Indices log biggest 1-day fall in 9 mths; Sensex sinks 1,939 points, holds 49K

A steep hike in US treasury yields took the global markets by surprise on Friday as investors dumped equities for bonds. That apart, an air strike by the United States in Syria on Thursday, targeting facilities near the Iraqi border, further dented trading sentiment.

US Treasury yields vaulted to their highest levels, of about 1.5 per cent, since the outbreak of the coronavirus pandemic on expectations of a strong economic expansion and related inflation. Back home, the 10-year goverment bond firmed up to 6.23 per cent on Friday mirrowing similar trends. Effectively, fear of reversal in rate cut cycle, spooked investors who off-loaded equities worth Rs 5 trillion.

Additionally, the US air strike in retaliation for a rocket attack in Iraq earlier this month, and caution ahead of the release of the gross domestic product (GDP) for the December quarter made investors sit on the fence.

In the intra-day trade, the benchmark S&P BSE Sensex tumbled 2,149 points while the Nifty50 index slumped 629 points. The indices ended near the lowest point of the day, at 49,100 and 14,529 levels, respectively, down 1,939 points and 568 points.

All the 30 constituents on the Sensex index and 50 stocks on the Nifty ended the day in the red. ONGC, JSW Steel, GAIL, M&M, Bajaj Finance, Grasim, and Hero MotoCorp were the top Nifty losers, down up to 8 per cent; Axis Bank, HDFC, Power Grid, ICICI Bank, and HDFC Bank were the top drags on the Sensex.

In the broader markets, small-cap stocks held their ground relatively better as the S&P BSE SmallCap index settled only 0.7 per cent down. The S&P BSE MidCap index, on the the hand, ended 1.75 per cent lower.

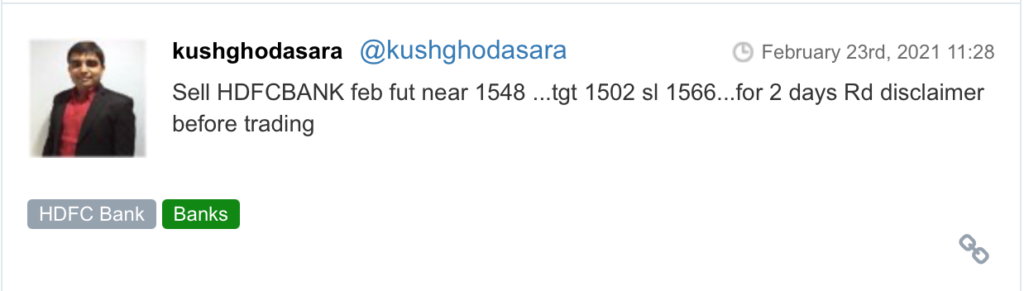

On the sectoral front, banking counters got butchered as yield concerns soured sentiment in the sector. Expectations that banks may have to show yield-induced fall in G-sec value as losses, investors pushed the sell button for banks. The Nifty Bank, and Private bank indices closed 5 per cent down, followed by losses in the Nifty PSU Bank index, down 4.5 per cent.

The Nifty Metal and Auto indices dropped 3 per cent while the Nifty FMCG, IT, and Pharma indices slipped 2 per cent each.

Shares of Eveready Industries (EIIL) India, on Friday, zoomed 20 per cent to hit an over two-year high of Rs 311.70 on the BSE in intra-day trade in an otherwise weak market. The stock of the dry cell battery maker was trading at its highest level since April 2018. The Burman family, the single-largest investor in EIIL with a 20 per cent stake, may become joint promoters of the battery maker along with the Khaitan family, the Mint reported quoting two people familiar with the talks between the two groups.

At 1:33 PM, the Nifty Bank index was trading nearly 5 per cent, or 1,718 points, down on the National Stock Exchange (NSE) compared with a 3 per cent slide in the benchmark Nifty50 index. The Nifty Private Bank and PSU Bank indices, too, were quoting 4.6 per cent and 3.7 per cent lower, respectively.

Shares of Nava Bharat Ventures, on Friday, reversed early losses to trade 7 per cent higher in intra-day after the company board approved the plan to buy back shares worth Rs 150 crore. The company, in a BSE filing, said the Board of Directors of Nava Bharat Ventures, at its meeting held on February 26, 2021, has approved the proposal to buyback fully paid-up equity shares of face value of Rs 2 each for an aggregate amount not exceeding Rs 150 crore.

Shares of Dilip Buildcom jumped nearly 5 per cent in intra-day trade on Friday, defying the market trend, to scale a fresh 52-week high of Rs 697 on the BSE after the firm emerged as the lowest bidder for orders worth Rs 2,241 crore. “Dilip Buildcon has been declared as L-1 bidder for two new National Highways Authority of India HAM projects under Bharatmala Pariyojana, Phase I in Tamil Nadu and Puducherry for orders worth Rs 2,241 crore,” the company said in a BSE filing.

Pharma stocks were holding their ground on Friday even as the rest of the market was painted red amid feeble global cues. At 11:50 AM, Nifty Pharma index was trading 0.2 per cent higher on the National Stock Exchange (NSE), compared with a 430-point or nearly 3 per cent cut in the Nifty50 index. In the intra-day trade, the Nifty Pharma index had gained 1.5 per cent on the NSE, and had hit a high of 12,322.

Shares of RailTel Corporation of India (RailTel) listed at Rs 109 on the NSE on Friday, a premium of 16 per cent over its issue price of Rs 94 per share. Meanwhile, on the BSE, the scrip listed at Rs 104.60 per share. The state-owned telecom infrastructure provider’s IPO got bids 42 times more demand than the shares on offer.

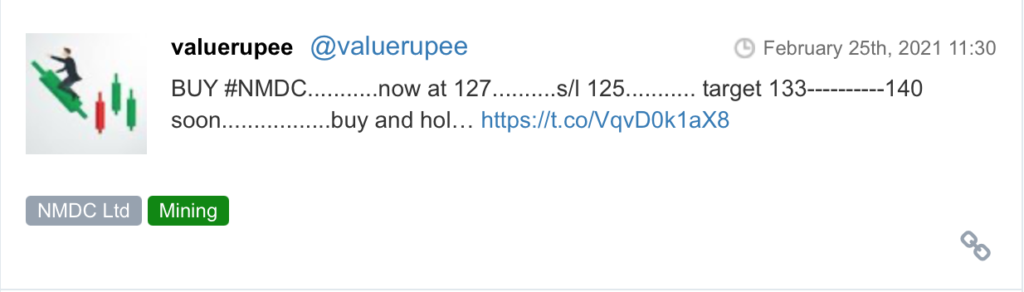

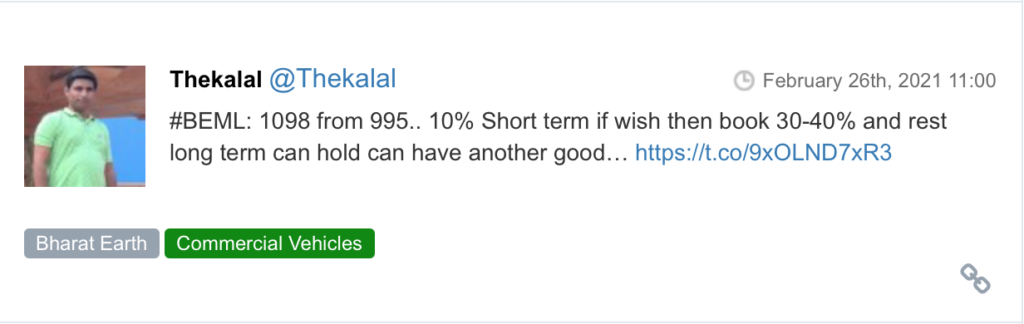

Here are some picks from the week gone by.