Sensex slips 118 pts, Nifty ends at 11,922 in volatile trade

After reclaiming the crucial 40,000 and 12,000 levels, respectively in the early deals, the benchmark indices S&P BSE Sensex and Nifty50 index turned volatile in the afternoon session.

The S&P BSE Sensex ended at 39,714, down 118 points while the broader Nifty50 index settled at 11,923, down 23 points.

The S&P BSE Sensex was trading 132 points or 0.33 per cent lower at 39,700 levels while the NSE’s Nifty50 index was quoting 33 points or 0.28 per cent lower at 11,913 levels. Nifty Bank saw a swing of 1,200 points during the session. Volatility index India VIX was trading over 4 per cent higher at 16.24.

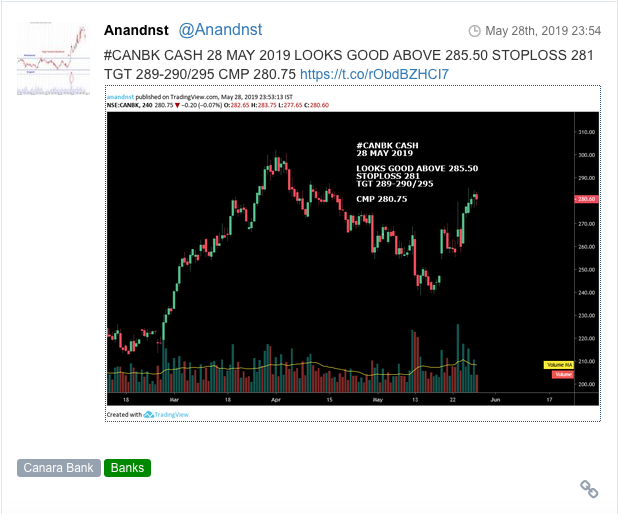

Sectorally, barring IT and FMCG counters, all the indices were trading in the red with the Nifty PSU Bank index taking the hardest knock, followed by media and realty stocks. The Nifty PSU Bank index was trading nearly 2 per cent lower at 3,232.50 levels.

In the broader market, the S&P BSE MidCap index was trading flat at 15,070 levels while the S&P BSE SmallCap index was ruling at 14,876, down 88 points or 0.59 per cent.

Putting rest to all speculation, the President of India on Friday released the portfolio details of new Cabinet, a day after Narendra Modi took oath as the country’s 16th Prime Minister. There were expectations that Amit Shah, a seasoned stock broker and a key architect of NDA’s victory for the second consecutive time will be handed over reigns of the Finance Ministry. This is after Arun Jaitley expressed his desire to stay away from any role in the new government citing health reasons. However, Nirmala Sitharaman has been appointed the new Finance Minister, while Amit Shah will handle the Home Ministry. Smriti Irani, who was expected to be awarded handsomely for defeating Rahul Gandhi in Amethi, has been made the Minister of Women and Child Development and Minister of Textiles.

Shares of Hindustan Petroleum Corporation (HPCL) hit a 52-week high of Rs 330, up 4 per cent, after surging 20 per cent in two weeks on the BSE, lifted by strong earnings in March quarter (Q4FY19) and fall in crude oil prices. In comparison, the S&P BSE Sensex was up 5 per cent during the same period.

Coal India shares rallied as much as 4.11 per cent in the morning deals on Friday, a day after the company reported an impressive 362.46 per cent jump in its net profit at Rs 6,024.23 crore for the quarter ended March 31, 2019.

Shares of Vinati Organics were trading higher for the sixth straight day, up 5 per cent at Rs 2,197 on the BSE, also its new high in an otherwise weak market on Friday. The S&P BSE Sensex was down 0.48 per cent at 39,681 points at 02:39 pm. In the past two weeks, the stock has outperformed the market by surging 21 per cent, after the company reported strong earnings in March quarter (Q4FY19). In comparison, the benchmark index was up 4 per cent during the same period.

NCC shares tumbled 17 per cent at Rs 97 on BSE on Friday to record their sharpest intra-day fall in the past 30 months, on report that the YS Jaganmohan Reddy government had decided to cancel projects sanctioned by Chandrababu Naidu in Andhra Pradesh. The stock reported its biggest intra-day decline since November 9, 2016. The counter has seen huge trading volumes with a combined 71 million shares, representing 12 per cent of total equity of NCC, changing hands on the NSE and BSE till 12:49 pm.

Revathi Equipment shares rallied 17 per cent to Rs 519 on Friday, surging 40 per cent in the past two trading days on the BSE, after the company reported an over four-fold jump in consolidated net profit at Rs 10.17 crore in March quarter (Q4FY19). The company had a posted profit of Rs 2.25 crore in year ago quarter. Operational revenue during the quarter under review grew 27 per cent at Rs 81.88 crore against Rs 64.31 crore in the corresponding quarter of previous fiscal. EBITDA (earnings before interest tax depreciation and amortization) margin declined to 13.26 per cent from 15.3 per cent, due to higher other expenses.

The Australian state of Queensland on Friday approved Adani Enterprise’s management plan for an endangered bird at the site for a controversial coal mine, leaving only one more permit before construction can start on the project. India’s Adani has been working for a decade to obtain approvals to develop the Carmichael mine in the remote Galilee Basin, but the process has been slow as the project has become a touchstone for concerns about climate change.

Here are some picks from the week gone by.