Sensex ends 373 points up as rupee recovers; PM eco meet eyed

The equity markets settled 1 per cent higher on Friday as the rupee recovered against the dollar.

The S&P BSE Sensex reclaimed the 38,000 mark to end at 38,091, up 373 points while the broader Nifty50 index settled at 11,515, up 145 points.

In the broader markets, the S&P BSE MidCap settled 1.6 per cent higher and the S&P BSE SmallCap rose 1.4 per cent.

Among sectoral indices, the Nifty Pharma index settled 2.5 per cent higher led by a rise in the share prices of Divi’s Laboratories and Piramal Enterprises. On the other hand, the Nifty Bank index rose 1.3 per cent led by YES Bank and IDFC Bank.

The rupee strengthened by over 60 paise to 71.58 against the US dollar in intra-day trade. On Wednesday, the domestic currency rebounded from its historic low of 72.91 to end higher by 51 paise at 72.18 against the dollar.

This apart, Prime Minister Narendra Modi will hold a meeting with finance ministry officials later in the day to discuss the fall in the rupee and other economic issues. Rupee is Asia’s weakest currency in 2018, down more than 12 percent on a widening current account deficit and higher oil prices.

Shares of Vedanta rose 4.3 per cent to Rs 233.40 per share on the BSE in intra-day trade after the company on Thursday said that it has discovered natural gas in a Krishna Godavari basin block in the Bay of Bengal. The Anil Agarwal-led company which recently merged oil explorer Cairn India with itself said that it has notified the oil ministry and the upstream regulator Directorate General of Hydrocarbons (DGH) about the discovery in well A3-2 in block KG-OSN-2009/3.

Shares of KNR Constructions rallied 6 per cent in the intraday trade on Friday after the company’s subsidiary KNR Shankarampet Projects received sanction from bank to finance its Hybrid Annuity Mode (HAM) Projects.

The stock of AU Small Finance Bank (AU SFB) has surged about 20 per cent in the last six months, outperforming the BSE Bankex’s return of 8.4 per cent. The stock continues to trade at a premium valuation of over five times its FY20 estimated book value.

Shares of pharmaceutical companies were in focus with the Nifty Pharma index rising over 2 per cent to 10,623.60 levels in the intra-day deals after Sun Pharmaceutical Industries (Sun Pharma) and Lupin USFDA approval for their respective medicines.

Sun Pharma rose over 3 per cent to an intra-day high of Rs 670.90 on the National Stock Exchange (NSE) after the drug maker announced USFDA approval of XELPROS to treat open-angle Glaucoma or Ocular Hypertension. This approval is from Sun Pharma’s Halol facility.

Lupin, too, rose 2 per cent to Rs 978.75 on the NSE after the company on Wednesday said it has received nod from the US health regulator to market its Atovaquone oral suspension used for prevention and treatment of a type of pneumonia.

Shares of fertlizer companies rallied up to 18 per cent in intra-day deals on Friday after the government approved a new procurement policy on MSP (minimum support prices). Under the policy, one scheme will focus on compensating oilseeds farmers if rates fall below the MSP, and another will allow states to rope in private players for procurement, PTI reported Wednesday citing sources.

Rashtriya Chemicals & Fertilizers (RCF) surged as much as 18 per cent to hit a high of Rs 79.85 apiece on the BSE in intra-day trade. Fertilizers & Chemicals Tranvancore (FACT) stock was trading nearly 10 per cent higher at Rs 46.80 apiece on BSE. That apart, shares of National Fertilizers were trading 7 per cent higher at Rs 47.75, while those of Madras Fertilizers were trading at Rs 26.40 apiece, up 4.14 per cent.

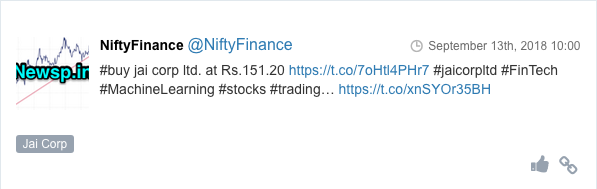

Here are some picks from the week gone by.