Reblog: How incorrect assessment of returns can lead to bad investment decisions

When it comes to gauging the worthiness of an investment, investors often land way off the mark. Most treat short-term returns as a yardstick, while others have unrealistic expectations. Yet others misinterpret returns completely. However, correct assessment of performance is a must to avoid bad investment decisions.

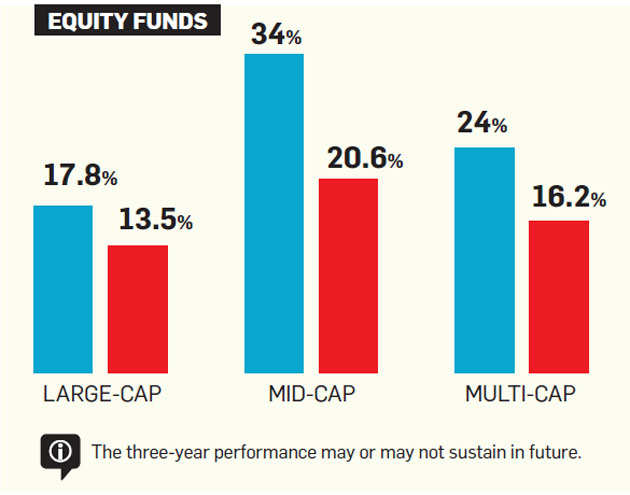

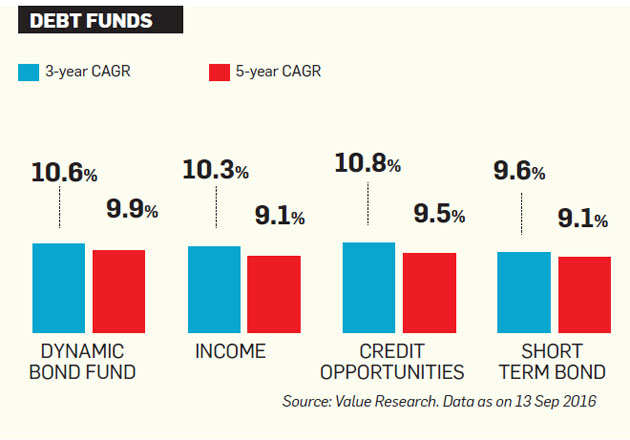

For most investors, point-to-point return figures serve as the performance yardstick. This can be misleading. The current return profile of equity funds, for instance, is a case in point. The three-year returns of most equity funds comfortably outshine the five-year figures (see chart). Large-cap funds have clocked 13.5% CAGR over the past five years compared to 17.8% over the past three. Mid-cap equity funds have yielded 20.6% CAGR over the past five years against a whopping 34% in three years. To the lay investor, this sharp disparity in returns poses a dilemma—if the return is so much higher for a three-year period, does it make sense to stay invested for five years or more? But the investor is overlooking two critical elements here. First, he is considering a singular point-to-point reference from the past to make an assumption about the future. Second, he is ignoring the difference between annualised returns and simple absolute returns.

The last three years have been immensely rewarding for equity investments. It has been marked by a transition from depressed investor sentiment to a sense of optimism fuelled by a reform-oriented government, apart from a favourable macro environment. The two years before the market upswing were not as healthy for investors and that has led to a comparatively muted five-year return profile.

“Don’t get swayed by point-to-point return,” says Amol Joshi, Founder, PlanRupee Investment Services. This three-year rally is not a norm; it may or may not sustain in future. If you stay invested for a few more years, you might see a dip in your fund’s return profile, in line with the stock market’s performance. That doesn’t mean you will not earn good returns if you stick around longer. The premise behind staying invested for longer periods is to catch an entire investment cycle or more, which smoothens out the erratic market returns to ultimately yield a healthy return irrespective of volatility.

Rohit Shah, Founder and CEO, Getting You Rich, insists, “Timing the market is futile. Instead, patience to stay invested over the long term will prove rewarding for investors.” If you had invested at the bottom of the stock market in March 2009 and exited when it hit a peak next year, you would have doubled your money. But you would have also missed out on the rally that played out subsequently, albeit with bouts of volatility. For instance, an investment of Rs 1 lakh in ICICI Prudential Value Discovery in March 2008 would have fetched Rs 3.07 lakh by 30 September 2010—a CAGR of 111%. Had you stayed invested, the same would have grown to Rs 7.67 lakh today, at a healthy CAGR of 31.5%. Would you still have rather exited in 2010?

Don’t get swayed by higher 3-year returns from investments

By staying invested over longer periods, one can catch an entire investment cycle, which will ensure a healthy return.

Let’s consider the second oversight. The returns mentioned are in compounded, annualised terms. They are not simple absolute returns. CAGR provides the year-over-year growth rate of an investment over a specified period of time. In other words, the return compounds over time. While absolute return can be used to evaluate performance for up to a year, CAGR is a better way to analyse return over longer time frames. It would not be right to compare an investment earning, say, 15% CAGR over five years and 12% CAGR over 10 years, and conclude that the investment has fared badly in the latter case.

Using rolling return

CAGR as a point-to-point return calculation ignores intermittent volatility. Equity fund returns are volatile and never linear over long periods. They can vary significantly from one year to another. For instance, a 12% CAGR over five years implies that if you invested five years ago and sold your investment today, you earned the equivalent of 12% a year. However, during those five years, the investment may have gone up 40% in one year and gone down 25% in another year. CAGR does not account for it and gives the impression that the investment is growing consistently at a particular rate. To overcome this, one can use a rolling return analysis.

Rather than a singular point-topoint comparison spanning the entire time frame, rolling returns break down the entire period into multiple reference points. Returns are calculated on a continuous basis for each defined interval. For instance, a three-year rolling return analysis as on 31 August 2016 will calculate return on a daily basis from 1 September 2013 to 31 August 2016, then 31 August 2013 to 30 August 2016, and so on. This exercise will throw up around 733 three yearly point-to-point returns, and the average is used as the three year rolling return. “Rolling returns provides a much better picture of performance as it takes volatility into account,” says Tanwir Alam, MD, Fincart.

Consider the example of ICICI Prudential Value Discovery Fund. From a simple three-year perspective, the fund has clocked a 36% CAGR. A look at the three-year rolling return shows that the fund has delivered an average of 24.8% CAGR during the past three years. The analysis also shows the disparity in returns over a particular period of time. In the above example, the fund’s return has ranged from a maximum of 39.3% CAGR to a minimum of 0.2% over three year intervals. Calculating rolling returns is a better way to identify consistent performers, insist experts.

Using IRR and XIRR

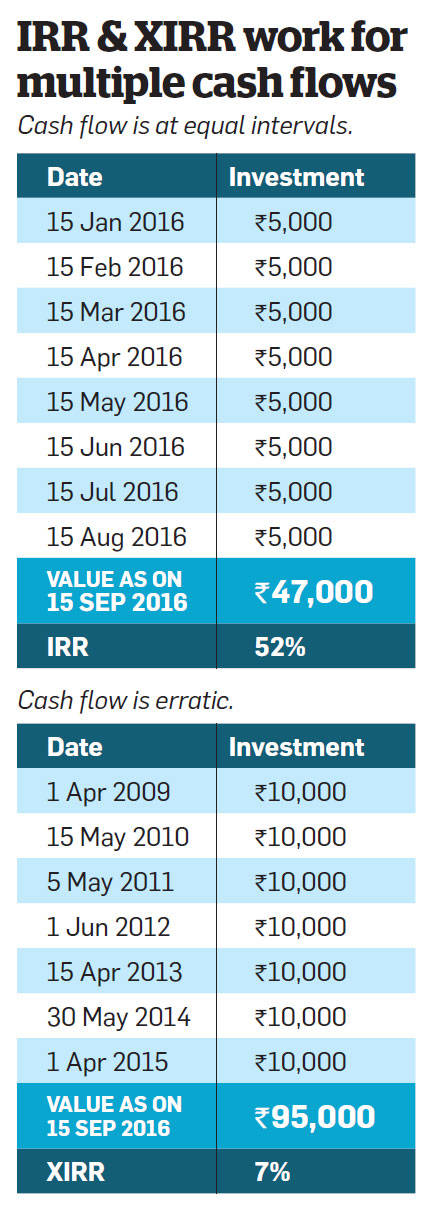

CAGR reflects the change in value from one point in time to another. But there are instances where multiple cash flows are involved. How do you calculate returns when you are putting in money at different points of time and getting back a lump sum at the end or receiving money back at different intervals in the form of dividends or interest? In such cases, investors need to use the Internal Rate of Return (IRR) or Extended Internal Rate of Return (XIRR) formula. The former is used when cash flows take place at equal intervals. The latter is applicable when the flows occur at irregular intervals. For a one time investment, the CAGR and IRR would be the same. But in case of a mutual fund SIP, where the investor is putting money at monthly intervals, the return is reflected by the IRR.

Suppose you had invested Rs 5,000 a month in Birla Sun Life Frontline Equity from the beginning of 2012 through September 2016. The total investment of Rs 2.45 lakh would be worth Rs 3.54 lakh today. In simple terms, this translates to a gain of 44.5% on your total investment or a CAGR of 8.1% over this period. But this is not the correct interpretation. This is because every instalment would have earned different returns, as they were invested over varying time frames. The initial Rs 5,000 you invested would earn a different return over the entire period of the SIP compared to the Rs 5,000 you invested at a later point of time. The IRR in this case works out to 18.7%.

XIRR is useful when calculating, say, the return from an insurance policy payout, where the premium payments typically occur at different dates through the years. Investors often err while assessing return on their investment at the time of payout. The lump sum maturity benefit may give the impression of a high return, but the actual yield on your investment when calculated for the regular cash outflows would give a better picture of performance. Thus IRR and XIRR provide a more accurate comparison of returns when you invest across several time frames. These are calculations that are easily handled using MS Excel.

Consider relative performance

In the above examples, we have considered a fund’s performance in isolation. However, any analysis of fund performance is meaningless without a relative comparison, either with the fund’s benchmark or its category peers. A fund clocking 20% CAGR over the past five years seems a great investment. But it is possible it may have done well due to the recent market rally, thereby showing its overall performance over the 5-year time frame in a better light. If the fund’s category itself has averaged 30% CAGR during this period, or the scheme benchmark has gained 28%, the performance takes on another hue. Ensure that you compare the fund to an appropriate benchmark or category. For instance, it makes no sense comparing the return from a mid-cap equity fund to that of the frontline BSE Sensex or BSE 100.

The original article appears in the Economic Times and is authored by Sanket Dhanorkar. Here is the link to the original article.