Sensex slips 674 points on Friday, financials hit; Nifty settles at 8084

Continuing their downward trend, the benchmark indices settled with over 2 per cent loss on Friday as coronavirus (Covid-19) cases showed no signs of abating. Global confirmed cases surpassed 1 million on Thursday with more than 52,000 deaths. Back home, an ongoing 21- day lockdown has already brought the economy to a standstill.

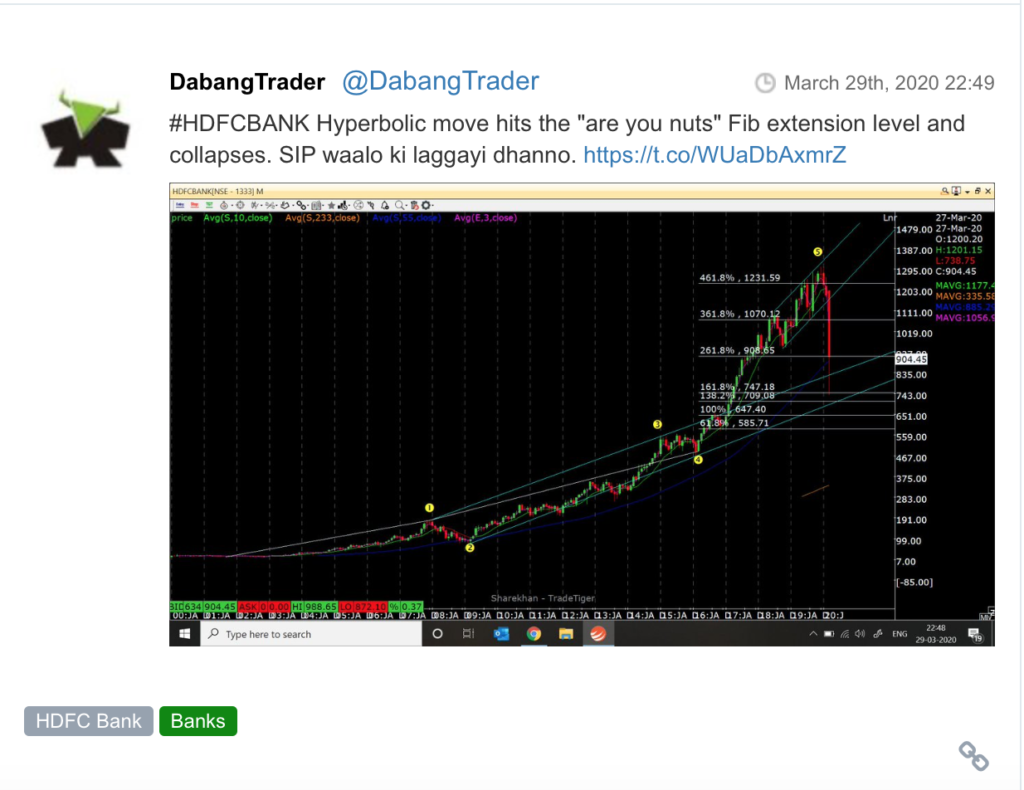

The S&P BSE Sensex ended at 27,591, down 674 points or 2.39 per cent amid heavy selling in financial stocks such as ICICI Bank (down 7.5 per cent), HDFC (over 5 per cent), HDFC Bank (down 2 per cent), and Axis Bank (down over 9 per cent). The other major contributors to the index’s loss were Infosys, TCS, and Asian Paints. They all fell in the range of 3-5 per cent.

India VIX cooled-off over 8 per cent to 55.01 levels. On the other hand, the Nifty50 index ended at 8,084, down 170 points or over 2 per cent. In the broader market, the S&P BSE MidCap index declined over 1 per cent lower at 10,219 whereas the S&P BSE SmallCap closed at 9,409, down over 1 per cent.

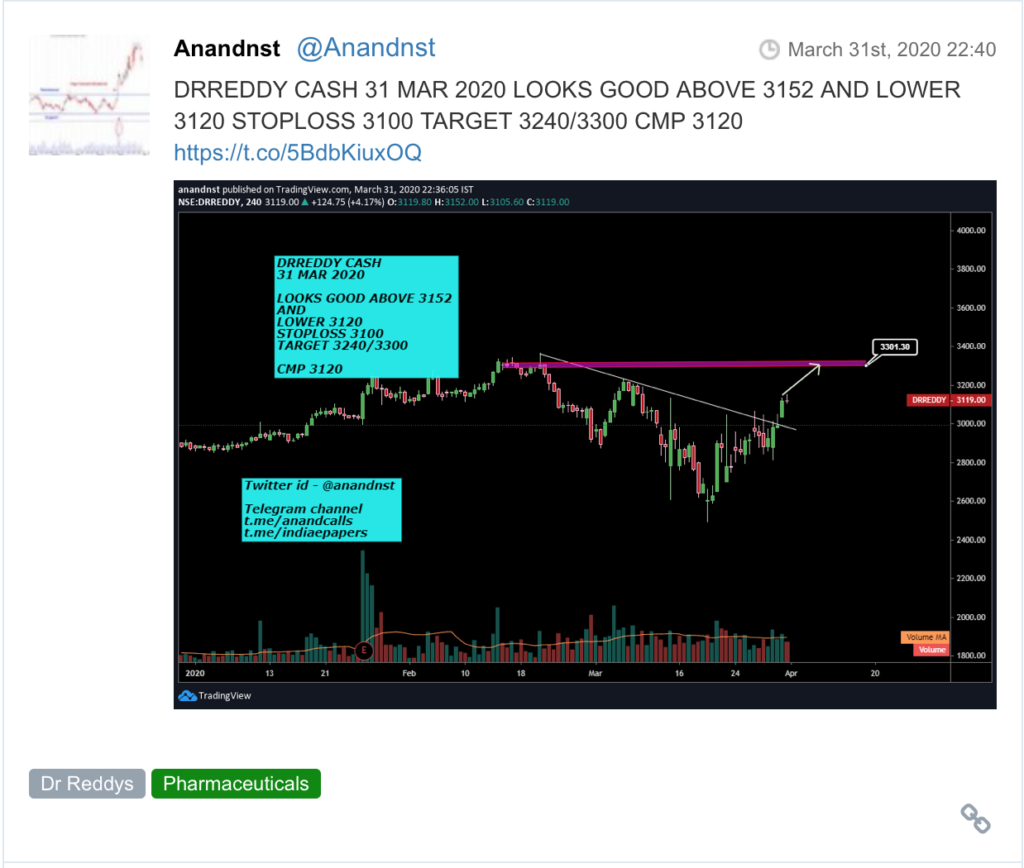

Among sectors, pharma stocks continued to rally. The Nifty Pharma index rose around 5 per cent to 7,362 levels with 8 out of 10 constituents advancing. Nifty FMCG index, too, ended in the green, up 0.7 per cent at 26,538 levels.

On a weekly basis, the S&P BSE Sensex lost 7.46 per cent, while the Nifty50 slipped 6.65 per cent.

Meanwhile, the Reserve Bank of India (RBI) has cut timing for money market operations from 9am to 5pm to 10am till 2pm. Truncated hours will be in operational till April 14.

Cipla surged 8% on completing Phase-3 study of asthma generic drug. The Phase-3 study was conducted over a period of 15 months, at over 100 sites in the US enrolling 1400 asthma patients, it added. According to IQVIA (IMS Health), Advair Diskus and its generic equivalents had US sales of approximately US$2.9bn for the 12-month period ending February 2020.

Shares of automobile companies declined as much as 7 per cent on the NSE on Friday as the March sales numbers disappointed, largely due to the nationwide lockdown to prevent the spread of coronavirus. According to a Business Standard report, the country’s automobile sales are down by an average 64 per cent as all manufacturing plants have been shut since the lockdown announced on March 24.

IndusInd Bank, SBI tumbled as Moody’s downgraded sector outlook to negative. Among individual stocks, IndusInd Bank tanked 7.3 per cent to Rs 317 on the NSE. Besides, Bandhan Bank declined 5 per cent, ICICI Bank (5.6 per cent), SBI (4 per cent), and Punjab National Bank (3.6 per cent). Canara Bank, Bank of Baroda, Axis Bank, RBL Bank, HDFC Bank, and Union Bank of India slipped between 2 and 4.3 per cent.

Shares of oil marketing companies (OMCs), paints and aviation companies were trading in the negative territory on Friday, a day after the crude oil prices posted their biggest-one day gains on record after US President Donald Trump said he expects Russia and Saudi Arabia to announce a major oil production cut, and Saudi state media said the kingdom was calling an emergency meeting of producers to deal with the market turmoil.

Here are some picks from the week gone by.