Sensex slips 334 points, Nifty holds 11,900; YES Bank tumbles 11%

Investors turned to profit-booking on Friday as weak growth concerns dampened sentiment at D-Street. Financials slipped the most on the index with heavyweights such as State Bank of India, HDFC, and ICICI Bank declining up to 5 per cent.

On Thursday, the Reserve Bank of India (RBI) sharply lowered its gross domestic product (GDP) growth forecast for financial year 2019-20 (FY20) further by 110bps to 5 per cent from 6.1 per cent on substantially weaker growth in Q2FY20, and incremental data on Q3 which suggests that the slowdown is still persisting. Besides, the central bank retained status quo on rates, against expectation for a 25bps cut, on inflationary concerns. The accommodative stance was maintained on rising output gap.

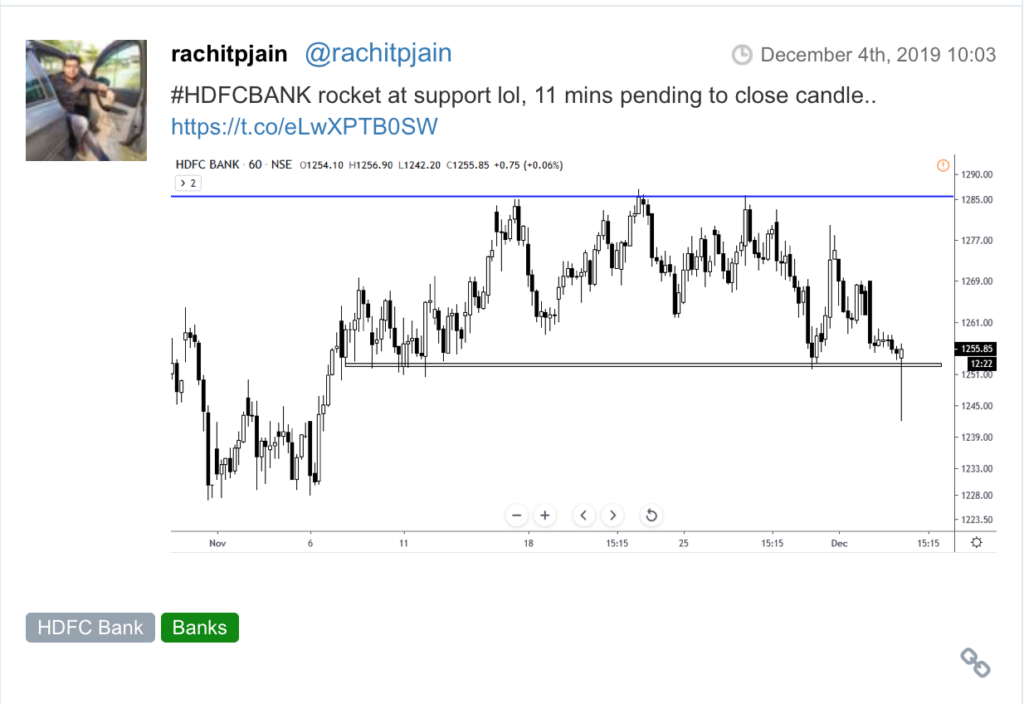

The benchmark S&P BSE Sensex closed 334 points, or 0.82 per cent, lower at 40,445.15 level. YES Bank, SBI, Tata Motors, HDFC, and IndusInd Bank were the top laggards at the 30-share index. Loses were, however, trimmed by gains in Reliance Industries, and HDFC Bank. In the intra-day trade, the Sensex hit a low of 40,337.53.

On the NSE, the Nifty50 slipped below the 11,900-mark in the intra-day trade to hit a low of 11,888.85. At close, the index was at 11,921.5 level, down 97 points, or 0.81 per cent. All the sectoral indices ended the day in the red. Nifty PSU Bank index was the top loser, down over 4 per cent.

In the broader market, mid-caps tumbled the most. The S&P BSE mid-cap index ended the day 1.27 per cent lower at 14,668.31, while the S&P BSE small-cap index closed at 0.85 per cent lower at 13,341.39.

Shares of Mahindra & Mahindra (M&M) slipped 2 per cent to Rs 512 on the BSE on Friday and was trading close to its 52-week low level. The car & utility vehicles maker’s stock is less than 2 per cent away from its 52-week low price of Rs 503, touched on August 14, in intra-day trade. In past one month, M&M has underperformed the market by falling 12 per cent as the company’s tractor sales delivered disappointing performance.

Shares of Vodafone Idea slumped 9 per cent to Rs 6.66 on the BSE on Friday after its chairman Kumar Mangalam Birla said the company will shut down if the government does not provide relief on the liability it faces in past statutory dues following a Supreme Court order. The Bombay Stock Exchange (BSE) however said, the exchange has sought clarification from Vodafone Idea about Birla’s comment. The company is yet to reply.

Shares of public sector banks were trading lower for the second straight day, with Nifty PSU Bank index down 3 per cent on Friday, as investors booked profit on fears of weak economic growth. The index was ended 2 per cent lower on Thursday.

Shares of Allcargo Logistics climbed up to 4 per cent to Rs 98 on the BSE in the intra-day trade on Friday, a day after the company acquired 44.64 per cent stake in Gati. At 12:29 am, the stock was trading over 2 per cent higher at Rs 96.15 apiece on the BSE. Gati, on the other hand, slipped around 3 per cent to Rs 64. In comparison, the S&P BSE Sensex was trading 0.23 per cent lower at 40,685 levels.

Mid- and small-cap indices were trading with deep losses in the morning deals on Friday. The S&P BSE MidCap slipped nearly a per cent or 122 points to 14,733 levels while the S&P BSE SmallCap index slid 80 points or 0.59 per cent to trade at 13,375 levels. In comparison, the benchmark S&P BSE Sensex was trading around 175 points or 0.43 per cent lower at 40,605 levels.

Shares of Eris Lifesciences hit a five-month high of Rs 473, up 7 per cent on the BSE on Friday, in an otherwise range-bound market. The stock of the pharmaceutical company was trading at its highest level since July 2019.

Shares of Omaxe were locked in lower circuit of 20 per cent at Rs 144 — an over three-year low level — on the BSE in morning deals on the back of heavy volumes. The real estate company’s stock was trading at its lowest level since April 2016. At 10:19 am, there were pending sell orders for 2.1 million shares, representing 1.1 per cent of total equity of Omaxe, on the NSE and BSE. As on September 2019, nearly half or 51 per cent of the total promoters holding was pledged.

Shares of YES Bank dipped 5.5 per cent to Rs 58.70 on the BSE on Friday after Moody’s downgraded the bank’s long-term foreign currency issuer rating to ‘B2’ from ‘Ba3’, as potentially stressed assets and low loss-absorbing buffers may add pressure to its funding and liquidity. The global rating agency assigned negative outlook on the bank’s rating.

Here are some picks from the week gone by.