Sensex snaps 3-day winning run, sheds 317 points; Banks, realty shares decline

The key benchmark indices wilted under the selling pressure on Friday amid fears of higher interest rates globally. Banks and realty stocks bore brunt of the selling pressure, as the Sensex and Nifty snapped their three-day winning run.

The S&P BSE Sensex started the day with a negative gap of over 300 points at 60,994; the index did recoup losses but could only manage to touch a high of 61,303. A fresh round of selling in noon deals, saw the BSE benchmark slide to a low of 60,811 – down 509 points from the previous day’s close.

Some buying in late trades helped the Sensex trim losses and end at 61,003, down 317 points.

The Nifty 50 registered a low at 17,885, before settling 92 points lower at 17,944.

A vast majority of the Nifty 50 stocks ended in red today. Adani Enterprises was the top loser, down over 4 per cent. Nestle, IndusInd Bank, SBI Life, HDFC Life and Mahindra & Mahindra were the other major losers. On the other hand, Larsen & Toubro gained over 2 per cent. UltraTech Cement, BPCL, Hero MotoCorp and Asian Paints were the other major losers.

Shares of PTC Industries hit 10% upper circuit as it’s arm won an order from Safran Aircraft. Aerolloy Technologies, a wholly-owned subsidiary of the company has received an order from Safran Aircraft Engines, to develop and supply of Titanium cast components for Aircraft Engines.

Shares of Bajaj Steel Industries hit a 52-week high of Rs 1,098.90, spurting 13 per cent on the BSE in Friday’s intra-day trade, in an otherwise weak market.

Shares of Surya Roshni hit a 14-month high of Rs 711.35, as they surged 10 per cent on the BSE in Friday’s intra-day trade in an otherwise subdued market.

Ipca Labs slipped 5% as it hit a 52-week low on weak December quarter results. In Q3, Ipca’s operating profit margin was lowest since FY19, impacted by lower gross margins, and continued higher overheads.

Medanta hit it’s highest level since listing as the stock surged 13% in 2 days. For October-December quarter (Q3FY23), Medanta reported its highest-ever quarterly total income of Rs 706.2 crore; growth of 19.0 per cent year-on-year (YoY). For first nine months (April to December) of financial year 2022-23 (9MFY23), Medanta’s consolidated total income grew 21.2 per cent year-on-year (YoY) to Rs 2,027 crore.

Greaves Cotton rose 2% as it’s arm forayed into high-speed electric two-wheeler segment. The firm’s e-mobility business, Greaves Electric Mobility, forayed into high-speed electric two-wheeler segment with the launch of Ampere Primus at Rs 1.09 lakh. The management said that company continues to embody ‘Make-in-India’ thrust, with high degree of localisation, domestically sourced components.

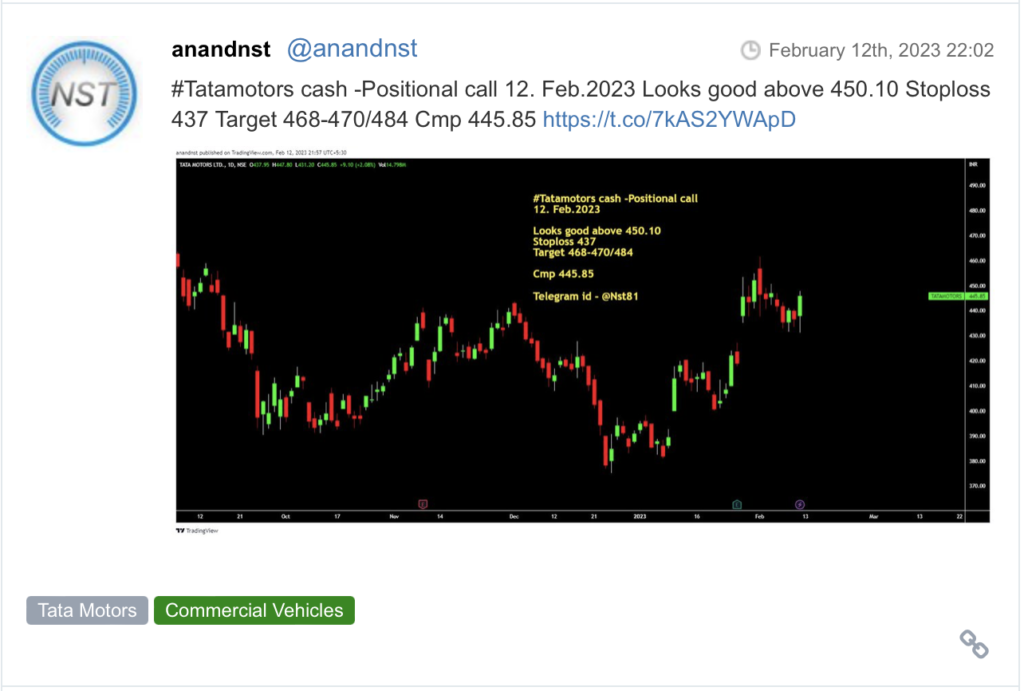

Here are some picks from the week gone by.