Sensex surges 1,266 points, Nifty ends at 9,112; auto stocks jump

The domestic equity market ended with over 4 per cent gains on Thursday, in line with global peers that gained on hopes that the coronavirus pandemic was nearing its peak globally. That apart, hopes of more stimulus measures by the government also kept the investor sentiment upbeat.

The S&P BSE Sensex jumped 1,266 points or 4.23 per cent to settle at 31,160 amid heavy buying in index heavyweights such as HDFC, HDFC Bank, ICICI Bank, Reliance Industries (RIL), and Maruti. NSE’s Nifty reclaimed the crucial 9,000 levels to end at 9,112, up 363 points or 4 per cent.

On a weekly basis, both Sensex and Nifty added around 13 per cent.

In the broader market, the S&P BSE MidCap index ended over 3.63 per cent higher at 11,374 and the S&P BSE SmallCap index added over 3 per cent to 10,294.

On the sectoral front, all the indices on the NSE ended in the green with the Nifty Auto index jumping over 10.5 per cent to 5,569 levels. Volatility index India VIX declined over 5 per cent to 49.56 levels.

Among individual stocks, Sun Pharma regained the market-capitalisation of Rs 1 trillion after a sharp rally in its stock price. The stock ended at Rs 455.20 on the BSE, up over 4 per cent.

Shares of Cipla jumped 16 per cent at Rs 595, also its 52-week high on the BSE after the drug firm received United States Food and Drug Administration’s (USFDA) nod for the first generic Proventil HFA (albuterol sulfate) metered-dose inhaler, used for conditions such as asthma. It ended at Rs 579.50, up 13 per cent.

Shares of Sun Pharmaceuticals Industries were trading higher for the fourth straight day, up 8.5 per cent to Rs 474 on the BSE on Thursday on the expectation of improvement in the company’s outlook. The drug firm’s stock was trading close to its 52-week high of Rs 480, touched on April 10, 2019. In the past four days, it has rallied 38 per cent, as compared to 10 per cent rise in the S&P BSE Sensex and 23 per cent up move in S&P BSE Healthcare index.

The Nifty Pharma index witnessed a tremendous rally in the last four sessions – up over 20 per cent. A formation of “Inverse Head and Shoulder” pattern may be seen on the daily chart. Broadly, if the index manages to close strongly above 9,000 levels, which is its resistance level, then it may see further upside towards 9,400 and 9,700 levels. The immediate support comes in at 8,550 and 8,200 levels.

Shares of IDBI Bank advanced up to 10.5 per cent to Rs 21.95 on the BSE on Thursday after the private lender said it has targeted to raise up to Rs 7,500 crore through rupee bond in the current fiscal.

Shares of Cipla were locked in the upper circuit of 15 per cent at Rs 590, also its 52-week high on the BSE on Thursday after the drug firm received United States Food and Drug Administration’s (USFDA) nod for the first generic Proventil HFA (albuterol sulfate) metered-dose inhaler, used for conditions such as asthma.

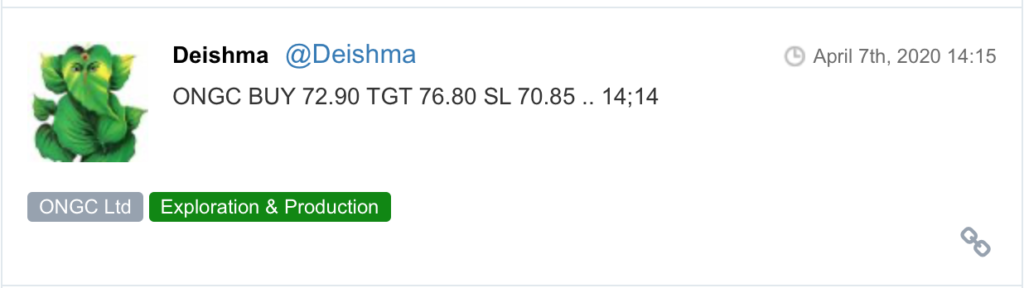

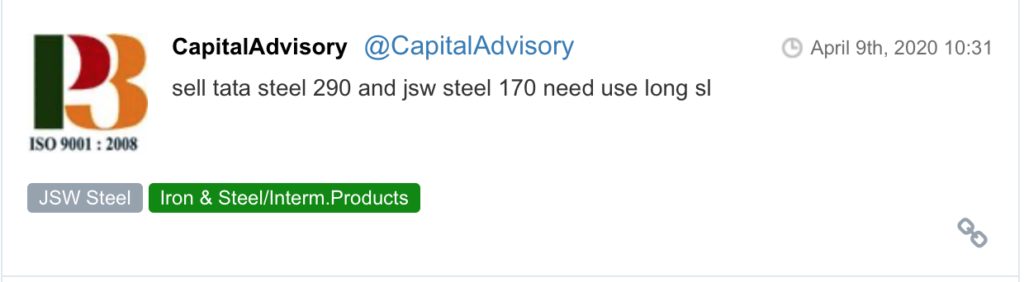

Here are some picks from the week gone by.