Nifty ends below 9,600, down almost 1% for the week; Nifty IT slips 0.8%

Benchmark indices swung between gains and losses on Friday to end the day flat amid lack of global as well as domestic cues. Nifty50 settled the week 0.8% lower, its first weekly loss in six weeks, breaking its longest gaining streak since late 2014 while Sensex ended the week 0.6% lower.

Gains were capped by a sharp correction in pharma and IT stocks on worries over their earnings outlook while ITC, Tata Motors continued to support the market.

The S&P BSE Sensex settled at 31,056, down 19 points, while the broader Nifty50 ended at 9,588, up 10 points.

In the broader market, the S&P BSE Smallcap pared gains to finish 0.1% higher after rising 0.5% to hit its record high, while the S&P BSE Midcap index was up 0.2%.

Pharma was the top losing index amid worries about their earnings outlook because of pricing pressures in the United States, down 1.8%. Lupin was the biggest laggard on the index, down over 4% followed by 4% Divi’s Lab, Cadila Healthcare, Sun Pharma and Cipla.

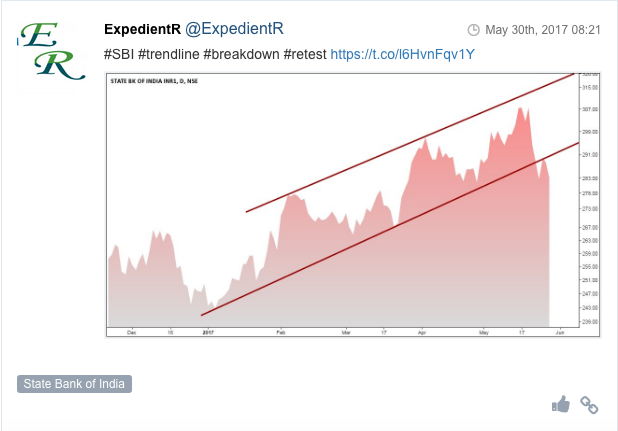

Banking stocks made a comeback after consolidating in the past few sessions and the Nifty Bank index gaining 0.5%. Nifty PSU Bank index ended lower in three of the last four sessions.

Reliance Industries pared losses to trade in positive on BSE after the company announced that BP, world’s leading integrated oil and gas companies and the company will progress and expand partnership.

IT shares fell on worries over outlook at a time when US President Donald Trump is contemplating tougher visa actions in a key market for software services exporters. Nifty IT index settled 0.7% lower to end the week over 2% down becoming the second biggest sectoral loser on the index.

Infosys fell over 1% after Sandeep Dadlani, the head of Americas and global head of manufacturing and retail resigned from the company, in a setback for chief executive Vishal Sikka.

Ipca Laboratories tanked 15% to Rs 437 on BSE in intra-day trade after the company said the US Food and Drugs Administration (USFDA) has refused admission to all drugs made at the company’s Pithampur and Silvassa facility. The stock is currently trading near to its 52-week low of Rs 435 touched on June 24, 2016. The stock ended 7.5% lower.