Sensex up 228 points on reports that Govt. may rollback higher tax on FPIs

Indices settled higher on Friday ahead of finance minister Nirmala Sitharaman’s media address, scheduled later in the day, wherein measures to revive the economy, clarity on the possible rollback of super-rich tax on FPIs, and implementation of direct tax code (DTC) are expected.

That apart, investors were also eyeing Federal Reserve chair Jerome Powell’s speech at Jackson Hole, Wyoming for clarification on whether the US central bank remains on course to deliver another interest rate cut in next month.

The benchmark S&P BSE Sensex settled 228 points, or 0.63 per cent, higher at 36,701 levels lifted by gains in metals, and public sector banks’ stocks. Vedanta, YES Bank, ONGC, and M&M were the top gainers at the 30-share index, while IndusInd Bank, ITC, ICICI Bank, and Power Grid ended as top laggards. The broader Nifty50, too, closed at 10,829-mark, up 88 points or 0.82 per cent.

The Sensex and Nifty50 settled nearly 600 and 192 points higher, respectively from the day’s low.

For the week, both Sensex and Nifty50 settled in the negative territory for second week in a row, down 2 per cent each. Further, Nifty Bank index slipped 4.5 per cent this week, registering the biggest weekly fall in 11 months, while Nifty mid-cap index settled 3 per cent lower, its biggest monthly fall.

Sectorally, indices for private bank and FMCG stocks ended in the red. Nifty media index ended as the top gainer, up 4.2 per cent, followed by Nifty metal index (up 3.3 per cent), and Nifty PSU bank index (up 2 per cent). Nifty FMCG and PSB indices closed with cuts of 0.35 per cent each.

In the broader market, mid-cap scrips fared better than small-cap stocks. The S&P BSE mid-cap index settled 121 points, or 0.93 per cent, higher at 13,202 level, as against a gain of 67 points, or 0.55 per cent, at the S&P BSE small-cap index, which closed at 12,186 level.

The country’s largest lender State Bank of India on Friday slashed interest rates on fixed deposits across various tenure by up to 0.5 percentage point, a move which will lower returns for savers. In view of the falling interest rate scenario and surplus liquidity, SBI realigns its interest rate on Term Deposits with effect from August 26, 2019, SBI said in a statement.

Midcaps and small-cap stocks continued to suffer with both indices slipping to over two-year low levels on the BSE on Friday amid weak earnings and slowdown concerns. The S&P BSE Smallcap index hit its 32-month low, while the midcap index touched 30-month low in intra-day deal today. The smallcap index touched 11,951 levels, its lowest level since December 29, 2016, while the midcap index hit a low of 12,915, its lowest level since February 1, 2017.

Shares of Future Retail slumped as much as 7.94 per cent to Rs 380.60 apiece on the BSE in the morning trade on Friday, a day after the company informed American e-commerce giant Amazon.com is acquiring a 49 per cent stake in a group entity — Future Coupons Ltd. Early in the trade, the stock hit a high of Rs 424.30 against yesterday’s close of Rs 413.45. At 10:38 am, the stock was trading at Rs 393.85 apiece on the BSE, down around 5 per cent.

The Centre’s disinvestment target of raising Rs 1.05 trillion for 2019-20 may take a hit as the stocks of several public sector undertakings (PSUs) hit all-time lows on Thursday. Some of these are trading at multi-decade lows. The BSE PSU index is down 22 per cent in the trailing 52 weeks and 16 per cent since January. In comparison, the Sensex is down 4.7 per cent in the past 12 months and is still in the green for 2019, with gains of 1.1 per cent. The target for disinvestment receipts was increased to Rs 1.05 trillion for FY20 in the Budget.

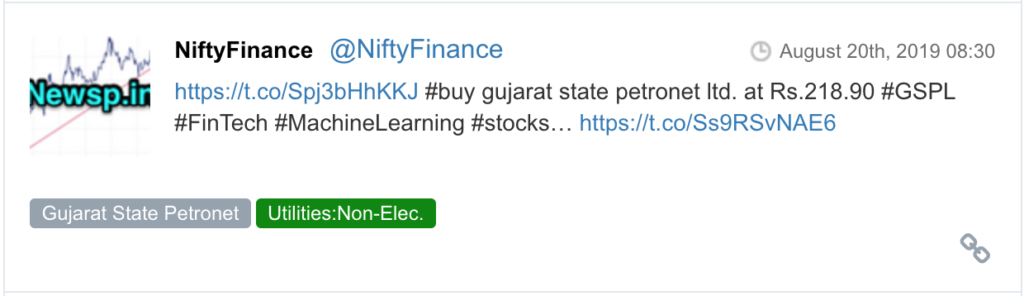

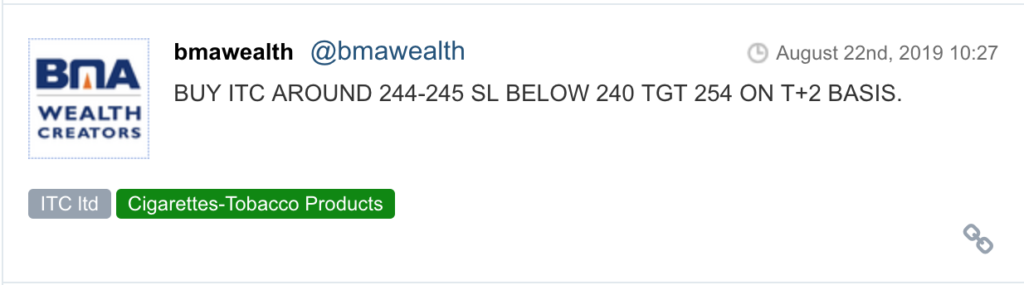

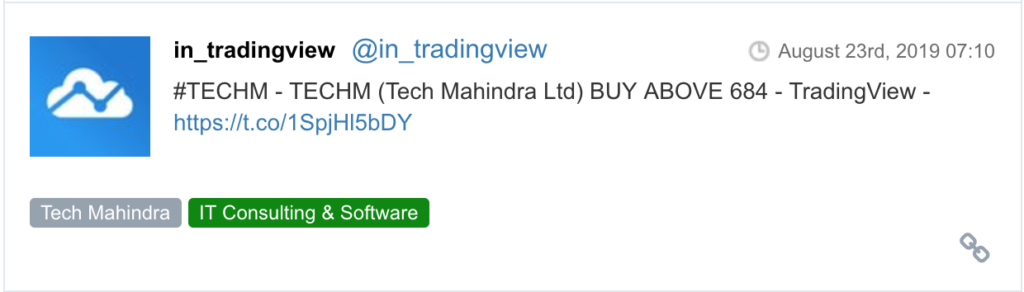

Here are some picks from the week gone by.