Sensex ends 986 points higher on Friday; financials rally post RBI measures

The domestic stock market witnessed a sharp rally on Friday after the Reserve Bank of India (RBI) Governor Shaktikanta Das announced a slew of measures to support the economy in the wake of Coronavirus (Covid-19) outbreak. The central bank slashed reverse repo rate by 25 basis points to 3.75 per cent. It also announced special refinance facility of Rs 15,000 crore to SIDBI; Rs 25,000 crore to NABARD, and Rs 10,000 cr to HFCs to support liquidity.

Reacting to it, financials stocks made solid gains, thus aiding the benchmark indices to settle over 3 per cent higher. The S&P BSE Sensex surged 986 points or 3.22 per cent to end at 31,588.72, with Axis Bank (up nearly 13.5 per cent) being the top gainer. ICICI Bank (up 10 per cent), IndusInd Bank (up 9 per cent), and Maruti (up 7 per cent) were next on the list.

On the NSE, the Nifty gained 274 points or 3.05 per cent to end at 9,266.75. Volatility index, India VIX, continued to cool-off. It slipped 7.71 per cent to 42.54 levels.

The Reserve Bank of India (RBI) on Friday announced an additional set of regulatory measures to reduce the burden of debt servicing due to disruptions caused by the coronavirus (Covid-19) pandemic, including an asset classification standstill for accounts that avail a moratorium between March 1 and May 31. Such accounts will, therefore, be classified as non-performing assets from 180 days of overdue, rather than the current norm of 90 days, according to a set of measures announced by RBI Governor Shaktikanta Das on Friday.

Select real estate shares surge after RBI announces liquidity measures. Among individual stocks, Oberoi Realty, Kolte-Patil Developers, Ajmera Realty & Infra India and Puravankara rose 13 per cent to 20 per cent on the BSE intra-day. The stocks later came off the high point of the day but were still outperforming the market. Oberoi Realty has rallied 20 per cent to Rs 410 on the BSE in intra-day trade. The stock of the Mumbai-based real estate developer has soared 32 per cent in the past two trading days. It touched a multi-year low of Rs 291 on the BSE in intra-day trade on Monday, April 13, 2020.

Shares of financials, including banks, non-banking finance companies (NBFCs), housing loans companies and microfinance institutions, were in focus on Friday after the Reserve Bank of India Governor Shaktikanta Das announced various measures, including a reduction in reverse repo rate. The apex bank also announced special refinance package for National Bank for Agriculture and Rural Development (Nabard), Small industrial Development Bank of India (Sidbi) and National Housing Bank (NHB). The reverse repo rate was also cut by 25 basis points (bps) to 3.75 per cent in order to tackle the coronavirus pandemic.

Shares of Sudarshan Chemical Ind zoomed 5% as the company received permissions to restart production at its manufacturing facility in Mahad.

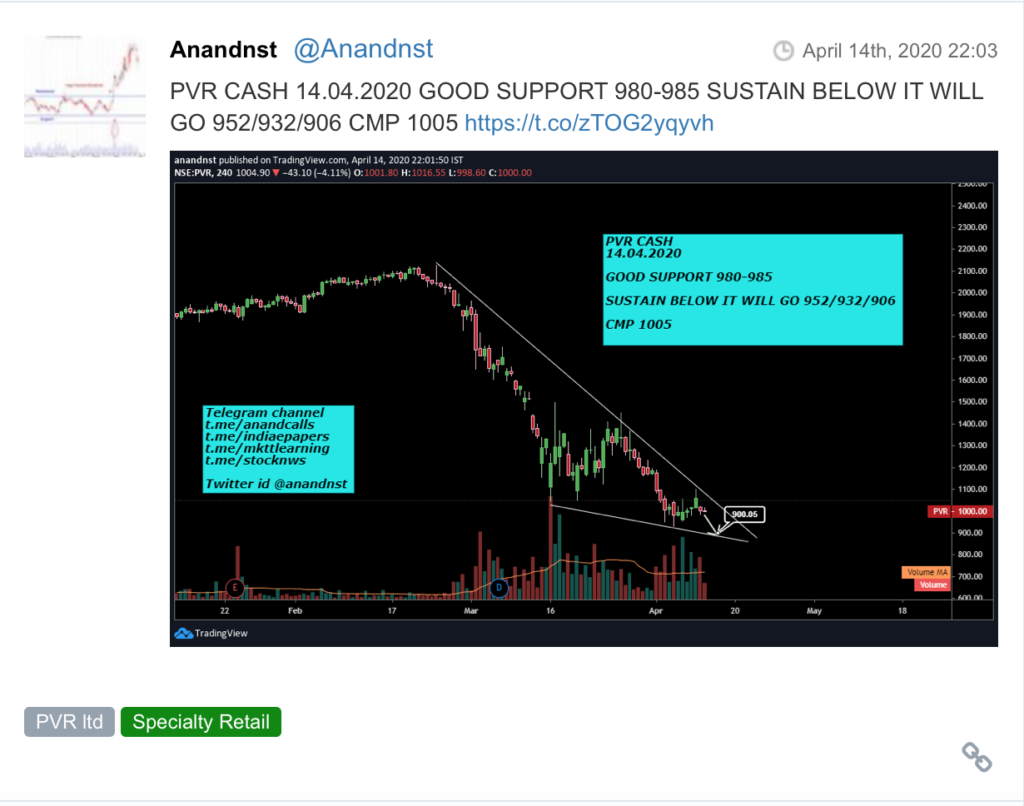

Here are some picks from the week gone by.