Reblog: Explaining a Paradox: Why Good (Bad) Companies can be Bad (Good) Investments!

12In nine posts, stretched out over almost two months, I have tried to describe how companies around the world make investments, finance them and decide how much cash to return to shareholders. Along the way, I have argued that a preponderance of publicly traded companies, across all regions, have trouble generating returns on the capital invested in them that exceeds the cost of capital. I have also presented evidence that there are entire sectors and regions that are characterized by financing and dividend policies that can be best described as dysfunctional, reflecting management inertia or ineptitude. The bottom line is that there are a lot more bad companies with bad managers than good companies with good ones in the public market place. In this, the last of my posts, I want to draw a distinction between good companies and good investments, arguing that a good company can often be a bad investment and a bad company can just as easily be a good investment. I am also going argue that not all good companies are well managed and that many bad companies have competent management.

Good Businesses, Managers and investments

Investment advice often blurs the line between good companies, good management and good investments, using the argument that for a company to be a “good” company, it has to have good management, and if a company has good management, it should be a good investment. That is not true, but to see why, we have to be explicit about what makes for a good company, how we determine that it has good management and finally, the ingredients for a good investment.

|

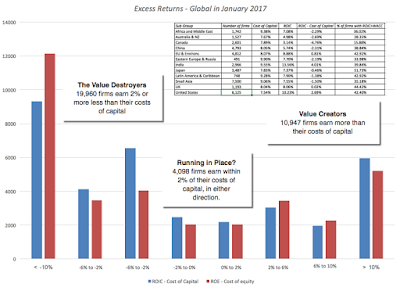

To the extent that you want the capital that you have invested in companies to generate excess returns, you could argue that the good companies in this graph as the value creators and the bad ones are the value destroyers. At least in 2017, there were a lot more value destroyers (19,960) than value creators (10,947) listed globally!

Good and Bad Management

If a company generates returns greater (less) than its opportunity cost (cost of capital), can we safely conclude that it is a well (badly) managed company? Not really! The “goodness” or “badness” of a company might just reflect the ageing of the company, its endowed barriers to entry or macro factors (exchange rate movements, country risk or commodity price volatility). The essence of good management is being realistic about where a company is in the life cycle and adapting decision making to reflect reality. If the value of a business is determined by its investment decisions (where it invests scarce resources), financing decisions (the amount and type of debt utilized) and dividend decisions (how much cash to return and in what form to the owners of the business), good management will try to optimize these decisions at their company. For a young growth company, this will translate into making investments that deliver growth and not over using debt or paying much in dividends. As the company matures, good management will shift to playing defense, protecting brand name and franchise value from competitive assault, using more debt and returning more cash to stockholders. At a declining company, the essence of “good” management is to not just avoid taking more investments in a bad business, but to extricate the company from its existing investments and to return cash to the business owners. My way of capturing the quality of a management is to value a company twice, once with the management in place (status quo) and once with new (and “optimal” management).

I term the difference between the optimal value and the status quo value the “value of control” but I would argue it is also just as much a measure of management quality, with the value of control shrinking towards zero for “good” managers and increasing for bad ones.

As you can see at the bottom, investing becomes a search for mismatches, where the market’s assessment of a company (and it’s management) quality is out of sync with reality.

Screening for Mismatches

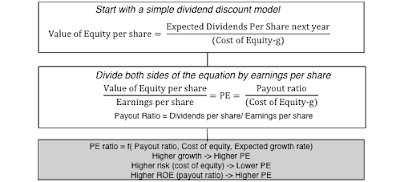

If you take the last section to heart, you can see why picking stocks to invest in by looking at only one side of the price/value divide can lead you astray. Thus, if your investment strategy is to buy low PE stocks, you may end up with stocks that look cheap but are not good investments, if these are companies that deserve to be cheap (because they have made awful investments, borrowed too much money or adopted cash return policies that destroy value). Conversely, if your investment strategy is focused on finding good companies (strong moats, low risk), you can easily end up with bad investments, if the price already more than reflects these good qualities. In effect, to be a successful investor, you have to find market mismatches, a very good company in terms of business and management that is being priced as a bad company will be your “buy”. With that mission in hand, let’s consider how you can use multiples in screening, using the PE ratio to illustrate the process. To start, here is what we will do. Starting with a very basic dividend discount model, you can back out the fundamentals drivers of the PE ratio:

Now what? This equation links PE to three variables, growth, risk (through the cost of equity) and the quality of growth (in the payout ratio or return on equity). Plugging in values for these variables into this equation, you will quickly find that companies that have low growth, high risk and abysmally low returns on equity should trade at low PE ratios and those with higher growth, lower risk and sold returns on equity, should trade at high PE ratios. If you are looking to screen for good investments, you therefore need to find stocks with low PE, high growth, a low cost of equity and a high return on equity. Using this approach, I list multiples and the screening mismatches that characterize cheap and expensive companies.

| Multiple | Cheap Company | Expensive Company |

|---|---|---|

| PE | Low PE, High growth, Low Equity Risk, High Payout | High PE, Low growth, High Equity Risk, Low Payout |

| PEG | Low PEG, Low Growth, Low Equity Risk, High Payout | High PEG, High Growth, High Equity Risk, Low Payout |

| PBV | Low PBV, High Growth, Low Equity Risk, High ROE | High PBV, Low Growth, High Equity Risk, Low ROE |

| EV/Invested Capital | Low EV/IC, High Growth, Low Operating Risk, High ROIC | High EV/IC, Low Growth, High Operating Risk, Low ROIC |

| EV/Sales | Low EV/Sales, High Growth, Low Operating Risk, High Operating Margin | High EV/Sales, Low Growth, High Operating Risk, High Operating Margin |

| EV/EBITDA | Low EV/EBITDA, High Growth, Low Operating Risk, Low Tax Rate | High EV/EBITDA, Low Growth, High Operating Risk, High Tax Rate |

If the length of this post has led you to completely forget what the point of it was, I don’t blame you. So, let me summarize. Separating good companies from bad ones is easy, determining whether companies are well or badly managed is slightly more complicated but defining which companies are good investments is the biggest challenge. Good companies bring strong competitive advantages to a growing market and their results (high margins, high returns on capital) reflect these advantages. In well managed companies, the investing, financing and dividend decisions reflect what will maximize value for the company, thus allowing for the possibility that you can have good companies that are sub-optimally managed and bad companies that are well managed. Good investments require that you be able to buy at a price that is less than the value of the company, given its business and management.

Thus, you can have good companies become bad investments, if they trade at too high a price, and bad companies become good investments, at a low enough price. Given a choice, I would like to buy great companies with great managers at a great price, but greatness on all fronts is hard to find. So. I’ll settle for a more pragmatic end game. At the right price, I will buy a company in a bad business, run by indifferent managers. At the wrong price, I will avoid even superstar companies. At the risk of over simplifying, here is my buy/sell template:

| Company’s Business | Company’s Managers | Company Pricing | Investment Decision |

|---|---|---|---|

| Good (Strong competitive advantages, Growing market) | Good (Optimize investment, financing, dividend decisions) | Good (Price < Value) | Emphatic Buy |

| Good (Strong competitive advantages, Growing market) | Bad (Sub-optimal investment, financing, dividend decisions) | Good (Price < Value) | Buy & hope for management change |

| Bad (No competitive advantages, Stagnant or shrinking market) | Good (Optimize investment, financing, dividend decisions) | Good (Price < Value) | Buy & hope that management does not change |

| Bad (No competitive advantages, Stagnant or shrinking market) | Bad (Sub-optimal investment, financing, dividend decisions) | Good (Price < Value) | Buy, hope for management change & pray company survives |

| Good (Strong competitive advantages, Growing market) | Good (Optimize investment, financing, dividend decisions) | Bad (Price > Value) | Admire, but don’t buy |

| Good (Strong competitive advantages, Growing market) | Bad (Sub-optimal investment, financing, dividend decisions) | Bad (Price > Value) | Wait for management change |

| Bad (No competitive advantages, Stagnant or shrinking market) | Good (Optimize investment, financing, dividend decisions) | Bad (Price > Value) | Sell |

| Bad (No competitive advantages, Stagnant or shrinking market) | Bad (Sub-optimal investment, financing, dividend decisions) | Bad (Price > Value) | Emphatic Sell |

YouTube Video

The original article is written by Aswath Damodaran and can be found here.