Sensex surges 580 points on Friday on strong Asian cues; auto, banks rally

The benchmark indices settled over 1.5 per cent higher on Friday led by a sharp rise in automobile stocks amid a jump in the Asian markets which rose as China and the United States expressed optimism about resolving their bruising trade war.

The S&P BSE Sensex ended at 35,012, up 580 points (up 1.8 per cent), while the broader Nifty50 index settled at 10,553, up 173 points (up 1.7 per cent). The indices ended over 5 per cent higher this week, making it the biggest weekly gain since May 2016.

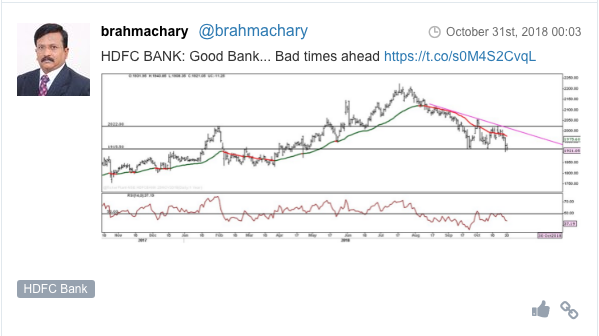

Among the sectoral indices, Nifty Auto index rose 4.2 per cent led by a rise in Maruti Suzuki, Tata Motors and Hero MotoCorp. The Nifty Bank index, too, ended 1.5 per cent led by IndusInd Bank and Axis Bank.

In stocks, the oil and gas companies rallied led by BPCL which rose 6.4 per cent to Rs 301 on the BSE while IOC ended nearly 5 per cent higher at Rs 148.

The rupee firmed against the US dollar, reclaiming the 72-per-dollar levels. The Indian currency rose to 72.53 against the greenback in intra-day trade, up from its previous close of 73.45 per dollar.

Shares of Punjab National Bank (PNB) dropped 8% to Rs 68.20, falling 13% from intra-day high level, after the state-owned bank reported higher- than-expected net loss in September quarter (Q2FY19), due to higher provisioning for bad loans. The stock touched a high of Rs 78.60 on the BSE in early morning trade, before the announcement of results.

Indiabulls Housing Finance Ltd. rose for third straight session. It was quoting at Rs 877.05, up 3.13% on the day on the NSE. Indiabulls Housing Finance Ltd is down 28.05% in last one year as compared to a 1.08% gain in NIFTY and a 3.13% gain in the Nifty Financial Services index.

State-run refiner Indian Oil Corp Ltd posted a 12.2 percent fall in second-quarter profit on Friday, missing estimate by a wide margin, dented by forex expenses and raw material costs. Net profit came in at 32.47 billion rupees ($446.92 million) in the quarter ended Sept. 30, compared with 36.96 billion rupees a year earlier, IOC said.

A sharp turn in mid and small-cap index stocks have seen the market price of 14 companies rally more than 30% during the current week, taking cues from falling oil prices, strengthening of the rupee, strong inflows from domestic mutual funds and easing of US-China trade war fears. PC Jeweller, Dhanlaxmi Bank, Reliance Communications, Adani Power, Bombay Dyeing & Manufacturing Company, DB Realty, KEI Industries, Usha Martin and Kalpataru Power Transmission were among 14 stocks, rallied in the range of 30% to 66% during the current week.

Shares of Hero MotoCorp and Mahindra & Mahindra (M&M) were up by 5% each on the BSE after these companies posted more than 15% year-on-year (Y-o-Y) growth in total sales during the month of October. Hero MotoCorp was up 5% at Rs 2,934 after the company dispatched 734,668 units of motorcycles and scooters in October 2018 – a growth of 16.4% over the corresponding month of the previous fiscal. The two-wheeler company had sold 631,105 units in the month October 2017.

Shares of West Coast Paper Mills have hit a new high of Rs 415 per share, up 4% from its previous close, surging 36% from their recent low of Rs 306 per share touched on October 8, on the BSE on the expectations of a strong set of quarterly results. In past one year, the stock has outperformed the market, zooming 117% from Rs 191, as compared to a 4.2% rise in the S&P BSE Sensex. In the past two years, it appreciated 301% against 27% gain in the benchmark index.

Shares of aviation, tyre and paint manufacturing companies were trading higher by up to 11% on the BSE in early morning trade on Friday due to a fall in crude oil prices. Asian Paints, Berger Paints, Shalimar Paints, Kansai Nerolac Paints, JK Tyre, SpiceJet, Jet Airways and Ceat were trading higher more than 4% as the extension of a low oil price scenario augurs well for their crude-related raw material expenses.

Shares of Indraprastha Gas (IGL) have rallied 6% to Rs 297 per share on the BSE in early morning trade on Friday, extending their 11% rally in the past two trading days after the company agreed to take over the supply of natural gas in Gurugram district from Haryana City Gas Distribution (HCGDL). The Supreme Court has suggested that IGL take over the natural gas supply in Gurugram from HCGDL.

Here are some picks from the week gone by.