Sensex settles 39 points higher; IT, pharma stocks decline

Markets ended flat on Friday dragged by uncertainty over announcement of any revival package by the government and weak global cues. Indices remained lacklustre for better part of the day, only to turn volatile in the afternoon trading session.

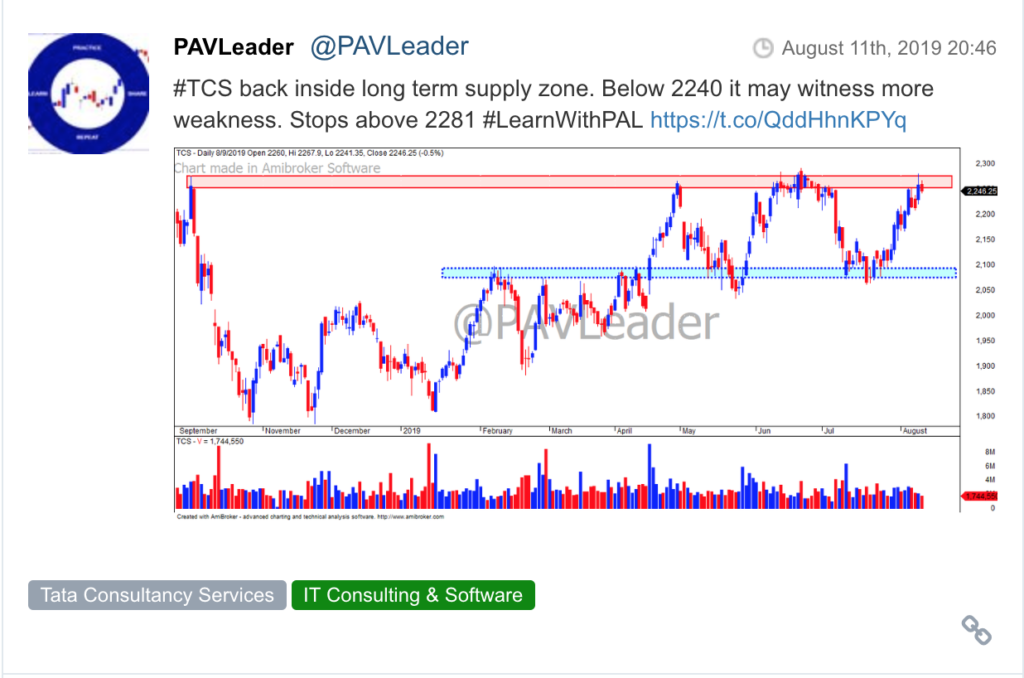

The benchmark S&P BSE Sensex settled with gains of 39 points, or 0.10 per cent, at 37,350 levels led by banking and automobile stocks. The gains were, however, capped by losses in the technology and metal scrips. Power Grid, Maruti Suzuki, YES Bank, and IndusInd Bank were the top gainers at the 30-share index, while TCS, Vedanta, HCL Tech, and HDFC were the top laggards. The broader Nifty50, too, closed at 11,048-mark, up 18 points or 0.17 per cent.

Sectorally, public sector banks gained the most, with the Nifty PSU Bank index closing 1.5 per cent higher. This was followed by Nifty auto index, up 1.15 per cent. Nifty IT and pharma indices ended with cuts of 0.65 per cent and 0.77 per cent, respectively.

In the intra-day trade, the Sensex and Nifty50 slumped to lows of 36,974 and 10,924 levels, down 337 points and 105 points respectively.

In the broader market, S&P BSE mid-cap ended the day at 13,491 level, up 14 points or 0.10 per cent. Further, S&P BSE small-cap settled at 12,585 level, up 14 points, or 0.11 per cent.

Shares of Aarti Industries slipped 8 per cent to Rs 1,595 on the BSE in the intra-day trade on Friday. The stock fell 9 per cent from its early morning high on profit-booking after the management lowered FY20 revenue/profit guidance considering slowdown in end-use industries. The stock closed at Rs 1591, down 8 per cent.

Shares of Apollo Hospitals Enterprises rallied 7 per cent intra-day to Rs 1,454 apiece on the BSE on Friday, also its 52-week high, on strong June quarter results for FY20 (Q1FY20). The stock has surged 10 per cent at the bourses since Tuesday, when it reported more than double consolidated net profit at Rs 49 crore. The company had a profit of Rs 23 crore in the year-ago quarter. The stock is 6 per cent away from its all-time high level of Rs 1,544 touched on March 2, 2016. It ended at Rs 1471, up 8 per cent.

YES Bank said on Friday it has raised Rs 1,930 crore through the qualified institutional placement (QIP) route which opened on August 8 and closed on August 14. The bank allotted 23.1 crore equity shares of face value of Rs 2 each to eligible qualified institutional buyers (QIBs) at Rs 83.55 per equity share in accordance with the pricing formula provided under Regulation 176(1) of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations 2018.

Shares of Indiabulls Housing Finance (IBH) slumped 10 per cent to Rs 498 on the BSE in Friday’s early morning trade after global rating agency Moody’s downgraded the mortgage lender’s long-term corporate family rating to Ba2 from Ba1, while changing its outlook to negative from stable. The ‘negative’ outlook generally means the ratings won’t improve in the next 12-18 months. The ‘Ba’ rating, as per Moody’s rating scale, is “judged to be speculative, subject to substantial credit risk.”

Here are some picks from the week gone by.