Sensex, Nifty end flat on a choppy day; IT stocks drag

Benchmark indices ended Friday’s session with marginal cuts after erasing its intraday gains in the final hour. IT stocks remained subdued throughout the day after the US-based IT services company Cognizant nearly halved its 2019 growth guidance.

The intra-day rise in the indices was spurred by a slip in oil prices with financial stocks gaining the most, before the indices retreated to trade flat in the end.

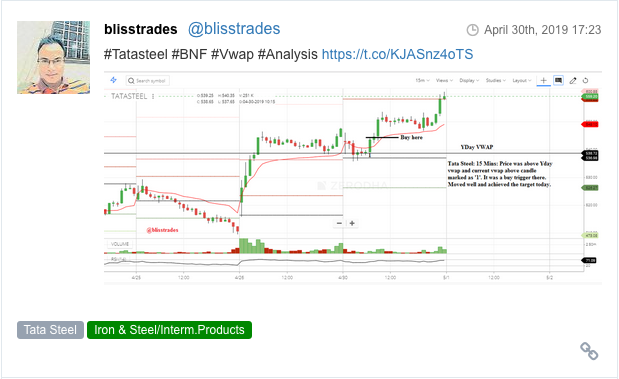

S&P BSE Sensex settled 18 points lower for the day at 38,963, with TCS, Hindustan Unilever, TATA Steel, HCL Tech and Infosys being the top drags. Twelve out of the 30 constituents of the BSE ended the day in red.

The broader Nifty50 was also down 12.5 points, or 0.11 per cent, to end at 11,712 levels. The market breadth was tilted in favour of declines. About 1,031 stocks fell and 702 shares advanced on National Stock Exchange.

Among sectoral indices, the Nifty IT index was the biggest loser, down almost 1.9 per cent while the Nifty FMCG index also slipped 1.13 per cent. On the other hand, Nifty Realty index and Nifty PSU Bank index gained 1.57 per cent and 1.09 per cent, respectively.

On a weekly basis, the S&P BSE Sensex closed 0.27 per cent lower while and the NSE Nifty50 slipped 0.36 per cent. This was the indices’ biggest weekly loss since February 11.

The volatility index, VIX, ended the day 4.35 percent higher at 23.98.

The broader market took the cue from benchmark indices to end flat. The S&P BSE MidCap index slipped 15 points, or 0.10 per cent, at 14,783, while the S&P BSE SmallCap index ended the day at 14,548, down 45 points, or 0.31 per cent.

Information technology (IT) stocks remained under pressure on Friday, after the US-based IT services company Cognizant nearly halved its 2019 revenue expectations after missing first-quarter results, as it faces sluggish demand in its financial and healthcare businesses.

Shares of Balrampur Chini Mills continued their northward journey, with the stock hitting 18-month high of Rs 157 before ending the day at Rs 156.50, up 1.69 per cent, on the expectation of strong earnings growth. The stock was trading at its highest level since December 6, 2017.

McLeod Russel India shares continued to reel under pressure, hitting an over decade low of Rs 45.45, down 10 per cent on the BSE on back of heavy volumes. The stock of flagship tea company of the BM Khaitan group was trading at its lowest level since March 12, 2009 on the BSE.

Roto Pumps shares were locked in upper circuit for second straight day, up 20 per cent at Rs 143 on the BSE, on the back of delivery-based buying. The stock of industrial machinery company zoomed 44 per cent in the last two trading days, in an otherwise range-bound market. In comparison, the benchmark S&P BSE Sensex was up 0.25 per cent at 39,078 levels.

The Mumbai-based real estate developer, Godrej Properties buys RK Studios for an undisclosed sum. It plans to build a mixed-use project with modern residences and luxury retail. The plot is located strategically on the main Sion-Panvel Road and the Kapoor family was in talks with many interested parties, sources said.

Shares of Kansai Nerolac Paints slipped 6 per cent to Rs 395 on the National Stock Exchange (NSE) after the company reported 12 per cent decline in its net profit at Rs 93 crore in March quarter (Q4FY19), due to lower demand for industrial products. The company had a profit of Rs 106 crore in year-ago quarter.

The share price of food major Britannia Industries was down nearly 4 per cent on Thursday following concerns over loans to group companies. The stock remained volatile through the day after a disclosure by Britannia that it had inter-corporate deposits (ICDs) in associate companies, which was under 25 per cent of its total investments.

Here are some picks from the week gone by.