Repost: Eight common behavioural mistakes in a bull market

The famous economist John Maynard Keynes once said, “Markets can remain irrational longer than one remains solvent”, guessing the levels of the markets could turn out to be a futile exercise and one that could cause damage.

However, what really matters is the balance of mind and behaviour particularly during times of exuberance in the markets where stocks tend to run ahead of fundamentals. While behavioural fallacies are common in all kinds of markets, here are a few that need a serious check in a bull market.

Every time just after I sell a stock it makes a new high. Let me buy it again

If one recollects, a short para written in Benjamin Graham’s investment classic “The Intelligent Investor”, it illustrated a famous story about physicist Sir Isaac Newton, who back in 1720 bought the shares of South Sea Company, considered as a hot stock at that time in England. When prices soared, he said that he could calculate the motion of heavenly bodies, but not the madness of the people. Soon Newton sold his stock pocketing 100 percent gain. However, feeling he sold early, as the prices further spiked, a month later he again purchased the stock and lost more money than he gained after his first purchase. The moral is that even the world’s greatest scientist could not understand the crowd and lost huge money.

Rajeev Thakkar, CIO at Parag Parikh Financial Advisory Services explained this dilemma in his words as “What many people forget is that there are a lot of things in life which go by cycles rather than in a linear relation. If noon temperatures keep rising month on month from January to May, it would be foolish to expect that temperatures will keep rising in June, July, August and so on. Everyone understands that seasons go through cycles. However, in the investing field, especially as regards stock markets investors get taken in by recency and drive their investing decisions looking at the rear view mirror instead of looking through the windshield.”

In other words, investment decisions purely based on price and behaviour of the crowd could be costly.

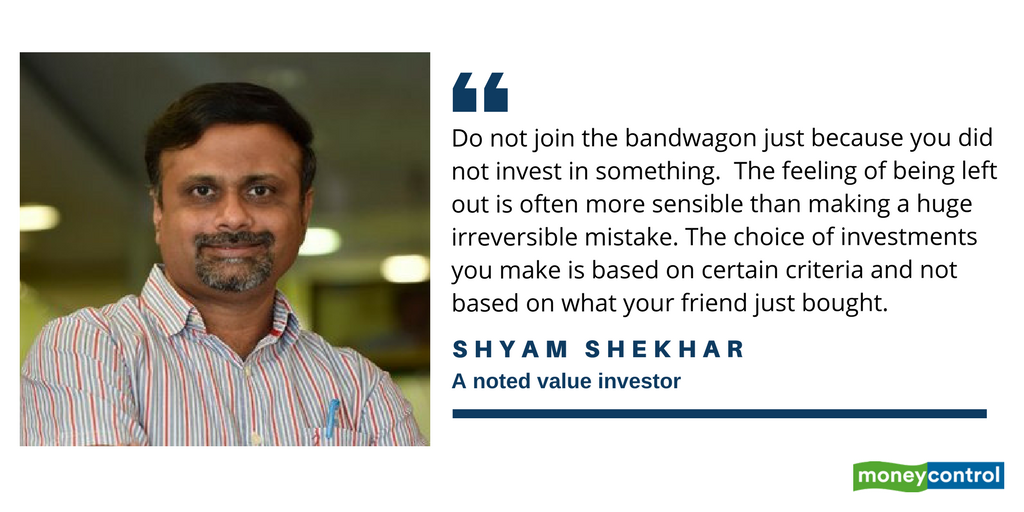

Friend, “you did not buy that stock… it rose 50 percent last week”?

Bull markets produce many stock pickers and one of them could be your friend, who is itching your head every time he made money. When every other stock is rising and a friend is making more money trading a few quick ones it is difficult not to attend his phone call next time.

Saloon-wala making stock recommendations

Saloon-wala making stock recommendations

In a rising market it is often seen that every stock and every other investor is making money. When the optimism continues for a prolonged period it makes many a novice investor an expert. This is precisely the reason that they start to make recommendations, which is one of the early signs of danger. As a rational investor what is important is to stay away from the greed and take every investment decision cautiously.

Behavioural gurus suggest a rational investor will always look for a reason or a rationale for investing or picking any stock rather than get trapped by behavioural mistakes such as herd mentality bias where everyone around you is trying to act smart.

IPOs make quick money…Let me break my child’s piggy bank

The old wisdom says that the best time for any company to come out with the IPOs is when the markets are at peak and sentiments and liquidity is high because that is the time promoters can get best possible valuations. No wonder most of the recent IPOs have not only subscribed several times but helped in bailing out many private equity investors and promoters to quick money.

Investors make listing gains and that drive liquidity, which in turn allow more and more IPOs to come and raise funds. This is typically known as the self-propelled positive feedback loop where output becomes input like listing gains in the case of IPOs. As long as IPOs are making listing gains investors drive higher optimism, which is also known as recency bias in behavioural investing.

I would not miss this turnaround story

Do you feel anxiety having not invested in the most celebrated turnaround story in stocks market? In a bull market, it is quite common for people looking for a trade-off between the quality and low-quality stocks. When high-quality stocks have low steam left, investors start to subscribe to all sort of stories like a turnaround, value unlocking and many more.

Warren Buffett once said “What the wise do in the beginning, fools do in the end” As an investor what is important is to remain calm and rational rather than take a plunge in fancy stories.

Investors will often find transitory stories. Companies which are in the industry that are in upsurge for making transitory profits will be the ones making all the headlines. If profits are transitory and not structural sooner or later share prices deflate to reflect the reality.

“In a bull market where there is ample liquidity people come out with all sort of stories subscribing to higher valuations building valuations froth. People who have seen the bear market of 2008-09 will never make such blind mistakes,” said Vijay Kedia.

Let me redeem my mutual funds I can make more money than my fund manager

One by-product of the optimism driven by notional profits earned in the market is increased gut feeling. Investment guru Peter Lynch once said, “The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them.”

Excessive confidence which is not well argued could lead to costly mistakes. A fund manager or a mutual fund has enough resources in terms of knowledge, access to information and a large pool of experience, whose utility could be often far greater than an individual investor who lacks enough homework.

As an investor, our temperament, rationality and how we think are considered to be most important and critical to investment success.

Rolf Dobelli in his famous book “The Art of Thinking Clearly” said let’s be honest. We do not know for sure what makes us successful. We cannot pinpoint exactly what makes us happy. But we know with certainty what destroys success or happiness. This realisation, as simple as it is, is fundamental”.

Best returns are made in leveraged positions

Greed to generate more and more money with the same amount of investment often lead investors to leverage. Leveraged investing is like a double-edged sword, where people feel thrilled in a gaining position but often end up getting killed in a falling trade. “A common joke in the markets (with a large element of truth) is that all gains from stock investing are due to the smartness of investors while all losses are the fault of the company, the government, stock brokers, global events and so on. In a bull market, everyone feels like a genius and that is at the root of overconfidence. Overconfidence leads to excessive risk-taking, larger stock allocations, leverage and derivatives trading and so on,” said, Rajeev Thakkar.

If company A is trading at price to earnings (PE) of 70, company B is actually cheap at 50 PE

The most common mistake that is often talked about in a bull market is comparing valuation of two companies to make the other one a compelling story.

“This is not new. In the early 90s, we saw euphoria in cement companies with even dormant, sick capacities getting higher valuations without any underlying business. The non-functional companies or the companies which were under BIFR were compared with the giants like ACC. Other interesting incidents happened around 1993-94 GDR rush when equity markets were opened for the foreigners and they wanted to buy Indian stocks. They bought our stocks at high valuations and that led others to justify their buying when the same stocks corrected marginally from the astronomical valuations at which FIIs bought them. Ultimately, they all got punctured and most GDR stocks fell to 10 percent of the value at which the foreigners bought. During the tech boom, investors started to compare everything and anything with Infosys, we saw this happening in infrastructure and real estate sector in 2007-8,” said, Shyam Sekhar.

Shyam Further added: “In chemicals, NBFC, graphite and few other commodity sectors people are running out of ideas. To be part of the story what they are doing is actually buying the next low value company in the sector irrespective of the underlying business of the company, whose prospects may be vastly different from the one that deserves valuations.”

One needs to think independently and should not rush their investment decisions just because the other company is selling at higher valuations and the one which is trading at lower valuation may at some point deserve higher valuations.

The original post is written by Jitendra Kumar Gupta, appears on moneycontrol.com and is available here.