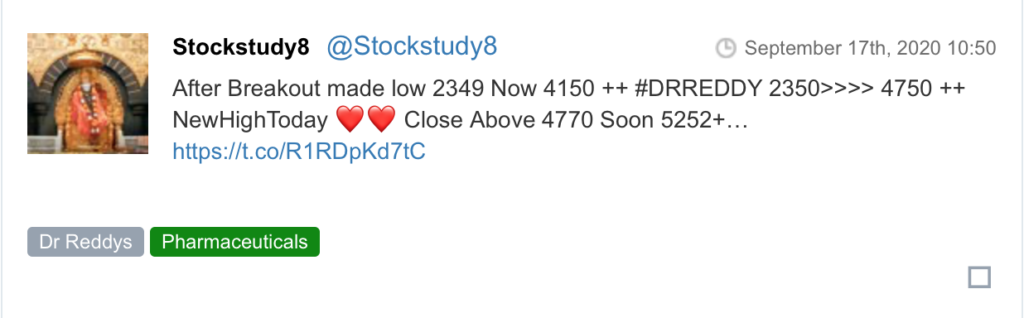

Meanwhile, pharma stocks gained big in the trade. The Nifty Pharma index jumped 5 per cent to 12,321 levels with all the 10 constituents advancing. Dr Reddy’s hit a record high of Rs 5,496.95 during the trade after the company said it has settled its patent litigation with Celgene for the latter’s cancer drug capsules. The stock settled at Rs 5,306, up 10 per cent on the NSE.

Nifty Bank index fell 2%; RBL, Bandhan, HDFC Bank down over 3%. Bandhan Bank, RBL Bank, HDFC Bank, and IDFC First Bank were down 3 per cent, while Federal Bank, State Bank of India (SBI), Punjab National Bank, and IndusInd Bank from the index were down in the range of 1 per cent to 2 per cent on the National Stock Exchange (NSE).

Surya Roshni surges 25% in 8 days after winning orders worth Rs 287 crore. On September 8, 2020, the company said it received two separate orders worth Rs 287.45 crore from Indian Oil Corporation and Bharat Gas Resources. The company received an order worth Rs 152.31 crore from Indian Oil Corporation for supplying API grade pipes for LPG pipeline project in Uttar Pradesh. The order is to be executed in 10 months. The company also received an order worth Rs 135.14 crore from Bharat Gas Resources for supplying API grade pipes for pan-India city gas distribution. The order is to be executed in 12 months.

Shares of real estate companies were in focus with the Nifty Realty index gaining 3 per cent on Friday. Oberoi Realty and DLF rallied 8 per cent and 6 per cent, respectively, on the National Stock Exchange (NSE). Brigade Enterprises, Sobha, Godrej Properties, Sunteck Realty, and Indiabulls Real Estate were up in the range of 1 per cent and 3 per cent.

Shares of Ashok Leyland climbed 6 per cent to Rs 83.10 on the BSE on Friday, on the expectation of demand revival. The commercial vehicles maker’s stock is trading close to its 52-week high level of Rs 87.50, touched on January 24, 2020. In the past two months, the stock has rallied 61 per cent, as compared to 5.3 per cent rise in the S&P BSE Sensex.

Vinati Organics extends rally into the fifth straight day, soars 36% in 1 week. The Company’s products find application across various sectors such as pharmaceutical, water treatment, oil and gas, agrochemicals and personal care. For FY21, there is some pressure on the oil-related application but demand for pharma, water treatment and others are expected to continue growing.

Shares of Escorts hit a fresh record high of Rs 1,280, up 3 per cent on the BSE on Friday. Thus far in September, the commercial vehicles company’s stock has outperformed the market by surging 18 per cent on the expectation of good tractor sales. In comparison, the S&P BSE Sensex was up 1 per cent during this period. The market sentiment continues to be highly positive with good monsoons, better Kharif sowing, crop prices holding up well, and a good supply of retail finance.

Shares of Essel Propack tanked up to 6.2 per cent to Rs 256 on the BSE on Friday after 83.2 million shares changed hands on the NSE and BSE. At 9:15 am, 74.55 million shares, representing 23.63 per cent stake in the company, changed hands on the BSE at Rs 260 per share, data show.

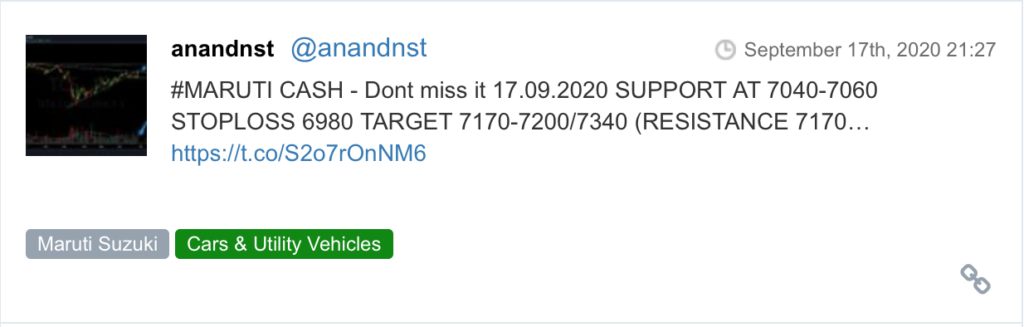

Here are some picks from the week gone by.