Sensex tanks 634 points on Friday on broad-based sell-off; Nifty Bank slips 2%

The Indian markets ended over 1.5 per cent lower on Friday amid across-the-board sell-off. The volatility index, India VIX, rose over 7 per cent to 21.95 levels.

The S&P BSE Sensex tanked 634 points, or 1.63 per cent, to settle at 38,357 levels. Of 30 constituents, 29 declined and just one advanced. Axis Bank (down 4 per cent) ended as the biggest loser on the index. On the other hand, Maruti ended as the only gainer (up nearly 2 cent).

Reliance Industries (RIL), HDFC, ICICI Bank, and Infosys were the major contributors to the Sensex’s loss.

NSE’s Nifty ended at 11,334, down 194 points or 1.68 per cent.

On a weekly basis, Sensex declined 2.8 per cent while NSE slipped 2.69 per cent.

All the Nifty sectoral indices were painted red, led by Nifty Metal, which slipped 3 per cent to 2,451 levels. Nifty Bank dipped over 2 per cent to 23,011.50 levels, with all the 12 constituents declining.

In the broader market, the S&P BSE MidCap index fell 1.74 per cent to 14,817 levels while the S&P BSE SmallCap index fell over 1 per cent to 14,603 points.

Shares of Vodafone Idea (VIL) hit a 15-month high of Rs 13.45 during the session on the BSE ahead of the company’s board meeting later in the day to consider fundraising plan. The stock, however, ended at Rs 12.01 on the BSE, down over 4 per cent.

Shares of CreditAccess Grameen rallied 9 per cent to hit a high of Rs 749 on the BSE in the intra-day session after the company announced that its board has approved Rs 1,000 crore fundraising plans. The stock ended at Rs 703.40, up over 2 per cent.

Shares of Granules India hit an all-time high of Rs 350 in an otherwise weak market, ralling 8 per cent on the BSE on Friday. Thus far in the current week, the stock of the pharmaceutical company has surged 13 per cent as compared to 2 per cent decline in the S&P BSE Sensex. It surpassed its previous high of Rs 336 touched on August 10, 2020.

Hindustan Foods was locked in 5 per cent upper circuit for the third straight day at Rs 858 – also its all-time high — on the BSE. DFM Foods hit a 52-week high of Rs 360 after rallying 7 per cent in intra-day trade. The stock has surged 24 per cent in the past four trading days. In comparison, the S&P BSE Sensex was down 0.85 per cent at 38,657 points, at 01:01 pm.

Shares of Adani Gas hit an all-time high of Rs 201 on the BSE in intra-day trade on Friday after the company said rating agency ICRA has upgraded its long-term rating and re-affirmed the short-term rating with a stable outlook. The stock of Adani Group bounced back 9 per cent from its early morning low of Rs 183 on the BSE. In the past one month, it outperformed the market by surging 23 per cent against a 2 per cent rise in the S&P BSE Sensex.

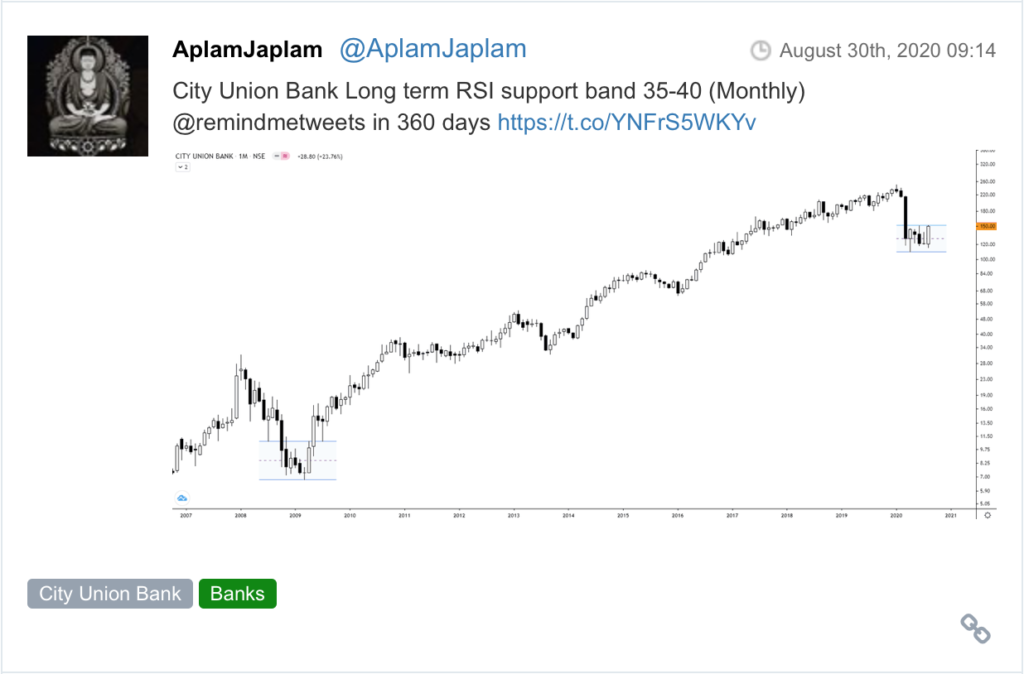

Here are some picks from the week gone by.