Sensex up 227 points, mid-cap rally continues; metal stocks gain

Bulls held their reigns for the second consecutive day on Friday, as markets decisively stayed in the positive territory after a mild blip in the early morning trade. Pre-budget rally and decent Q3FY20 results throughout the day were the biggest factors driving the markets today. Banking counters were leading the charge from the front with HDFC twins, ICICI Bank, Kotak Mahindra Bank, and Axis Bank being the top contributors of the gains today.

The benchmark S&P BSE Sensex surged 421 points off day’s low to hit an intra-day high of 41,697.03. At close, the Sensex settled at 41,613.19 level, up 226.79 points or 0.55 per cent. UltraTech Cement, L&T, Tech Mahindra, and Kotak Mahindra Bank were the top gainers on the 30-share index, while Power Grid, IndusInd Bank, TCS, and Reliance Industries were the top laggards.

On the NSE, the Nifty50 reclaimed the 12,250-mark in the intra-day trade today and hit a high of 12,272.15. The 50-share index ended 67.90 points, or 0.56 per cent, higher at 12,248.25 mark. Sectorally, all the key indices settled in the positive territory barring Nifty IT and Pharma indices. Nifty Metal index settled 1.02 per cent higher, followed by Nifty Financial Services index (up 0.9 per cent) and Nifty Bank index (up 0.8 per cent).

Broader markets continued their outperformance on Friday as well, with the S&P BSE mid-cap index hitting its fresh 52-week high in the intra-day trade today. At close, the index was at 15,826.57 level, up 0.8 per cent. The S&P BSE small-cap index, meanwhile, settled 0.5 per cent higher at 14,848.49.

AU Small Finance Bank, ICICI Securities and Indraprastha Gas (IGL) from the midcap index hit their respective all-time highs in the intra-day trade today. While, Amara Raja Batteries, MRF, Page Industries, Tata Chemicals, Torrent Power and Voltas touched their 52-week highs.

For private lender ICICI Bank, one-time gain from Essar Steel resolution would be the biggest factor driving the bank’s December quarter earnings for FY20 (Q3FY20). On the back of an estimated recovery worth over Rs 2,000 crore, the bank is likely to see provision write-off, stable slippages, and improved credit cost. At the bourses, the bank has outperformed the indices during the quarter under review. Between October and December, 2019, the stock of the lender surged 24.3 per cent, as against a 6.68 per cent rise in the benchmark S&P BSE Sensex.

Shares of YES Bank climbed 10 per cent to Rs 45 on the BSE, recording its sharpest intra-day gain in the past month. The stock has rallied 17 per cent in the past two days after State Bank of India Chairman Rajnish Kumar said he’s certain “some solutions will emerge” to steady YES Bank. At close, the stock was 4.4 per cent higher at Rs 43 apiece.

Besides, Bank of Baroda gained 1.8 per cent to Rs 96.55 apiece in the intra-day trade today, ahead of its December quarter, scheduled to be released later in the day. Analysts at Edelweiss Securities expect the asset quality to “spring in some volatility” given the exposure to few of the stressed groups.

On the downside, shares of Adani Gas slipped 14 per cent on the BSE after media reports suggested that Petroleum and Natural Gas Regulatory Board of India has sent a notice to the company for failing to disclose crucial information regarding a scheme of arrangement with Adani Enterprises. The company later clarified that it had responded to the regulator “with all required information to close the matter”. At close, the stock erased its entire loss to settle 1.4 per cent higher.

In corporate news, the Supreme Court on Friday stayed the NCLAT’s order dismissing the Registrar of Companies’ plea seeking modification of its verdict in the Tata-Cyrus Mistry matter. The SC bench agreed to hear Tata Sons’ appeal and issued notice to the parties concerned.

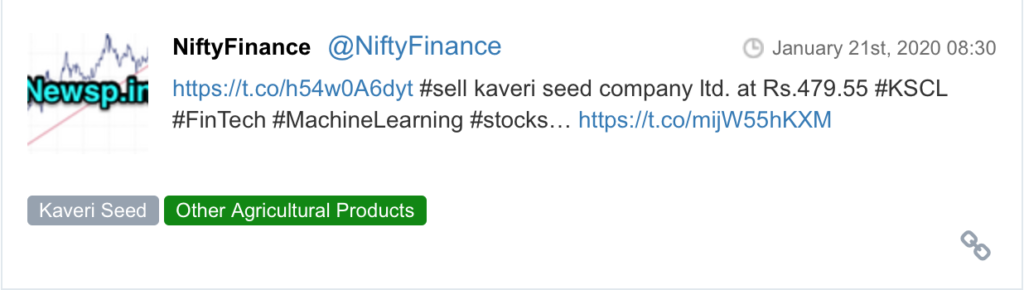

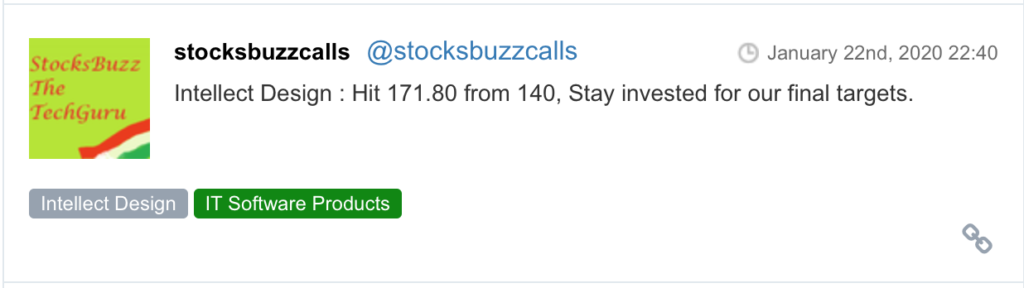

Here are some picks from the week gone by.