Reblog: Fibonacci Trend Line Strategy – Simple Fibonacci Trading Strategy

Fibonacci Trendline Strategy: 5 Steps To Trade

I am going to share with you a simple Fibonacci Retracement Trading Strategy that uses this trading tool along with trend lines to find accurate trading entries for great profits.

There are multiple ways to trade using the Fibonacci Retracement Tool, but I have found that one of the best ways to trade the Fibonacci is by using it with trend lines.

The Fibonacci Retracement tool was developed by Leonardo Pisano who was born around 1175 AD in Italy was known to be “one of the greatest European mathematicians of the middle ages.”

He developed a simple series of numbers that created ratios describing the natural proportions of things in the universe.

And these numbers have been used by traders now for many years!

With this strategy, you will learn everything you need to know to start trading with the Fibonacci Retracement tool. You’re going to find out the Fibonacci meaning, Fibonacci algorithm, Fibonacci biography, the Fibonacci formula for market trading, Fibonacci series algorithm, the Fibonacci sequence in nature, along with many other useful facts about this great tool!

Below is a picture of the different ratios that Leonardo created. We will get into detail later on as to which of these lines we will use for our trading strategy.

Your charting software should come standard with this, however, you are the one that puts this on your chart.

The bottom line is, many traders use this tool which is why it is highly important to have a trading strategy that uses this.

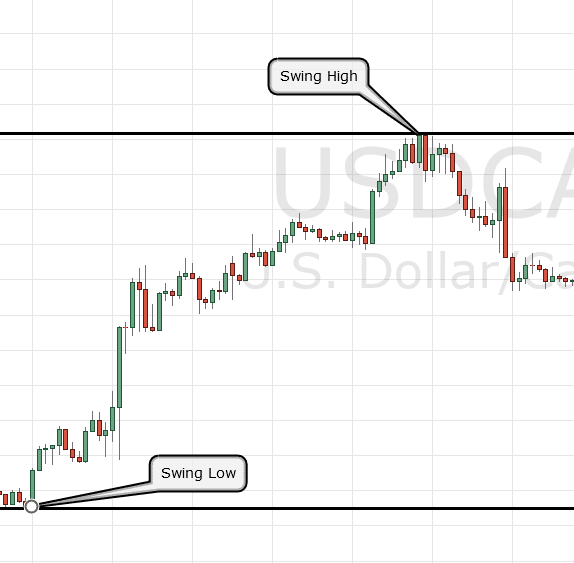

You are going to need to know where to apply these fibs. You will need to place them on the swing high/swing low.

A Swing High is a candlestick with at least two lower highs on both the left and right of itself.

A Swing Low is a candlestick with at least two higher lows on both the left and right of itself.

If you are unsure of what that means let’s take at a chart to see what this looks like:

So here is what it would look like then on your chart with the Fibonacci Retracement:

A quick concept to remember about this is that if it is an uptrend, you want to start with the swing low and drag your Fibonacci level all the way up to the swing high. If it’s a downtrend you start with the swing high and drag your cursor all the way down to the swing low.

Simple enough. Let’s go ahead and look at all we will need with this trading strategy:

Trading Tools for Fibonacci Trend Line Trading Strategy

1. Fibonacci Retracement

2. Trend lines

This trading strategy can be used with any Market (Forex, Stocks, Options, Futures)

It can also be used on any time frame.

This is trend trading strategy that will take advantage of Retracement of the trend.

Forex traders identify the Fibonacci retracement levels as areas of support and resistance. Because of this, the levels are watched by many traders which are why this strategy could be a difference maker to your trading success.

Since we know some information about the Fibonacci Retracement let’s look at the rules of the Fibonacci Trend Line Strategy.

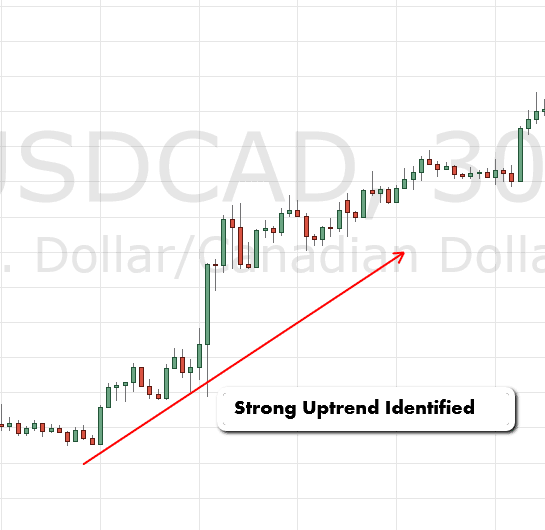

Rule #1 Find a Trending currency Pair

This is simple enough. We need to make sure it’s either an uptrend or a downtrend.

In the example, we will be using today this will be an uptrend. We will be looking for a retracement in the trend and then make an entry based on our rules.

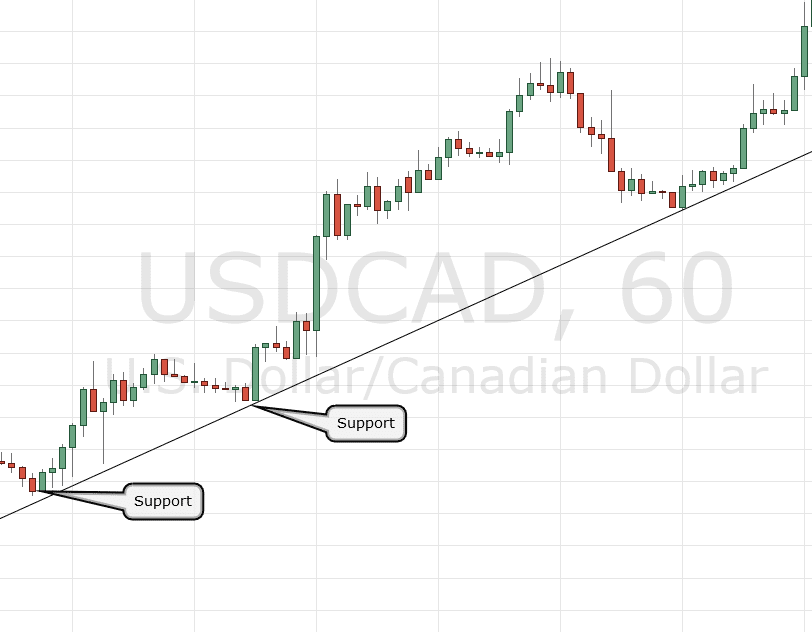

Rule #2 Draw a Trend Line

Since you identified already that it is in fact trend by looking at your chart, now you need to draw your trend line.

Draw this on the support and resistance levels as the trend is going up or down.

Once you draw this trend line you are good to move on to the next step.

Trend lines are a key component to trading and I always recommend using them when you can.

Rule #3 Draw Fibonacci From Swing low to swing High

Now you can get you Fibonacci Retracement tool out and place it at the swing low to the swing high.

Remember this is an uptrend so we started at the swing low 100% and placed the second 0% level at the swing high.

Rule #4 Wait for the Price level to Hit Trend Line

So far we found a trending currency pair, drew a trend line to validate this, and placed our Fibonacci at the swing low and swing high.

This rule is the critical step to the strategy so you need to pay close attention.

Because we need the price to hit our trend line, stall, and go back in the direction of the trend.

If it breaks the trend line and keeps going and blows past the 50%, 61.8%, 78.6% then the trend is obviously broken and you need to look elsewhere because a trade with this strategy would be invalidated at that time.

With that being said let’s look at our chart and see what happened.

Great, it hit the trend line so why can’t we just go ahead and BUY now since it is an uptrend?

Well if you asked that, good question.

As I said, the market tends to follow these lines, but sometimes it will fake traders out and they will end up losing a lot of money when it breaks the trend.

This happens every single day, which is why it is critical to have a strategy that will help you know if this break may occur.

And we do not want any of that to happen to you, so let’s check out the criteria to enter to help us make a safe entry.

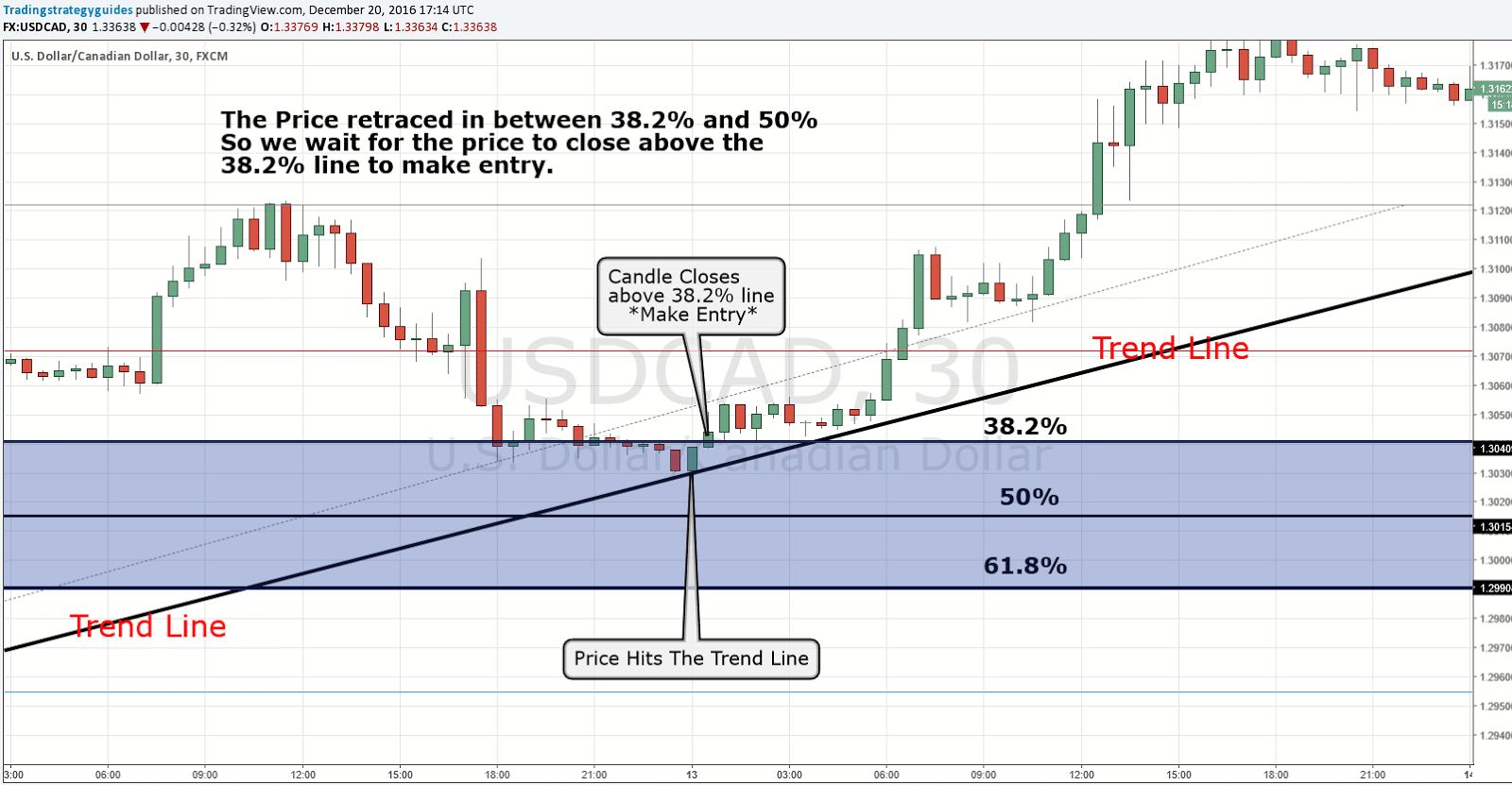

Rule #5 Price Must hit trend line in between 38.2% and 61.8% lines (Fibonacci golden ratio)

Before I start to explain, look at the chart to see what this exactly means:

The price retraced all the way back and tested the 38.2 mark for quite a while before hitting the trend line and continuing to go to the upside.

Once the price hit the trend line that we drew and we saw that this was in between 38.2-61.8 lines then our trade is one step closer to being triggered.

Why does it have to be in between these lines for this strategy?

We want to capitalize on the big retracements. And the 38.2, 50, 61.8 lines have all been proven to be the best retracement lines to use with the Fibonacci.

Once you find this, look for an entry.

Rule #6 Entry Point

So everything is lined up to make a great profit on this retracement, what is the last step to make the trade…

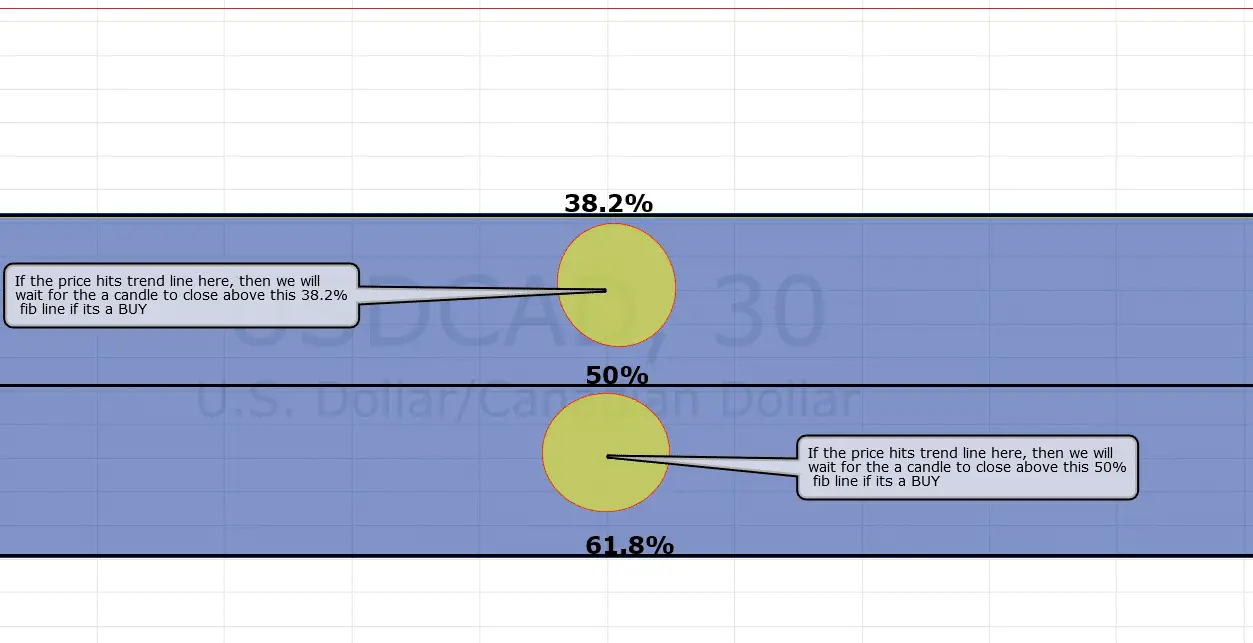

In a BUY-In order to make your entry, you will wait for the price to close above either the 38.2% or 50% line.

In a SELL-In order to make your entry, you will wait for the price to close below either the 38.2% or 50% line.

Lets Check out the charts to clarify this:

Refer back to this picture when you use this strategy since this basically shows us what our charts will look like before we make a trade.

Note** If the Price hit our trend line in between the 50% line and the 61.8% fib line, then we would wait for a candle to close above the 50% line to enter the trade.

The only reason to wait for a candle to close above the 38.3% fib line was because it was in between the 38.2%-50% lines for this example.

This process should not take very long, as our trend should continue upwards because of the previous support with the trend line.

In the above example, it illustrates these rules when the trend line meets the price level in these two zones.

Note** If the price breaks below the 61.8% fib level in the example, then you will also need to wait for a candle to close above the 50% fib level.

The reason you always wait, is because you do not want to get caught in a broken trend and end up getting stopped out.

Rule #7 Stop Loss Placement

Your stop loss can vary based on what you charts are showing you. Look in the past for prior resistance or support.

In the example trade, the stop was placed in between the 50% and 61.8% fib line. For this trade, it just made sense.

This is because if it would have broken the 50% fib line then the uptrend would have been invalidated and we want to get out of that BUY trade as quickly as possible.

It is always helpful to look in the past to determine a stop loss

Conclusion

You always want to push you winners. If you entered this trade using this strategy here are some of the returns you could have gotten is just a short period of time:

Which is why I would recommend using a 3 to 1 (or even 4 to 1) risk to reward ratio. If you want to see the best strategies that this R:R ratio check out some of these:Supply and demand strategy, Stochastic strategy, Big Three Strategy.

That is always up to you. You need to decide how much you are willing to risk vs. reward.

Some will go for just 20 pips, while others press their winners and usually end up profitable.

I would target a point where there is prior resistance/support or an area where you think the trend will stop.

You could even draw channels to help you find a good take profit mark.

Be smart and remember to only risk no more that 2% of your trading account.

The original article appeared on tradingstrategyguides.com and is available here.