Reblog: A Few Things I Learned Watching a Hedge Fund Manager Lose $4 Billion on One Trade

Maybe you also followed this story. Or maybe not. But basically a really big hedge fund manager, one of those guys who people quote and probably talk about at Harvard Business School, placed a super big bet on this company called Valeant.

Valeant is a pharmaceutical company trying to cure problems with skin and infectious diseases. They actually also own Bausch Lomb so that means they have a giant eye care business.

This hedge fund manager made a bet that Valeant would keep growing their business, diversifying, and acquiring. He once even called them the next “Berkshire Hathaway.”

This thesis turned out to be wrong. Like really wrong. The company crashed. People started to call Valeant out for jacking up the prices of their drugs. They also were apparently doing some dicey bookkeeping things. Just Google “Philidor Valeant scandal” if you want to learn more about that.

The end result looked like this:

So what did I learn from this story? Are there any interesting takeaways for you? I think so. And by writing this I hope I won’t make the same mistakes. Maybe now you won’t either. Here are a few things I learned from witnessing one of the worst trades ever:

- Risk management is everything. No single investment or trade should ever be able to wipe you out. You want to play this game forever. In 2015, this hedge fund manager had $12 billion in assets under management. He poured $4 billion into Valeant. So he essentially risked a third of his clients money on a single outcome.

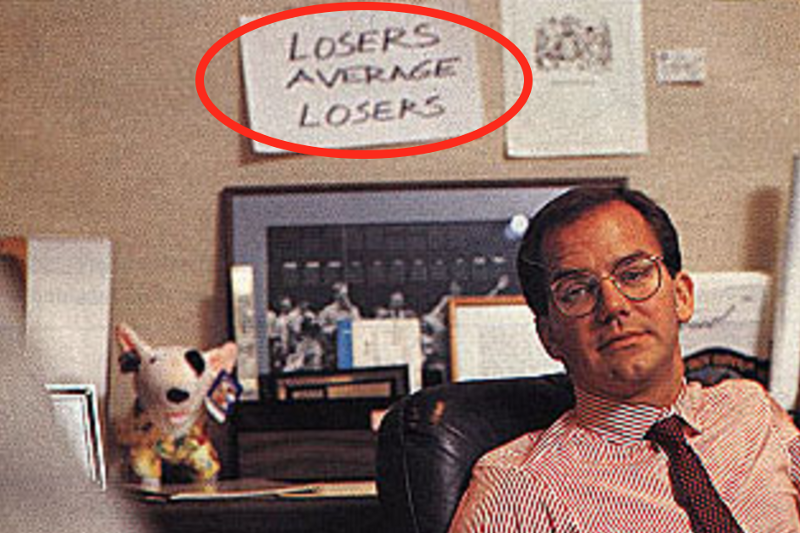

- Don’t ever average down! This hedge fund manager did not cut his losses when the stock started to crash. Instead he averaged down. He bought more. Then he played the options market. Just cut your losses if it’s not working anymore. Get out. Paul Tudor Jones said this best:

- Humility is everything. If you are going to make a trade like this, at least do it quietly. Don’t go on CNBC and tout it. Or promote it. When everyone knows about it on the way up, they’re also going to know about it on the way down. It might make things even worse. The media and people will turn on you for entertainment, clicks, and laughs.

- Social media is your friend. There are some seriously smart people on social media. The Valeant ($VRX) stream on StockTwits is filled with conversations, charts, and debates at all times. Don’t ignore that. Or even the bloggers. A few investment writers totally nailed it. They’ve been writing about Valeant and its problems for years. To this day it’s free and open on their blogs.

- It happens to everyone and it will happen to you. No one makes great investments 100% of the time. Everyone gets hit here and there. Even Warren Buffett admits to this. He wrote about it in his latest letter to shareholders. Like that one time:

“I made one particularly egregious error, acquiring Dexter Shoe for $434 million in 1993. Dexter’s value promptly went to zero. The story gets worse: I used stock for the purchase, giving the sellers 25,203 shares of Berkshire that at yearend 2016 were worth more than $6 billion.” — Warren Buffett

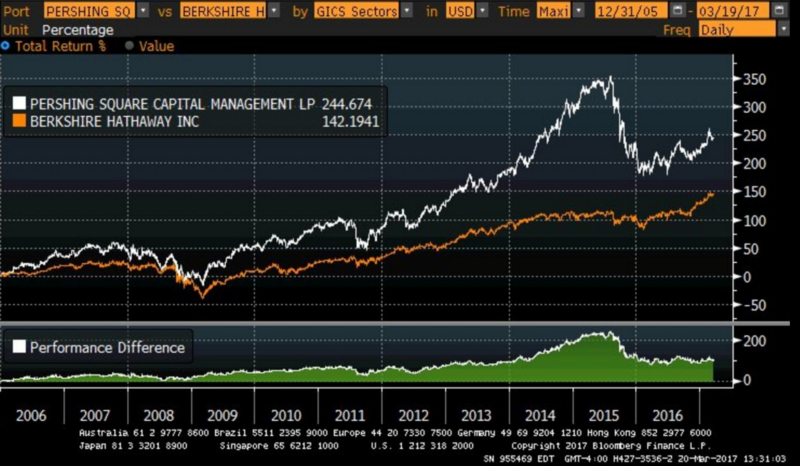

- Narratives are fun, but you also need to see the data yourself. What’s really amazing is how this hedge fund manager lost a ton of money. His brand and skill are being questioned and criticized around the globe. But someone recently showed me something interesting. The following chart shows the price of Warren Buffett’s Berkshire Hathaway vs. this hedge fund manager’s company Pershing Square. Yes, by this metric he’s outperforming Buffett! As a spectator, it’s fun to get into big story lines and narratives. But always make sure you corroborate the data:

The original article is penned by Stefan Cheplick and appears on medium.com. It is available here.

Follow us on Twitter, Facebook, Instagram, Pinterest, Google+