Indices end flat, Sensex slips 25 points; financials, autos fall

After remaining range-bound for the most part of the session, benchmark indices turned highly volatile in the last hour of the trade on Friday with the indices briefly swinging into positive territory, before settling flat with negative bias. Except for metal stocks, selling was witnessed across the board.

The S&P BSE Sensex ended at 31,098, down 25 points or 0.08 per cent. Of 30 constituents, 20 declined and 10 advanced. Mahindra & Mahindra (down around 5 per cent) ended as the top loser on the index while telecom major Bharti Airtel (up nearly 3 per cent) was the biggest gainer.

ICICI Bank, Axis Bank, HDFC Bank, and Infosys contributed the most to the index’s loss.

On the NSE, Nifty ended at 9,137, down 6 points or 0.06 per cent.

Shares of India Cements jumped 8% as Damani family increases stake to 20% in Q4. Gopikishan Damani and Radhakishan Damani’s combined stake in India Cements increased to 19.89 per cent at the end of March 2020 quarter, according to shareholding pattern disclosed by the company. Radhakishan Damani is the founder of Avenue Supermarts Ltd, which promotes DMart.

Shares of Escorts rallied 5% on strong operational performance in Q4. The company’s earnings before interest, taxes, depreciation, and amortisation (Ebitda) grew 2.5 per cent year-on-year (YoY) to Rs 194 crore, while Ebitda margin, adjusted for one-offs, expanded 50bps YoY to 12.1 per cent against analyst estimate of around 10.5 per cent during the quarter. Revenue fell 15 per cent YoY to Rs 1,380 crore in Q4YF20, due to poor performance by construction equipment segment.

The Tata group, the Adani group, and CESC are planning to join the race to buy the 51 per cent stake held by Reliance Infrastructure in BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Ltd (BYPL), say investment banking sources. They will be joining others keen on acquiring the stake in BRPL, the largest power distribution company in New Delhi with over 2.56 million consumers and in BYPL which supplies electricity to around 1.7 million consumers across Central and East Delhi.

Shares of Hikal froze at 5% upper circuit on development of Favipiravir API. The trading volumes on the counter more than doubled with a combined around 280,000 shares changing hands on the counter on the NSE and BSE. There were combined pending buy orders for 120,000 shares at 12:17 pm.

PVR, Inox Leisure hit 52-wk lows on reports of lockdown extension in Mumbai. As multiplexes were the first to be shut and could be the last to be opened, the market value of these stocks has more than halved from the peak. Inox Leisure and PVR have tanked 62 per cent and 60 per cent, respectively from their respective 52-week high values (touched in February 2020) on concerns of the impact of the Covid outbreak on the firms’ revenues and cash accruals on account of closures of cinemas.

Alembic Pharma hits new high, surges 45% in 4 weeks on strong Q4 results. On the National Stock Exchange (NSE), the pharma firm’s stock gained 3 per cent and hit a high of Rs 874. The stock price more-than-doubled from its recent low of Rs 436, touched on March 23, 2020.

Manappuram Finance jumps 7% in a weak market on strong Q4 result. The company’s total income grew 38.7 per cent to Rs 1618.15 crore during the quarter as against Rs 1166.51 crore during the same quarter a year ago. For the whole FY20, profit before tax grew by 37.8 per cent to Rs 2007.30 crore, as compared to Rs 1456.59 crore during FY19, total income for the fiscal year grew 30.8 per cent to Rs 5551.19 crore, as against Rs 4242.04 crore during the previous fiscal year.

Shares of Biocon Limited dipped 4.11 per cent to Rs 321.50 on the BSE on Friday after the biotechnology major’s net profit declined 42.2 per cent year-on-year (YoY) to Rs 123 crore in the fourth quarter of FY20 (Q4FY20). The firm’s profit before tax (PBT) declined 28.2 per cent to Rs 204 crore during the quarter when compared with the corresponding quarter of the previous financial year. The company’s revenue, however, saw a muted growth of 6 per cent as compared to Q4 of FY19, according to a BSE filing by the company.

Shares of Unichem Laboratories jumped as much as 9.6 per cent to Rs 139.70 apiece on the BSE on Friday after the company informed that it has received the Establishment Inspection Report (EIR) from United Stated Food and Drug Administration (USFDA) for its Active Pharmaceutical Ingredients (APIs) facility at Roha. The company received EIR on May 13 and the USFDA had conducted the inspection of its Roha facility from February 17 to 21, 2020.

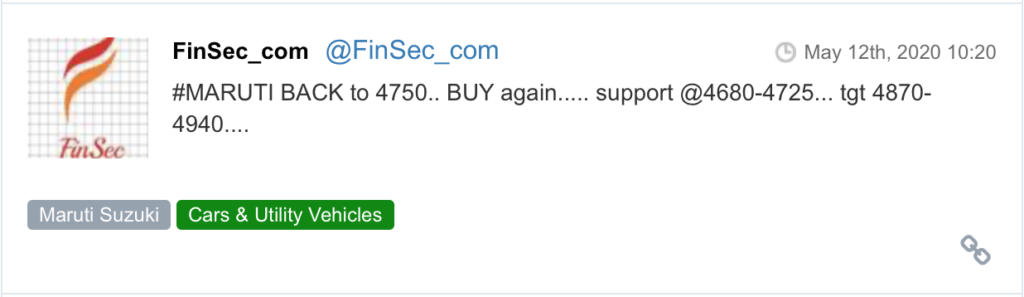

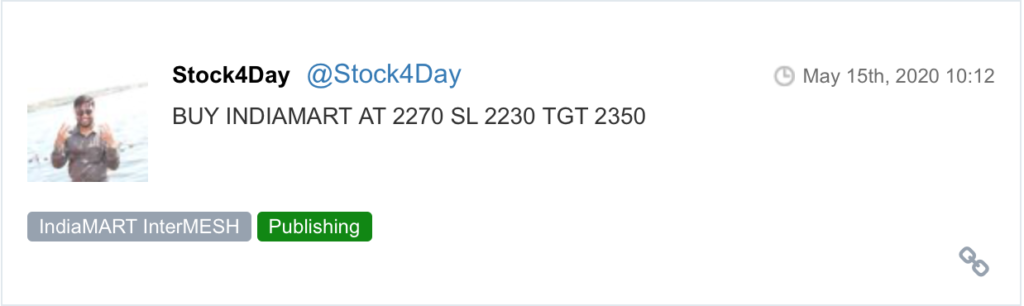

Here are some picks from the week gone by.