Sensex slips 97 points on Friday, Nifty ends at 10,795; TCS falls over 2%

The benchmark indices settled marginally lower on Friday weighed by IT bellwether Tata Consultancy Services (TCS) and select banking and automobile stocks.

The S&P BSE Sensex ended at 36,010, down 97 points or 0.27 per cent, while the broader Nifty50 index ended at 10,795, down 27 points or 0.25 per cent. On a weekly basis, the S&P BSE Sensex rose 0.88 per cent, while Nifty50 rose 0.63 per cent.

In the broader market, the S&P BSE MidCap index ended at 15,177, down 19 points or 0.13 per cent, while S&P BSE SmallCap index slipped 28 points or 0.19 per cent to 14,600.

Shares of Eveready Industries India (EIIL) jumped 13 per cent to settle at Rs 205 per share on the BSE on reports that promoter BM Khaitan is likely to sell the flagship company, a leader in dry cell batteries and flashlights.

IT bellwether Infosys gained 0.58 per cent to settle at Rs 684 on the BSE ahead of the board meeting today to consider the financial results for the third quarter of the financial year 2018-19 (FY19). Its peer Tata Consultancy Services (TCS) declined 2.45 per cent to Rs 1,842 even as it earned its highest-ever net profit of Rs 8,105 crore in the seasonally weak third quarter (Q3) of 2018-19 (FY19).

Shares of ITC hit a three-month high of Rs 295 apiece, up 2 per cent on the BSE in an otherwise range-bound market on Friday. The stock of fast moving consumer goods (FMCG) was trading at its highest level since October 4, 2018. In past one month, ITC outperformed the market by gaining 9 per cent, as compared to a 3 per cent rise in the S&P BSE Sensex.

The rupee traded on a weak note slipping to 70.58 against the dollar on Friday. The domestic unit had settled at 70.41 against the greenback on Thursday.

Shares of Caplin Point Laboratories surged to its 11-week high price of Rs 430, up 14 per cent on the BSE on Friday. The stock was trading at its highest level since November 16, 2018. The pharmaceutical company today announced that the meeting of board of directors of the company is scheduled to be held next Friday, January 18, 2019, to consider and approve the investment by a global financial investor with strong healthcare experience in the wholly-owned subsidiary company, Caplin Steriles.

Shares of Praj Industries moved higher by 12 per cent to Rs 154 on the BSE on Friday after the company announced a ground-breaking integrated demo plant of compressed bio gas (CBG). The stock was trading at its highest level since September 22, 2008. “The company unveiled its roadmap for commercialization of CBG technology and reaffirmed its readiness by way of required infrastructure to execute multiple CBG plants with advanced technology and designs. CBG is a complementary renewable transportation fuel to Compressed Natural Gas (CNG). Praj’s CBG technology is a major step in that direction,” Praj Industries said in a press release on Thursday, January 10, 2019, after market hours.

Shares of real estate companies were trading weak and falling up to 6 per cent on BSE in the intra-day deal on Friday after the goods and services tax (GST) Council on Thursday deferred a decision on a tax rejig for residential properties. Ansal Properties & Infrastructure, Marathon Nextgen Realty, DB Realty, Purvankara, Housing Development & Infrastructure (HDIL) and Sobha were down in the range of 4 per cent to 6 per cent on the BSE. DLF, Oberoi Realty, Indiabulls Real Estate and Prestige Estates were down 1 per cent each.

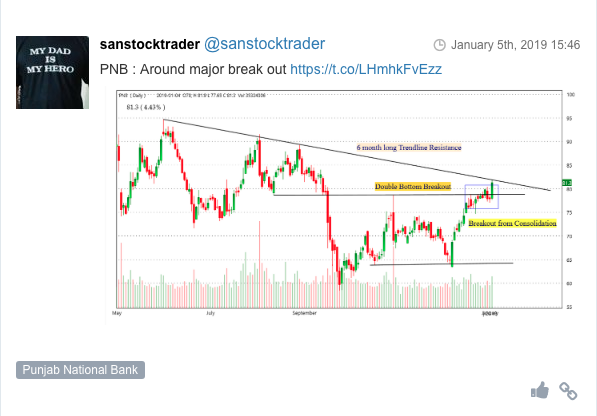

Here are some picks from the week gone by.