Sensex slumps 192 pts, Nifty below 11,800; pvt banks, metal stocks drag

Benchmark indices erased their early gains to close Friday’s session lower, dragged down by metal stocks.

The benchmark S&P BSE Sensex closed 192 points, or 0.48 per cent, lower, with YES Bank, IndusInd Bank, Tata Motors, Reliance Industries, and ONGC the top losers.

The broader Nifty50 index slipped 53 points, or 0.45 per cent, to 11,789. The market breadth remained in favour of sellers. About 919 stocks declined and 822 advanced on the NSE.

On a weekly basis, however, the indices gained with the Sensex closing 0.5 per cent higher and the Nifty climbing 0.6 per cent.

Among Nifty sectoral indices, only three closed the day in the green. Nifty Metal, down 1.1 per cent, took the deepest cuts while the Nifty Private Bank index dipped 0.6 per cent.

In the broader market, the S&P BSE MidCap index settled 45 points, or 0.3 per cent, lower at 14,808, while the S&P BSE SmallCap index lost 10 points, or 0.07 per cent, to 14,239.

Shares of Cox & Kings were locked in the 10 per cent lower circuit for the third straight day on Friday to quote at Rs 36 apiece on the BSE after the company defaulted on commercial paper worth Rs 150 crore.

Shares of Sadbhav Infrastructure Projects (SIPL) tanked 18 per cent to hit a record low of Rs 59 on the BSE on Friday after Care Ratings downgraded the credit rating of the firm’s wholly-owned subsidiary, Rohtak-Hissar Tollway Private Limited (RHTPL), from ‘BB+’ to ‘D’. The stock, however, recovered to Rs 72.60, up 0.8 per cent, by the end of the session.

Dewan Housing Finance Corporation Limited (DHFL) shares dipped 11.75 per cent to Rs 72.10 on the BSE on Friday, after the company deferred the release of its March 2019 quarter (Q4) results which were schedueled to be announced on Saturday (June 29) to July 13.

Shares of South India based real estate companies mainly Sobha, Prestige Estates Projects and Brigade Enterprises have fallen by up to 7 per cent on the National Stock Exchange (NSE) in intra-day trade on Friday after reports suggested that Karnataka government was mulling to ban construction activity in the state for 5 years owing to acute water supply shortage.

Shares of public sector undertaking (PSU) banks rallied by up to 12 on the National Stock Exchange (NSE) in intra-day trade on Friday after the Reserve Bank of India (RBI) said that bad loans cycle seems to have turned around as bulk of the legacy non-performing assets (NPAs) have already been recognized in the banking books.

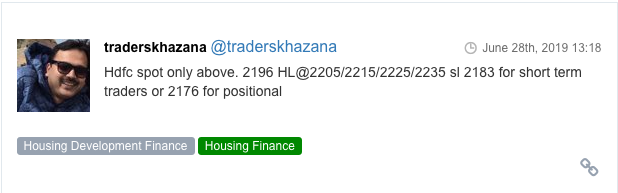

Here are some picks from the week gone by