Sensex slides 336 points ahead of Q2 GDP nos, Nifty holds 12,050

Expectations of slower GDP numbers for September quarter (Q2FY20) due later in the day and weak global cues weighed on investor sentiment on Friday with the benchmark indices sliding nearly a per cent.

It is widely expected that the second quarter GDP print will slip below 5 per cent on subdued consumer demand, weakening private investment and falling exports courtesy global slowdown.

The S&P BSE Sensex lost 336 points or 0.82 per cent to settle at 40,794 with YES Bank (down 2.50 per cent) being the top loser and Bharti Airtel (up over a per cent) the biggest gainer. During the day, the index hit a low of 40,664.18 levels. Reliance Industries (RIL), ICICI Bank, Hindustan Unilever (HUL), and State Bank of India (SBI) contributed the most to the index’s fall.

NSE’s Nifty50 index closed the session at 12,056, down 95 points or 0.78 per cent.

On a weekly basis, the Sensex gained 1.1% to reach a new life-time high. Markets were buoyed by progress on phase-1 of the US-China trade deal, resolution of stress in financial sectors and multiple government initiatives to arrest the ongoing economic slowdown.

In the broader market, Nifty Midcap 100 index ended flat at 17,222, up 0.06 per cent while Nifty SmallCap 100 index outperformed the benchmarks by settling nearly a per cent higher.

Sectorally, except realty stocks, all the counters ended in the red. Media stocks tumbled the most, followed by PSU banks, metals and auto stocks. The Nifty Realty index ended a per cent higher at 282 levels.

Zee Entertainment slipped nearly 6 per cent to end at Rs 293.55 apiece on the BSE. The stock has been under pressure on series of developments such as Subhash Chandra’s resignation as chairman of the company and then stepping down of three directors.

Shares of Future Group companies rallied in the trade a day after the Competition Commission of India (CCI) said it has approved Amazon.com NV Investment Holdings’ proposal to acquire about 49 per cent share in Future Coupons (FCL) – a subsidiary of Future Group.

Indiabulls Housing Finance rallied 13 per cent to Rs 377 during the day on the National Stock Exchange (NSE) after foreign portfolio investors (FPIs) bought nearly one percentage points stake in the company through open market. The stock of the housing finance company had zoomed 25 per cent on Thursday. However, the stock reversed gains in the intra-day deals to end at Rs 290, down over 13 per cent on the BSE.

Shares of Ujjivan Financial Services (UFSL) were trading higher for the sixth straight day, up 6 per cent at Rs 346 on the BSE on Friday ahead of the subsidiary company’s Ujjivan Small Finance Bank (USFB) initial public offer (IPO) due next week. In the past six trading days, the share price of UFSL has appreciated by 19 per cent, as compared to one per cent rise in the S&P BSE Sensex. The stock is trading close to its 52-week high of Rs 372, touched on June 4, 2019.

Shares of Adani Group companies were in focus on Friday and rallied up to 12 per cent intra-day on the back of heavy volumes on the BSE in an otherwise weak market. Adani Gas (Rs 168) and Adani Transmission (Rs 315) rallied 12 per cent each on the BSE. Adani Power (up 8 per cent at Rs 66.60), Adani Green Energy (5 per cent at Rs 139), Adani Enterprises (4 per cent at Rs 221) and Adani Ports and Special Economic Zone (3 per cent at Rs 384) were up in the range of 3-8 per cent on the BSE.

YES Bank shares climbed 6 per cent to Rs 74 on the BSE on Friday ahead of the board meet today to consider fundraising plan. The stock of the private sector lender rallied 17 per cent after the Bank, on Tuesday, said its board will meet on Friday, November 29, 2019, to discuss and consider fundraising by issue of equity/equity linked securities through permissible modes.

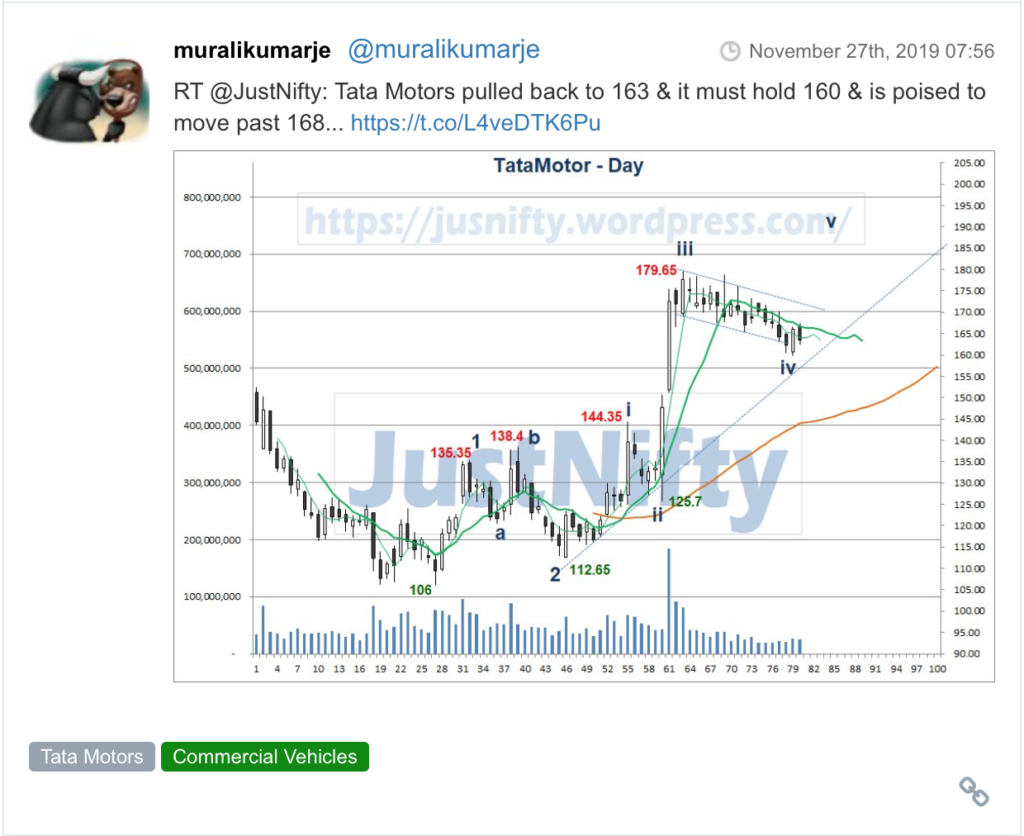

Here are some picks from the week gone by.