Sensex gains 336 points; Nifty above 11,750; financials advance

A sudden surge in the benchmark indices, lifted by gains in financials and metals, took Sensex nearly 300 points higher and Nifty beyond the 11,700 mark after a range bound morning trade.

At 2:10 PM, Sensex was trading at 38,980, up 250 points, or 0.64 per cent, with TATA Steel, Axis Bank, ICICI Bank, TCS and State Bank of India being among the top gainers. Nifty broke past the crucial 11,700 mark to trade 80 points, or 0.69 per cent, higher at 11,722.

Most of the sectoral indices on Nifty were trading in green, with Nifty Metal the top gainer at 1.63 per cent higher while Nifty Bank too was up over 1 per cent.

In broader markets, S&P BSE MidCap had slid 0.42 per cent, or 63 points, to trade at 15,067 while S&P BSE SmallCap was down 20 points, or 0.14 per cent, at 14,818.

Maruti Suzuki India shares were trading lower for the sixth straight day, down 2 per cent, at Rs 6,749 in early morning trade on the BSE after the company reported a weak set of numbers for the March quarter (Q4FY19).

GHCL surged 10 per cent to Rs 265 in early morning trade on the BSE on the back of heavy volumes after the company reported a healthy 44 per cent year-on-year (YoY) growth in net profit at Rs 119 crore in the March quarter (Q4FY19). The commodity chemicals company had registered a profit of Rs 82 crore in the year-ago quarter.

MRF shares slipped 2 per cent to Rs 54,500 on Friday, falling 5 per cent in one week ahead of the January-March quarter (Q4FY19) results next week. The stock is now 1 per cent away from its 52-week low price of Rs 53,901, touched on February 19, 2019, in intra-day trade. In the past three weeks, the MRF stock has slipped 10 per cent, as compared to no change in the benchmark index S&P BSE Sensex.

CG Power jumped 4% after Sunil Mittal picked up additional stake. He had already bought a total of 3.3 crore shares to pick up almost 5 per cent stake in the company between March 11 and April 23 through Bharti (SBM) Holdings, one of his personal investment arms, NSE’s bulk deal data showed.

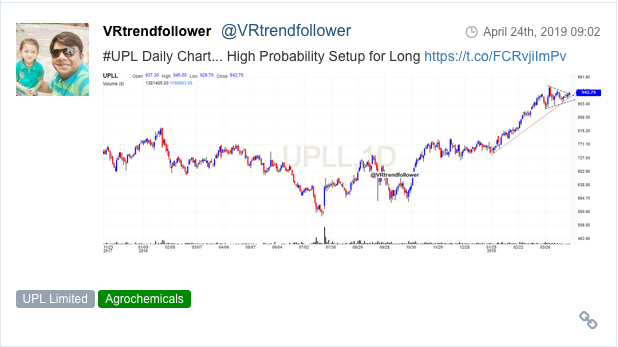

Here are some picks from the week gone by.