Sensex slips 216 points as IT shares plunge; Nifty ends at 11,914

Extending its slide for the second consecutive day, the domestic equity market ended with nearly half a per cent loss on Friday, mainly dragged by information technology (IT) shares. Besides, uncertainty on US-China trade deal talks, too, hurt sentiment.

The S&P BSE Sensex lost 216 points or 0.53 per cent to end at 40,359 levels. During the day, the index hit a high and low of 40,653.17 and 40,276.83, respectively. Tata Steel (up over 4 per cent) was the top gainer on the index while IT major Infosys (down around 3 per cent) was the biggest loser.

On the NSE, the broader Nifty50 index ended at 11,914, down 54 points or 0.45 per cent with 29 constituents declining and 21 advancing.

In the broader market, the Nifty Midcap 100 index ended flat at 16,868, up just 5 points or 0.03 per cent while Nifty Small Cap 100 index ended at 5,702, down over 4 points or 0.08 per cent.

India VIX declined over a per cent to 14.82 levels.

Sectorally, IT stocks declined the most with the Nifty IT index ending 2 per cent lower at 14,996 after reports said Goldman Sachs has downgraded counters such as Tata Consultancy Services (TCS), Wipro, and Mphasis. The brokerage, as per reports, noted that the IT sector, as a whole, will face cyclical hiccup ahead and the current valuation of the sector is at premium to historical average.

Financial and FMCG stocks, too, ended in the negative territory. On the flip side, metal stocks witnessed sharp rally in the fag-end of the session. Nifty Metal index added over 2 per cent to 2,521 levels.

Eicher Motors gained nearly 4 per cent to Rs 22,786 on the BSE, its highest level in the last eight months.

Shares of Essel Propack advanced 6 per cent on the BSE to hit a record high level of Rs 164. The container & packaging company’s stock has rallied 41 per cent in the past two weeks after reporting a strong set of numbers for the quarter ended September 2019 (Q2FY20). Shares of the company ended at Rs 154.65 apiece on the BSE.

Network18 Media & Investments rallied 15.50 per cent to Rs 32 on the BSE, thereby surging over 24 per cent in the past two trading days on media reports that Sony was eyeing up to 30 per cent stake in Mukesh Ambani’s media and entertainment company.

Shares of Zee Entertainment Enterprises (ZEEL) were up 5 per cent to Rs 363 on Friday, extending its previous day’s 12 per cent rally on the National Stock Exchange (NSE), after the promoters offloaded around 16 per cent stake in the company via open market on Thursday. In the past three trading days, the stock of ZEEL has rallied 27 per cent, as compared to a 0.25 per cent decline in the Nifty 50 index.

Shares of Gayatri Projects hit an over four-year low of Rs 62.5, and were locked in the lower circuit band of 10 per cent on the BSE on Friday, after the lenders to the company invoked pledged shares. The stock of construction & engineering company tanked 28 per cent in past two trading days, and was trading at its lowest level since July 2015. Till 10:27 am, a combined 577,855 shares have changed hands, with pending sell orders for 120,003 shares on the NSE and BSE.

Information technology (IT) stocks came under heavy selling pressure on Friday after reports said Goldman Sachs has downgraded counters such as Tata Consultancy Services (TCS), Wipro, and Mphasis. The brokerage, as per reports, noted that the IT sector, as a whole, will face cyclical hiccup ahead and the current valuation of the sector is at premium to historical average.

Shares of state-owned RITES slipped 3.4 per cent to Rs 295.35 apiece on the BSE on Friday after the government announced to sell up to 15 per cent of its holding in the railways’ firm, at a discounted price of Rs 293.5 per share via offer for sale (OFS) route. The sale would fetch the government Rs 1,100.6 crore.

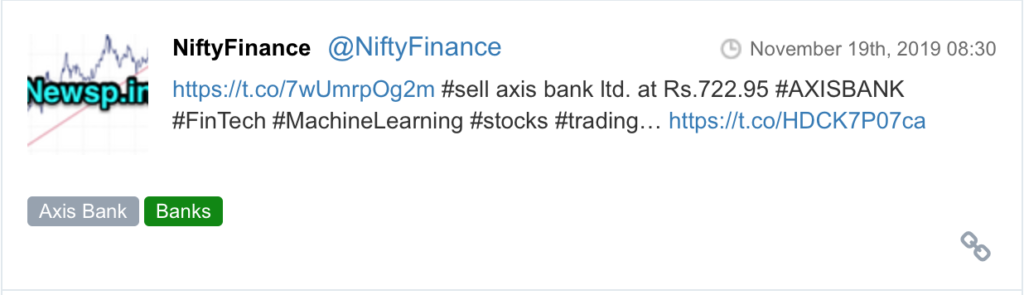

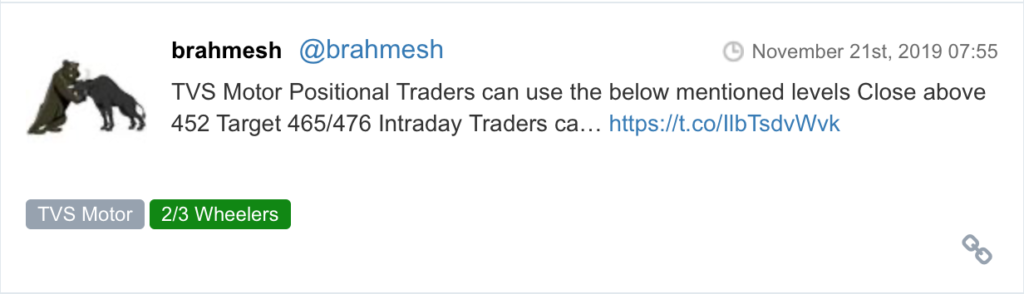

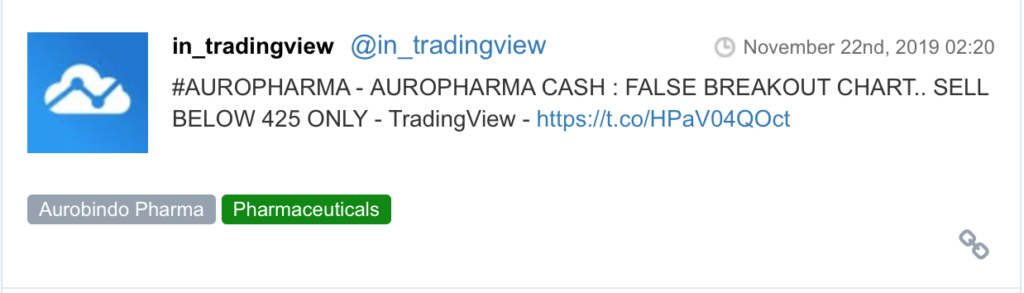

Here are some picks from the week gone by.