Sensex falls 202 points post AGR verdict; Voda-Idea tanks 23%

Equity market came under pressure on Friday after the Supreme Court (SC) rejected the telecom companies’ plea seeking new schedule of adjusted gross revenue (AGR) payments and directed them to clear their dues to the government by March 17.

The S&P BSE Sensex slid 202 points or 0.49 per cent to settle at 41,258, with IndusInd Bank (down 4 per cent) being the top loser and Bharti Airtel (up nearly 5 per cent) the biggest gainer.

On the NSE, the benchmark Nifty50 index ended at 12,113, down 61 points or 0.5 per cent.

Among telcos, Vodafone Idea tumbled over 23 per cent to Rs 3.44 apiece on the BSE post the AGR verdict. Bharti Infratel settled nearly 6 per cent lower at Rs 231. On the other hand, Bharti Airtel jumped 5 per cent to a fresh lifetime high of Rs 565 on the BSE as investors bet on a potential duopoly in the Indian telephony market after the Supreme Court today rejected the telcos’ review plea on adjusted gross revenues (AGR) payments. The stock settled at Rs 564, up around 4.5 per cent.

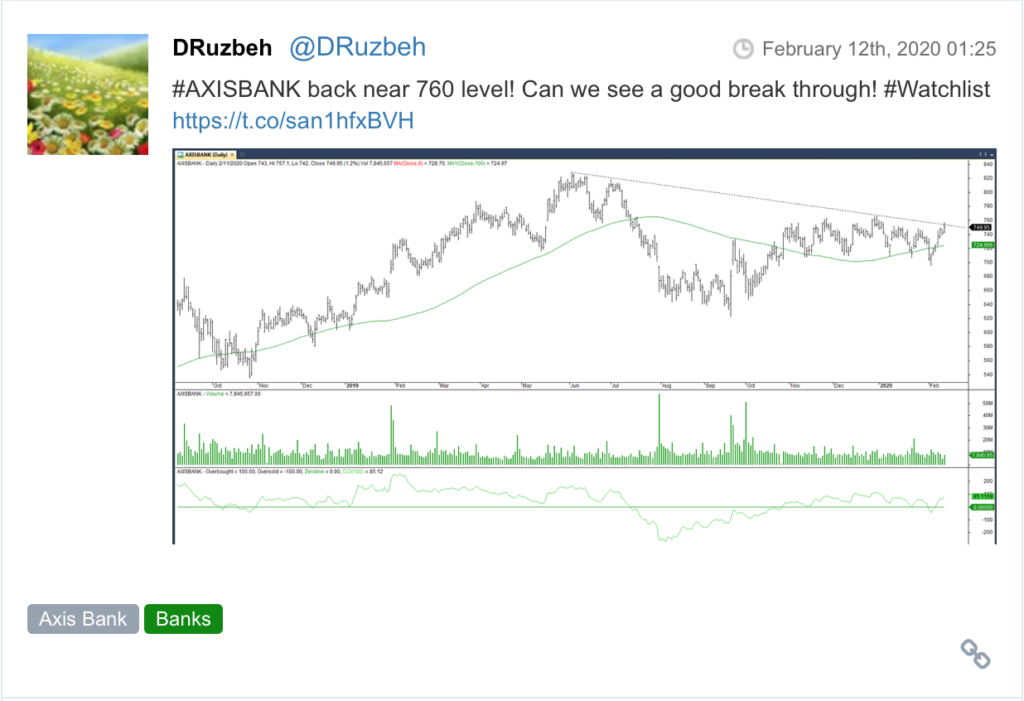

Financial and banking stocks, too, took a beating following the decision as, according to reports, they have high exposure to Vodafone Idea’s debt. Nifty Bank tumbled 395 points or over 1 per cent to 30,835 points.

In the broader market, the S&P BSE MidCap index slipped 0.8 per cent while the S&P BSE SmallCap index settled 0.4 per cent lower at 14,683.

Shares of Adani Enterprises hit a fresh 52-week high of Rs 259, up 3 per cent on the BSE on Friday after its arm signed agreement with Airports Authority of India (AAI) for the operations, management and development of three airports.

Shares of budget carrier SpiceJet surged as much as 10.27 per cent to Rs 93.4 on the National Stock Exchange (NSE) on Friday after the airline was back in the black and reported a standalone net profit of Rs 73.2 crore in the December quarter of FY20 (Q3FY20), as against Rs 55 crore in the corresponding quarter of the previous fiscal (Q3FY19). The airline had incurred a massive net loss of Rs 462.5 crore in the September quarter of the current fiscal.

Shares of IndusInd Bank slipped 4 per cent to hit an over three-year low of Rs 1,182 on the BSE on Friday amid concerns over rising bad loans. The private sector lender’s stock was trading at its lowest level since January 10, 2017. It has now fallen below its previous low of Rs 1,192, touched on October 11, 2019. In the past six trading days, IndusInd Bank’s stock price has slipped 11 per cent, as compared to a marginal 0.17 per cent rise in the benchmark S&P BSE Sensex.

Shares of Ircon International rallied 9 per cent and hit a new high of Rs 572 on the BSE on Friday after reporting margin improvement of 185 basis points in the quarter ended December 2019 (Q3FY20). The stock of the state-owned construction & engineering company was trading at its highest level since listing on September 28, 2018. In the past three trading days, the stock has surged 29 per cent, as compared to a marginal 0.35 per cent rise in the S&P BSE Sensex.

Shares of Nestle India advanced 2 per cent to hit fresh 52-week high of Rs 16,753.45 on the BSE on Friday after the packaged food firm staged an impressive December quarter show. That apart, the company also recommended a final dividend of Rs 61 per equity share for the year 2019. The company’s net profit rose 38.4 per cent year-on-year (YoY) to Rs 473.02 crore during the recently concluded quarter, helped by volume growth.

Shares of inner wear maker Page Industries slipped 8 per cent to Rs 21,650 on the BSE on Friday after the company reported a sharp 500 basis points decline in operating profit margins in December quarter (Q3FY20), due to higher expenses. Page Industries is engaged in the manufacturing, distribution, and marketing of innerwear athleisure sleepwear and swimwear for men, women, and kids.

Shares of Avenue Supermarts, the parent company of supermarket chain D-Mart, slipped over 5 per cent on Friday after the company announced its promoters will offload 2.28 per cent stake (14.8 million shares) through the offer for sale (OFS) route on Friday. The base price for the share sale has been set at Rs 2,049, a discount of 19.4 per cent to the current market price.

Here are some picks from the week gone by.