Indices end on Christmas eve near records; Sensex gains 529 points; RIL up 2.5%, Infy dips 1%

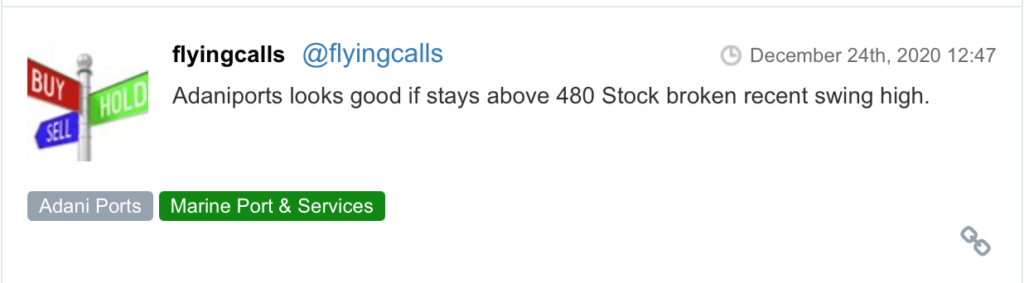

Frontline indices ended the session near record highs on Thursday as investors went on Christmas holiday in a festive mood. Reports that Britain and the European Union have closed in on a free-trade deal, while short covering in banking counters back home lifted the indices.

That apart, hopes for more fiscal spending and expectations that coronavirus vaccines will become more available next year also supported global sentiment.

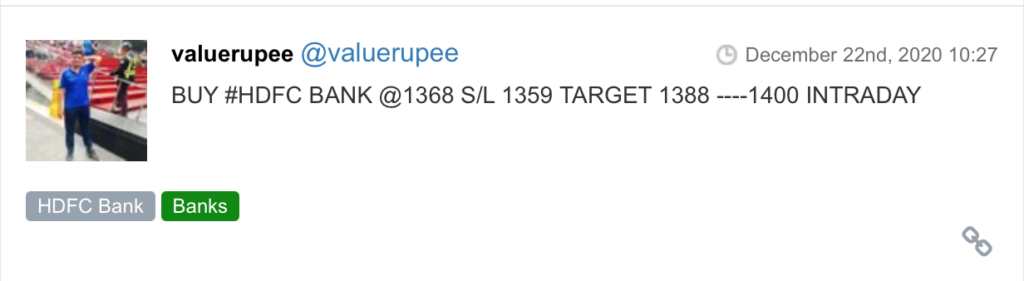

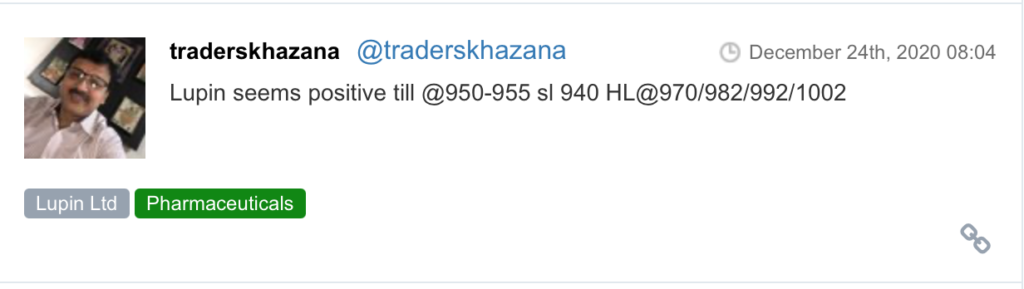

The S&P BSE Sensex gained 529 points, or 1.14 per cent, to settle the day at 46,973.5 levels. Sun Pharmaceuticals, Axis Bank, Reliance Industries, HDFC, and Bajaj Finance, up between 2 per cent and 3 per cent, closed the day as top gainers on the Sensex. On the downside, profit-booking in IT and FMCG stocks resulted in Infosys, Nestle, and HCL Tech ending the day as top drags.

The broader Nifty50 closed at 13,749-mark, up 148 points or 1 per cent.

Among other sectoral indices on the NSE, Nifty Bank and Nifty Financial indices ended Thursday’s session nearly 2 per cent higher each, while Nifty Pharma was up 1 per cent at close. Nifty IT index closed 0.65 per cent down.

Markets will remain shut on Friday on account of Christmas.

Shares of state-owned hotel company India Tourism Development Corporation (ITDC) and defence firm BEML rallied up to 17 per cent on the BSE in Thursday’s session on the back of heavy volumes following a report that the government could invite expression of interest (EoI) for divestment in these public sector companies.

Shares of Tata Communications surged 9 per cent to Rs 1,140 on the BSE on Thursday after the company announced the acquisition of majority stake in France-based embedded-SIM (eSIM) technology provider, Oasis Smart SIM Europe SAS (Oasis). The Tata Group company’s stock hit a record high in intra-day today, surpassing its previous high of Rs 1,103, touched on November 25, 2020. In the past six months, the stock has zoomed 90 per cent, as compared to 34 per cent rise in the S&P BSE Sensex.

Shares of Holcim-promoted cement companies – Ambuja Cements and ACC – rallied up to 10 per cent on the BSE on Thursday after the companies received board approval for paying technology fees to their parent company, Holcim Ltd. The TKH fees with the foreign promoter Holcim has been kept at 1 per cent of net sales every year for two years with effect from January 1, 2021. Among individual stocks, Ambuja Cements has rallied 10 per cent to Rs 261, while ACC jumped 7 per cent to Rs 1,692 on the BSE in intra-day trade.

Shares of Mrs. Bectors Food Specialities made a strong debut at the bourses on Thursday with the stock of the biscuit and bread manufacturer listing at Rs 501, a 74 per cent premium against its issue price of Rs 288 per share on the BSE on Thursday. A minute into the debut, the stock surged to its maximum upper limit of 20 per cent at Rs 601.20, rising more-than-double the issue price on the BSE.

Shares of Vedanta surged 8% after promoters decision to buy additional stake via open market. Reports on Wednesday said that the Vedanta promoters will launch an offer to buy 185 million shares of Vedanta i.e. about 4.9 per cent stake of total equity through block deal. The promoters have fixed the price range between Rs 150 and Rs 160 per share for the offer. With this transaction, the promoter’s stake in the company will likely to increase from 50.14 per cent to 55.04 per cent.

Here are some picks from the week gone by.