Sensex ends 289 points higher ahead of Karnataka polls

The markets ended higher on Friday ahead of the Karnataka Assembly elections. The southern state will vote on Saturday and the poll outcome will be known on May 15.

The S&P BSE Sensex ended at 35,536, up 289 points while the broader Nifty50 index settled at 10,807, up 90 points.

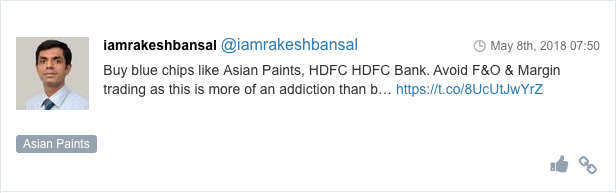

Among individual stocks, Asian Paints hit a record high on strong March-quarter results and was among the top contributors to index gains. Stock was the top gainer of the broader Nifty50 index.

Shares of Fortis Healthcare ended 3% lower at Rs 148 on the BSE, after the company said the board chooses the Hero Enterprises-Burman Family Office offer as the best for the hospital and diagnostic chain.

Shares of select pharmaceutical companies were under pressure, falling by up to 6% ahead of US President Donald Trump speech today about controlling prescription drug prices. Sun Pharmaceutical Industries slipped 6% to Rs 468 on the BSE in noon deal on back of heavy volumes. Novartis India, Marksans Pharma, Ajanta Pharma, Morepen Laboratories, Alkem Laboratories, Sun Pharma Advanced Research Company (SPARC) and Aarti Drugs were down in the range 3% to 4% on the BSE.

PC Jeweller on Thursday announced its board has approved buy-back of shares worth Rs 4.24 billion amid a sharp plunge in stock price in recent weeks. The shares will be bought back at Rs 350 per unit, which is 67 per cent higher than the closing price of Rs 209 apiece on the BSE on Thursday. Promoters will not participate in the buy-back process. In a regulatory filing, the jeweller said the board at its meeting held on Thursday considered and approved the buy-back of up to 1,21,14,286 fully paid-up equity shares of Rs 10 each.

Nestle India hit a new high of Rs 9,610, up 7% on the BSE in intra-day trade, inches towards Rs 10,000 mark after the company reported a better than expected 38% year on year (YoY) growth in net profit at Rs 4.24 billion in March 2018 quarter (Q1CY18). Analysts on an average had expected profit of Rs 4.06 billion for the quarter from the fast moving consumer goods (FMCG) company.

Shares of telecom services provider are under pressure with the Idea Cellular hitting a fresh 52-week low, while Bharti Airtel falling 6% in intra-day trade on Friday after Reliance Jio Infocomm (RJio) announced a new unlimited postpaid plan on Thursday with national roaming, international calling and international roaming plans among others.

Shares of Ingersoll-Rand (India) are locked in upper circuit of 20% or by Rs 142 at Rs 854 per share on the BSE after the company said its board declared a “special dividend” of Rs 202 per equity share as second interim dividend for the financial year ended March 31, 2018 (FY18). The record date for the payment of the special dividend is May 25, 2018 and the dividend will be paid on June 8, 2018.

Zee Entertainment posted a better-than-expected March quarter performance, led by strong growth in advertising revenues. The advertising segment, which accounts for over 60 per cent of the company’s revenues, grew 24 per cent over the year ago quarter. On like-to-like basis, which includes the exit from sports business and acquisitions, the growth was 21.5 per cent. The broad-based recovery in rural demand and the steady urban market has led to an increase in the advertising spends. The growth on advertising is however on a lower base due to demonetisation.

Ujjivan Financial Services hit 52-week high of Rs 432, up 7% on the BSE in early morning trade after the microfinance company reported more than three-fold jump in its consolidated net profit at Rs 649 million in March quarter (Q4FY18). It had profit of Rs 194 million in the same quarter year ago. The assets quality of the company also improved on sequentially with gross non-performing assets (NPA) declined to 3.6% from 4.2% in previous quarter. Net NPA declined to 0.7% in Q4FY18 from 1% in Q3FY18.

Here are some picks from the week gone by