Sensex gains 264 points ahead of FM’s media briefing, Q1 GDP nos.

Domestic indices remained volatile on Friday, but surged in the last trading hour, ahead of the June quarter GDP numbers, that were scheduled to be released later in the day. Further, reports of a likely announcement by the Finance Ministry on merger of public sector banks (PSBs) increased buying interest at the counters. That apart, hopes of face-to-face trade talks between the United States and China helped ease market sentiment.

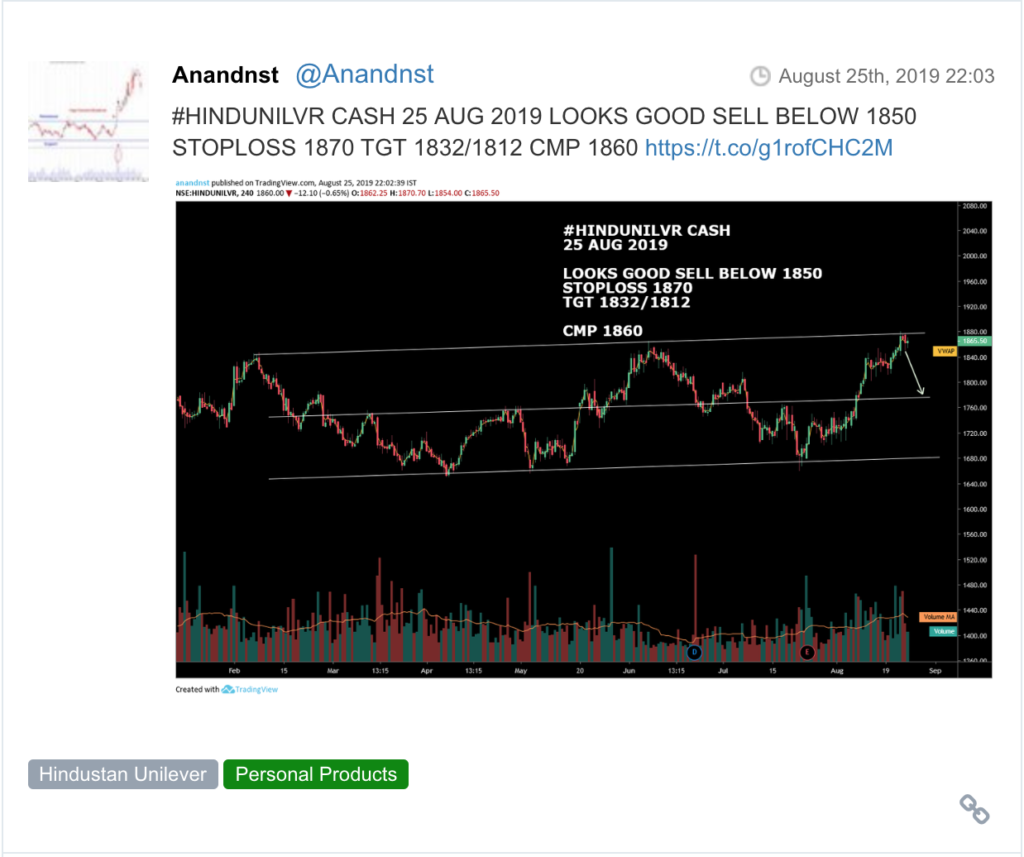

The benchmark S&P BSE Sensex settled 264 points, or 0.71 per cent, higher at 37,333 level, lifted by HDFC twins, ITC, ICICI Bank, and Hindustan Unilever. All the index heavyweights were up in the range of 1-3 per cent. YES Bank, Sun Pharma, IndusInd Bank, and Tata Steel ended the day as top gainers, while Power Grid, ONGC, HCL Tech, and Larsen and Toubro closed as top laggards. Meanwhile, the broader Nifty50 ended at 11,023-mark, up 75 points or 0.68 per cent.

Sectorally, all the indices ended in the green. Nifty Pharma index ended the day as top gainer, up 2.4 per cent, followed by Nifty Metal index, up 1.8 per cent.

In the broader market, the S&P BSE MidCap index closed at 13,468 level, up 134 points, or 1.01 per cent. The S&P BSE SmallCap index closed at 12,535 level, up 104 points, or 0.84 per cent.

Union Finance Minister Nirmala Sitharaman is scheduled to address media later in the day, where she is likely to announce mega plan for merging multiple set of public sector banks (PSB).

The department of financial services in the finance ministry called a meeting, on Friday, with chief executives of ten public sector banks which are seen as top contenders for merger. The banks invited for consultations on Friday are: Union Bank of India, Canara Bank, Punjab National Bank, United Bank, Oriental Bank of Commerce, United Bank, Allahabad Bank, Corporation Bank, Syndicate Bank and Andhra Bank.

Shares of PSBs were trading mixed on the National Stock Exchange (NSE) on Friday afternoon. Oriental Bank of Commerce, Central Bank of India, Syndicate Bank and Allahabad Bank were up in the range of 3 per cent to 6 per cent on the NSE. On the other hand, State Bank of India (SBI), Union Bank of India, Bank of India, Indian Bank and Bank of Baroda were down between 1 and 2 per cent.

HDFC AMC, Infosys, Bata India, Asian Paints, Berger Paints among BSE500 index stocks that hit record highs in today’s session.

Shares of ICRA, the Indian arm of global rating agency Moody’s, declined around 5 per cent on the BSE in the intra-day trade on Friday after the company terminated its Managing Director (MD) and Group Chief Executive Officer (CEO) Naresh Takkar’s employment. The rating agency has attributed the unprecedented move to protect interests of the company and its shareholders.

Shares of NTPC (National Thermal Power Corporation) slumped 6 per cent to Rs 116 on the BSE, in the intra-day trade on Friday, after the company announced incorporation of NTPC Mining, a wholly-owned subsidiary to take up coal mining business.

Shares of Adani Green advanced as much as much 10.49 per cent to Rs 47.90 apiece on the BSE in the early morning deals on Friday, a day after the company announced it will acquire Essel Infra’s 205 megawatt (Mw) of solar assets for Rs 1,300 crore. The assets are located in Punjab, Karnataka, and Uttar Pradesh. All these assets have long-term power purchase agreements with various state electricity distribution companies, the company said.

YES Bank shares slipped up to 3 per cent to Rs 55.55 in intra-day trade on the BSE on Friday, ahead of its board meeting scheduled for later in the day. The bank’s board is likely to consider raising funds worth $1.2 billion. The private sector lender’s stock has slipped 14 per cent in the past three trading days, as compared to a 2 per cent decline in the S&P BSE Sensex in the same period.

Shares of Gruh Finance rallied up to 8 per cent to quote at Rs 270 apiece in the early morning trade on the National Stock Exchange (NSE) on Friday after mortgage lender Housing Development Finance Corporation (HDFC) sold nearly 9 percentage point stake in the company through block deal.

Here are some picks from the week gone by.