Indices end at 6-month lows, Sensex tanks 894 points; YES Bank down 56%

Bears continued to be in the driver’s seat on Friday as markets witnessed another bout of across-the-board sell-off due to Coronavirus fears. Further, YES Bank crisis was another major factor that dragged the markets lower.

The S&P BSE Sensex tanked 894 points or 2.32 per cent to settle the day at 37,577. During the day, the index hit a low of 37,011 levels. Bajaj Auto emerged as the biggest gainer on the index while Tata Steel (down over 6.5 per cent) was the top loser.

On NSE, the broader Nifty50 index ended at 10,989, down 279.5 points or 2.48 per cent.

On a weekly basis, Sensex dropped 1.8 per cent while Nifty lost 1.89 per cent.

Among individual stocks, YES Bank cracked as much as 85 per cent during the day after RBI suspended the bank’s board and placed it under moratorium for 30 days and capped withdrawal limit to Rs 50,000 for the one-month period. The stock eventually settled at Rs 16, down 56 per cent.

State Bank of India (SBI) closed around 6.5 per cent lower at Rs 270, after it informed that its board has given in-principle approval to consider an “investment opportunity” in YES Bank. In a late night statement on Thursday, SBI, however, said no decision had yet been taken to pick up stake in the bank.

Besides, other banking stocks, too, tumbled in the trade. The Nifty Bank index ended at 27,781, down over 1,000 points or 3.6 per cent.

Volatility index India VIX rose around 12 per cent to 25.96 levels.

In the broader market, the S&P BSE MidCap index declined 343.5 points or over 2 per cent to 14,227 levels while the S&P BSE SmallCap index ended at 13,330, down 261.5 points or around 2 per cent.

Shares of Tata Motors slipped 10 per cent intra-day to Rs 112.95 on the BSE on Friday after the company said the reduction in China sales owing to the outbreak of coronavirus, is expected to reduce Jaguar Land Rover’s (JLR) full-year EBIT (earnings before interest and tax) margin by about 1 per cent. It, however, added free cashflow in Q4 is still expected to be modestly positive.

Shares of JB Chemicals & Pharmaceuticals gained 4 per cent to Rs 595.80 on the BSE on Friday, bouncing back 8 per cent from day’s low of Rs 550 in an otherwise weak market. The stock has already turned ex-date for interim dividend of Rs 10 per share on Tuesday, March 3, 2020. The pharmaceutical company’s stock was trading close to its record high of Rs 599, touched on February 14, 2020.

A sharp fall in equities on concerns over a Coronavirus (COVID-19)-led slowdown made three sectoral indices – Nifty Auto, Nifty Metal and Nifty Media – hit their respective 52-week lows on the National Stock Exchange (NSE) on Friday. Nifty Metal index tumbled 6.6 per cent to 2,134, while Nifty Media index slipped 5.5 per cent to 1,518, and Nifty Auto was down 4 per cent to 6,662, as against a 3.9 per cent decline in the benchmark Nifty50 index to 10,827 points on the NSE in intra-day trade today.

On Thursday, the Reserve Bank of India superseded the board of troubled private sector lender YES Bank and imposed a 30-day moratorium on it “in the absence of a credible revival plan” amid a “serious deterioration” in its financial health. During the moratorium, which came into effect from 6 pm on Thursday, YES Bank will not be allowed to grant or renew any loans, and “incur any liability”, except for payment towards employees’ salaries, rent, taxes and legal expenses, among others.

Shares of banks and financial services companies declined up to 25 per cent on the National Stock Exchange (NSE) on Friday after the government placed YES Bank under moratorium and capped withdrawals for a month, while the Reserve Bank of India (RBI) superseded the private lender’s board, citing a steady decline in its financial position.

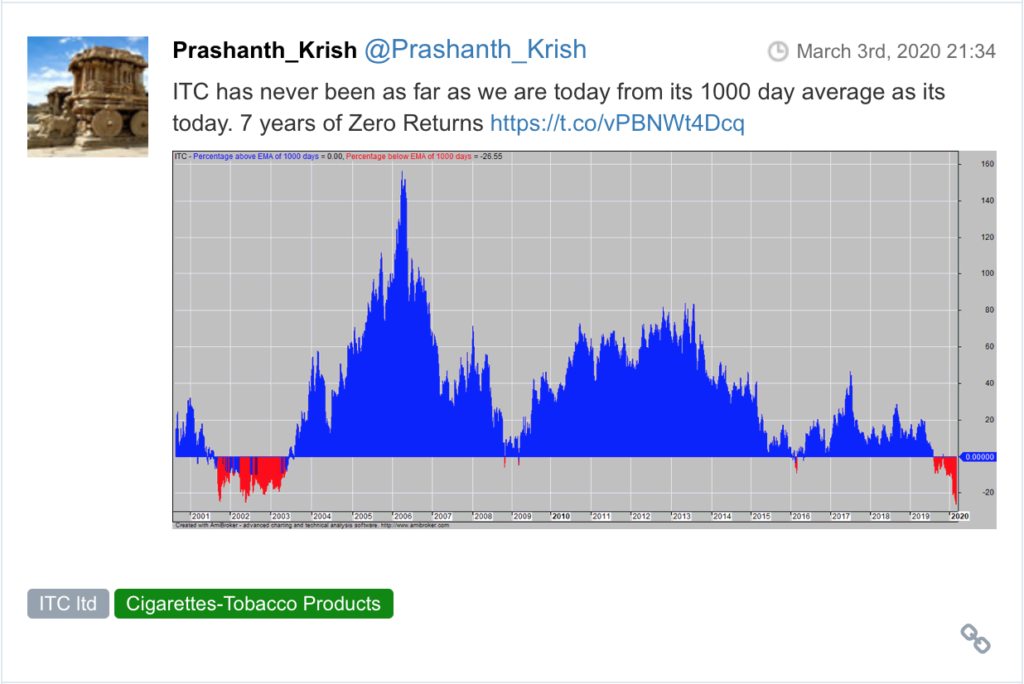

Here are some picks from the week gone by.