Sensex snaps 6-day losing streak, up 52 points; autos lead rally

Domestic indices ended Friday’s lackluster trade with marginal gains. The benchmark S&P BSE Sensex and broader Nifty50 traded range-bound for better part of the day tracking corporate earnings and weakness in global markets.

The Sensex ended 52 points, or 0.14 per cent, higher at 37,883 levels pulled up by automobile manufacturers, banking and financial stocks. YES Bank, Bajaj Finance, Hero Moto Corp, and M&M ended the day as top gainers while Vedanta, HDFC, Bharti Airtel, and Reliance were the top laggards at the close. On the other hand, Nifty50 settled at 11,284 mark, up 32 points, or 0.29 levels.

In the broader market, S&P BSE MidCap ended 73 points, or 0.53 per cent, higher at 13,856 levels while the S&P BSE SmallCap closed 29 points, or 0.22 per cent, higher at 13,060 levels.

Sectorally, all the indices ended in the green barring Nifty IT index. Nifty Auto index was the top performing index, closing with gains of over 2 per cent. Nifty Bank, including private bank and public sector bank indices, and Nifty Pharma ended with gains of a per cent each. Nifty IT index closed with a cut of 0.82 per cent.

Shares of IDFC First Bank gained 10 per cent to Rs 43 apiece on Friday, gaining 14 per cent in the past two trading days on the BSE, despite a net loss of Rs 617 crore in June quarter (Q1FY20). The loss was due to higher provisioning for stressed assets, financial data of the bank showed. The private lender had posted a net profit of Rs 181 crore in the year-ago quarter.

Maruti Suzuki reported standalone net profit of Rs 1,435 crore for June quarter, down 27.3 per cent from the year-ago’s Rs 1,975.3 crore profit. Revenue from operation came in at Rs 18,735.2 crore, down 14.1 per cent on a YoY basis. The company posted Ebitda of Rs 2048 crore, down 38.5 per cent from Q1FY19’s Rs 3,330 crore. Margin were down 440 bps at 10.4 per cent as compared to 14.8 per cent YoY.

Shares of Varun Beverages (VBL) hit an all-time high of Rs 667 apiece, up 8 per cent intra-day, on the BSE on Friday. The stock has surged 11 per cent in the past two trading days on the exchange after it turned ex-date for bonus issue in the ratio of 1:2 on Thursday. In comparison, the S&P BSE Sensex was up 0.20 per cent in past two days. The stock of the beverages manufacturer surpassed its previous high of Rs 650 (adjusted to bonus) hit on July 9, in the intra-day trade.

Shares of Westlife Development slipped 6 per cent intra-day to trade at Rs 272 apiece, also its 52-week low, on the BSE on Friday after the company’s consolidated net profit more-than-halved in Q1FY20 to Rs 5.77 crore from Rs 11.6 crore in the same period in the previous fiscal. The company’s total revenue during the quarter grew 12 per cent at Rs 382 crore on year-on-year basis while Earnings before interest, tax, depreciation and amortisation (EBIDTA) margins contracted 180 bps at 8.57 per cent from 10.37 per cent.

Tata Motors shares hit an over seven-year low of Rs 138 per share, slipping 4 per cent on the BSE in Friday’s early morning deal, after the company’s consolidated net loss nearly doubled at Rs 3,680 crore in the June quarter of 2019-20 (Q1FY20) on Jaguar Land Rover (JLR) woes and a slowdown in the automobile industry in India. The commercial vehicle major had posted a loss of Rs 1,863 crore in year-ago quarter.

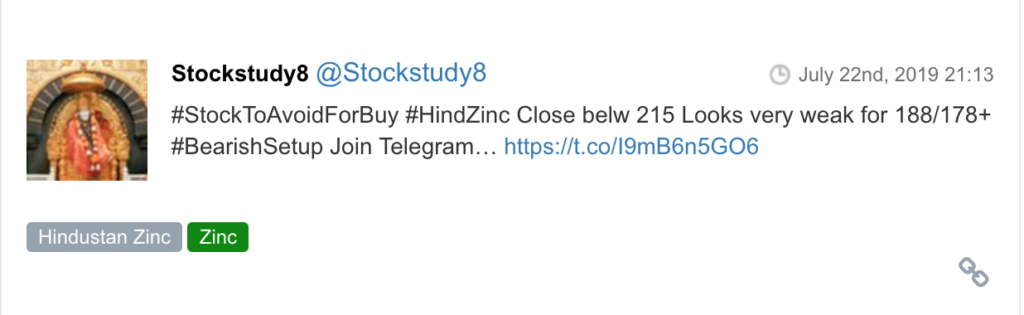

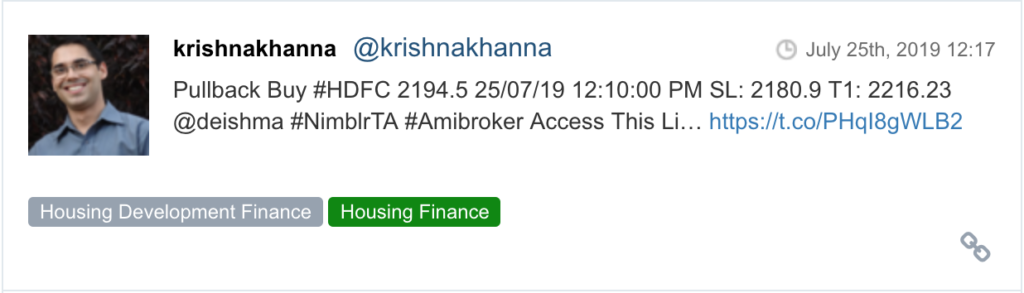

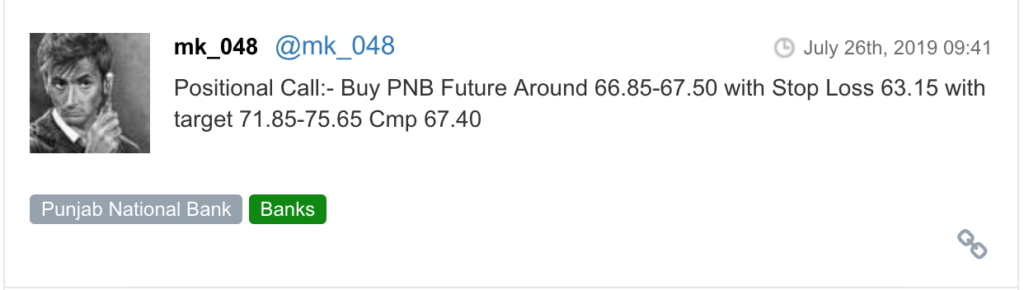

Here are some picks from the week gone by.