Rate cut fails to hold up markets; Sensex dips 1,310 points from day’s high

Equity market ended Friday’s highly volatile session on a subdued note even as the Reserve Bank of India (RBI), in an emergency move, slashed the repo rate by a huge 75 basis points (bps) to arrest the potential downturn in the economy due to coronavirus (Covid-19) pandemic. In addition, the RBI imposed a moratorium on principal and interest payments for three months and told banks and non-banking finance companies that that non-payment won’t be considered as non-performing assets (NPA).

The S&P BSE Sensex closed at 29,816, down 131 points or 0.44 per cent, with Axis Bank (up 5 per cent) being the top gainer and Bajaj Finance (down 9 per cent) the worst performer. Besides Bajaj Finance, stocks that contributed the most to the Sensex’s fall were Bharti Airtel (down 6 per cent), HUL (down 3 per cent), and HDFC Bank (down 1 per cent).

NSE’s frontline index Nifty50 ended at 8,660, up 19 points or 0.22 per cent.

On a weekly basis, Sensex slipped 0.33 per cent while Nifty fell 0.97 per cent.

On the sectoral front, auto stocks slipped the most, thus snapping their three-day gaining streak. The Nifty Auto index ended around 2.5 per cent lower at 4,939 levels. On the other hand, private banks gained the most with the Nifty Private Bank index ending 1.72 per cent higher at 10,738 levels.

Volatility index India VIX eased 0.77 per cent to 70.97 levels.

In the broader market, the S&P BSE MidCap index ended at 10,538, up 0.29 per cent while the S&P BSE SmallCap index ended 0.28 per cent higher at 9,497 levels.

Dr Reddy’s board approved the borrowing of Rs 2,000 cr through multiple routes. For the purpose, the company is allowed to pursue any of the multiple modes available such as the issuance of commercial paper, debentures, bonds and/ or through bank credit lines, term loans including external commercial borrowings that it may deem fit, according to a stock exchange filing.

Shares of Aurobindo Pharma gained 12 per cent to Rs 406 on the BSE on Friday, after the company announced that its Hyderabad-based facility has received an Establishment Inspection Report (EIR) with Voluntary Action Initiated (VAl) status from the US FDA. The stock of drugmaker was trading higher for the fourth straight day and has rallied 38 per cent during the period.

Shares of Balrampur Chini Mills were locked in the 10 per cent upper circuit for the second straight day, at Rs 90, on the BSE on Friday after ICICI Bank bought a minority stake in the company’s associate company Auxilo Finserve. “Pursuant to the definitive agreements executed on March 25, 2020, ICICI Bank has invested Rs 51.09 crore in the associate company, Auxilo Finserve by way of subscribing 34.06 million equity shares of Rs 10, constituting 9.90 per cent of its equity share capital at a premium of Rs 5 per share,” Balrampur Chini Mills said in a regulatory filing on Thursday after market hours.

Shares of automobiles companies erased their early morning gains and were trading up to 6 per cent lower on the National Stock Exchange (NSE) on Friday, despite the Reserve Bank of India (RBI) lowering the key repo rate by 75 basis points (bps) to 4.4 per cent to help arrest the economic slowdown in the wake of the coronavirus (Covid-19) outbreak.

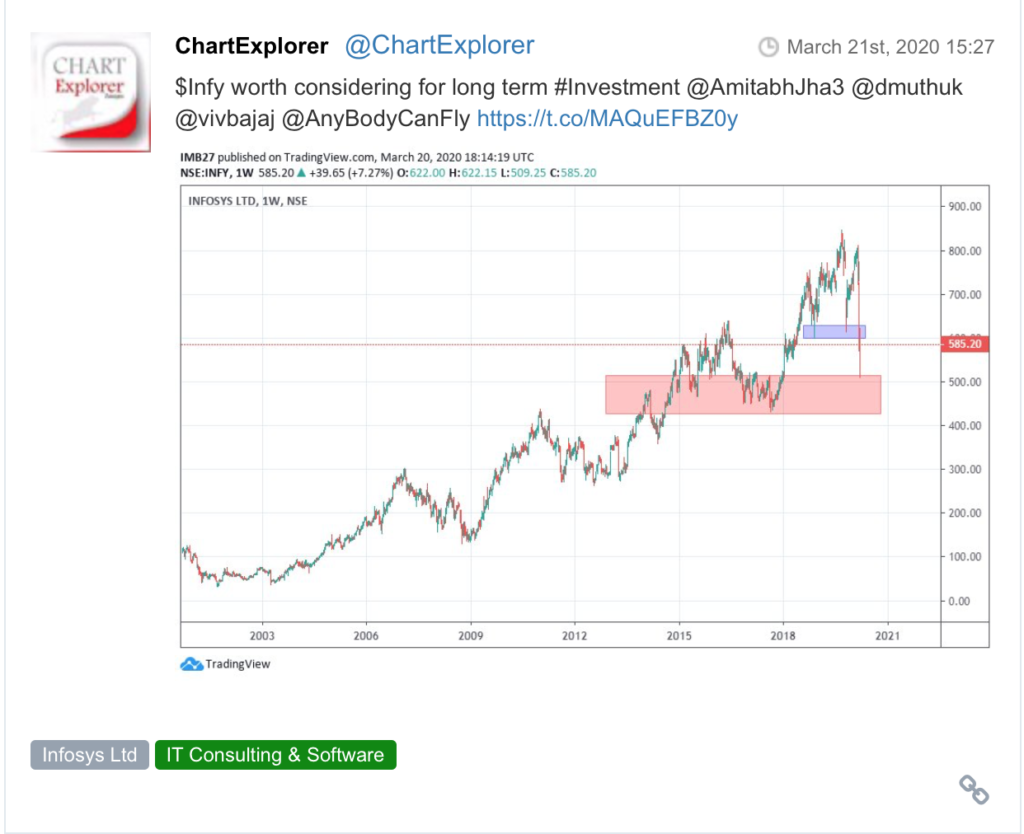

Here are some picks from the week gone by.