Sensex loses 167 points, Nifty ends at 11,512; metals, realty dip

Selling in select blue-chip counters such as HDFC, IndusInd Bank, TCS, L&T, ONGC, and Vedanta and weak global cues dragged the equity market lower on Friday. The S&P BSE Sensex lost 167 points or 0.43 per cent to settle at 38,822.57 while the Nifty50 index of the National Stock Exchange (NSE) closed the day at 11,512.40, down 59 points or 0.51 per cent.

On a weekly basis, however, Sensex gained 2.12 per cent while Nifty added 2.11 per cent.

In the broader market, the S&P BSE Mid-cap index ended at 14,266, down 90 points or 0.62 per cent and the S&P BSE Small-cap index lost 109 points or 0.81 per cent to settle at 13,332 levels.

On the sectoral front, metal stocks slipped the most with the Nifty Metal index ending 2.64 per cent lower at 2,453.95 levels. Realty and pharma counters were the other leading losers of the day.

Shares of YES Bank hit a fresh six-year low in the intra-day deals on Friday after YES Capital, one of the promoter entities of the private lender, sold nearly 2 per cent stake in the bank. “YES Capital (India) Private Ltd (“YCPL”), part of the promoter group of YES Bank, has today sold 1.8 per cent shareholding in the Bank,” YES Bank said in a press release on Thursday after market hours. The stock ended at Rs 49 apiece on the BSE, down over 4 per cent.

Piramal Enterprises shed over 7 per cent to end at Rs 1,726.55 apiece after a news report suggested Japanese tech giant SoftBank may shelve plans to invest in its parent Piramal Group.

Shares of Indiabulls Group were under pressure on Friday, falling by up to 19 per cent on the BSE on report that the Delhi High Court (HC) has issued notices to Indiabulls Housing Finance, Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI) & the Ministry of Corporate Affairs (MCA).

On the other hand, Bajaj Finance hit a new peak in the intra-day deals. Thus far in the calendar year 2019, Bajaj Finance has outperformed the market by surging 54 per cent, as compared to an eight per cent gain in the Sensex. Shares of the company settled at Rs 4,065.35, up 1.61 per cent.

Logistics stocks rallied in trade. Individually, Snowman Logistics, Allcargo Logistics, Aegis Logistics, VRL Logistics, Gateway Distriparks and Gati rallied up to 9 per cent on the BSE in intra-day trade today.

The stock of Concor hit a 52-week high of Rs 633 on Thursday, having rallied 17 per cent in the past six trading days.

Shares of Strides Pharma dipped 6% after it temporarily suspended Ranitidine sales in US.

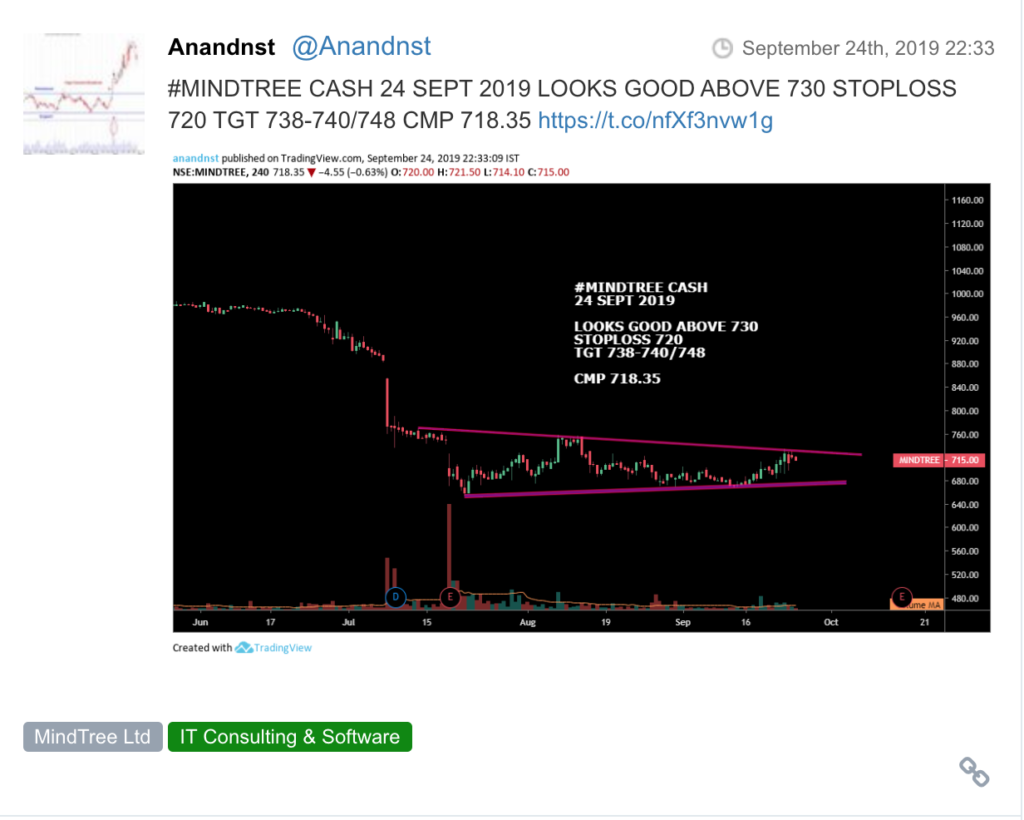

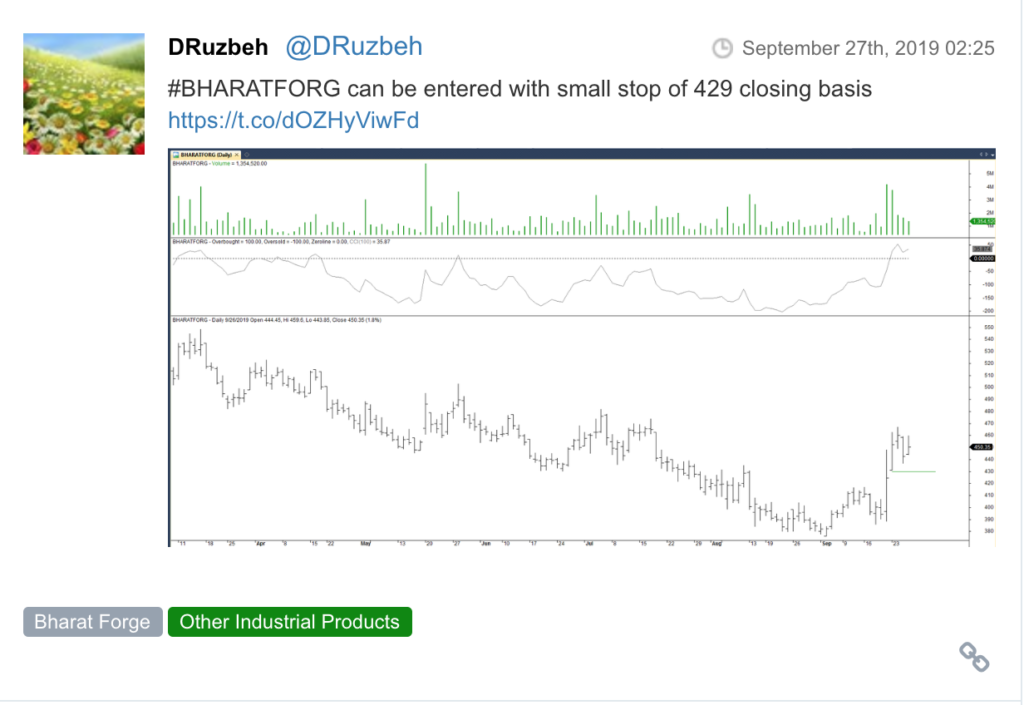

Here are some picks from the week gone by.