Sensex slides 330 points on Moody’s downgrade; Sun Pharma down 4%

Equity market was highly volatile in the afternoon session on Friday with the benchmark indices oscillating berween the positive and negative territories after Moody’s Investors Services downgraded India’s sovereign outlook from ‘stable’ to ‘negative’, saying concerns mount the economic slowdown will be prolonged and debt will rise.

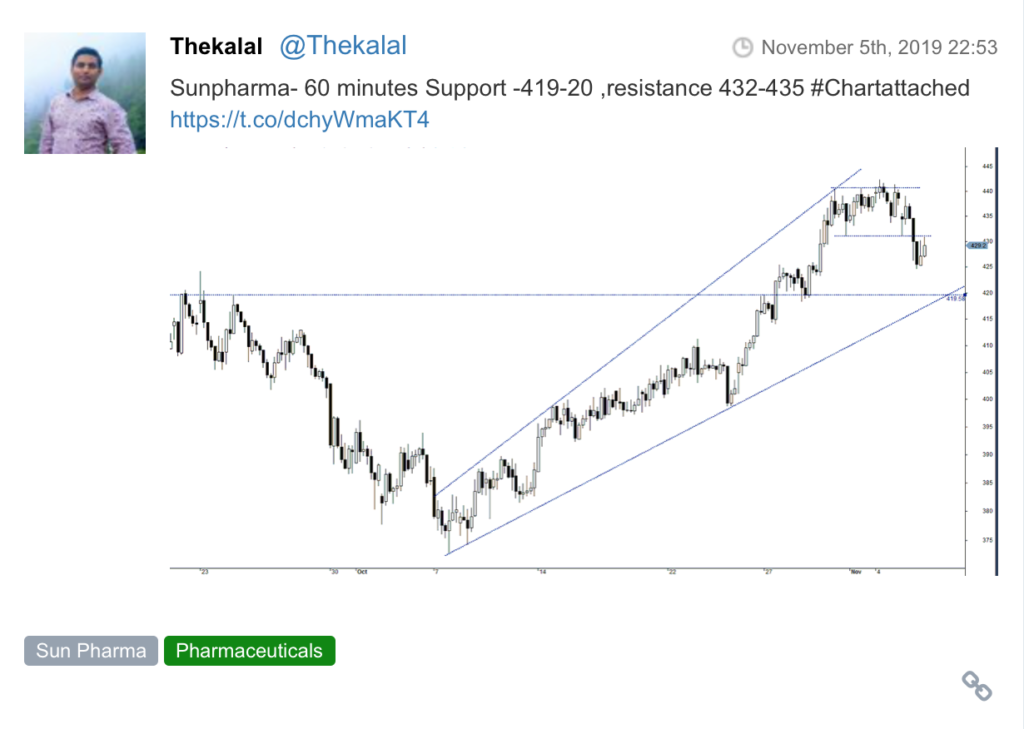

After hitting a fresh record high of 40741.69 levels during the session, the frontline S&P BSE Sensex was trading around 100 points lower. Private Banks were trading higher, with ICICI Bank, IndusInd Bank and YES Bank up in the range of 3-7 per cent. On the downside, Sun Pharma was trading nearly 3 per cent lower.

On the NSE, the Nifty50 slipped below the crucial 12,000-mark to hover around 11,950 levels. .

Sectorally, Nifty Realty index was the top gainer, up 2.3 per cent, followed by gains in Nifty Private Bank (up 0.74 per cent), and Nifty Auto (up 0.58 per cent) indices. On the flipside, Nifty Pharma and FMCG indices, each, were trading over a per cent lower.

The broader markets, however, were trading in the green. The S&P BSE mid-cap index was up 0.06 per cent, while the S&P BSE small-cap index was up 0.12 per cent.

Shares of DLF surged 6 per cent to Rs 204 on the BSE on Friday after the company reported a strong set of numbers for the quarter ended September 2019 (Q2FY20). Additionally, stock of the real estate developer was also included in the MSCI Global Standard Index with effect from November 26, 2019.

Shares of Raymond soared 18.9 per cent to Rs 801.10 on the BSE in intra-day trade on Friday after the company announced its plan to demerge its core Lifestyle business and list it as a separate entity. Furthermore, the company announced to use the entire net proceeds from sale of land parcel by JKIT (its Associate Company) for deleveraging of its Balance Sheet.

Shares of Indraprastha Gas (IGL) hit an all-time high of Rs 425, rallying 8 per cent on the BSE on Friday after the company reported healthy 12 per cent year-on-year (YoY) growth in sales during September quarter (Q2FY20). The stock surpassed its previous high of Rs 396 touched on November 1, 2019 in the intra-day trade.

Shares of HDFC Asset Management Company (AMC), ICICI Prudential Life Insurance (ICICI Pru) and Polycab India hit their respective all-time highs on Thursday after their inclusion in the MSCI Global Standard Index with effect from November 26, 2019.

Shares of Bharat Forge slipped 8 per cent to Rs 433 on the BSE on Friday after the company’s consolidated profit before tax (PBT) declined 27 per cent year on year (YoY) to Rs 251 crore in the September quarter (Q2FY20) due to de-growth in revenue.

GAIL, the state-owned natural gas processing and distribution company, on Friday posted a consolidated net profit of Rs 1,167.58 crore, down 34.7 per cent year-on-year (YoY) for September quarter of FY19. The company had posted net profit of Rs 1,788.98 crore in the year-ago period. Reacting to the news, shares of GAIL fell as much as 4.65 per cent to Rs 126 apiece on the BSE. At 02:31 am, the stock was trading 4 per cent lower at Rs 126.85 against 0.34 per cent decline in the benchmark S&P BSE Sensex.

Shares of Allahabad Bank slipped up to 11.2 per cent to Rs 23.95 per share in the afternoon trade on the BSE on Friday after the bank’s standalone loss in the Sepember quarter of FY20 (Q2FY20) widened to Rs 2,114 crore. The bank had incurred a loss of Rs 1,823 crore in the corresponding quarter of the previous fiscal. Besides, the bank’s asset quality deteriorated in the recently concluded quarter.

Here are some picks from the week gone by.