Sensex tumbles 792 points on Friday; RBI holds rates; rupee hits 74.22/$

Markets ended lower on Friday after the Reserve Bank of India (RBI) sprung a surprise and kept the repo rate unchanged at 6.50 per cent. Most experts had expected the central bank to hike rates by 25 bps.

The S&P BSE Sensex lost 792 points, or 2.25 per cent, to settle at 34,377 while the broader NSE’s Nifty50 index dropped 283 points, or 2.7 per cent, to close at 10,316. Among specific stocks, shares of oil marketing companies such as HPCL, BPCL and IOCL hit 52-week lows after the government announced that it will cut excise duties on petrol and diesel prices and OMCs will absorb Re 1 per litre.

Heavy losses were also visible in banking stocks with the Nifty Bank index slipping 1.5 per cent. YES Bank, State Bank of India (SBI), Bank of Baroda (BoB), IDFC Bank and ICICI Bank lost up to 5.1 per cent.

Earlier, the monetary policy committee (MPC) of the Reserve Bank on Friday kept the repo rate unchanged at 6.50 per cent in its fourth bi-monthly monetary policy review of 2018-19. The central bank changed the policy stance to ‘Calibrated tightening’ from ‘Neutral’. Calibrated tightening means rate will be maintained or hiked in this cycle.

Rate sensitive stocks took deep cuts despite RBI’s status quo. The Nifty PSU Bank index dropped 4.4 per cent to settle at 2,656 levels, while Nifty Auto index tumbled nearly 3.2 per cent. Nifty Realty, too, slipped 3 per cent. Volatility benchmark, India VIX, advanced 7 per cent.

The Indian rupee Friday crashed below the 74-level against the US dollar for the first time ever after the Reserve Bank kept its key policy rate unchanged. The domestic currency was quoted 55 paise lower at 74.13 against the dollar soon after the RBI announced its monetary policy. Investors remained concerned over sustained foreign capital outflows and fears of widening current account deficit in the wake of soaring crude oil prices.

Shares of two of IL&FS group companies Friday defied broader market sentiments and gained as much as 10 per cent on the bourses after the newly appointed board said it will take all necessary steps to preserve the value of the group.The scrip of IL&FS Engineering and Construction Company touched its upper circuit limit of Rs 25.32, up 10 per cent over its previous closing price.

Drug firm Vivimed Labs Friday said it has received establishment inspection report (EIR) from the US health regulator for its Mexico manufacturing facility after an inspection.

Shares of Titan Company was up 5% to Rs 814 on the BSE in otherwise weak market after the company said jewellery business in July-September (Q2) quarter picked up very well after a relatively soft growth in previous quarter. The growth in the jewellery industry in the last few months has been challenging on the back of several factors like lesser number of wedding dates, increase in Gold prices, tightening of the credit to the industry, subdued consumer demand etc.

Shares of state-owned oil & gas companies, including oil marketing companies (OMCs), are reeling under pressure falling by up to 29% on the BSE in intra-day deals, extending their Thursday’s fall after the government, on Thursday, asked the them to absorb a Re 1 a litre cut in excise duty on petrol and diesel. The government also cut the excise duty on petroleum products by Rs 1.50 a litre with immediate effect. This is the first time in over four years that prices of either petrol or diesel are being controlled.

Here are some picks from the week gone by.

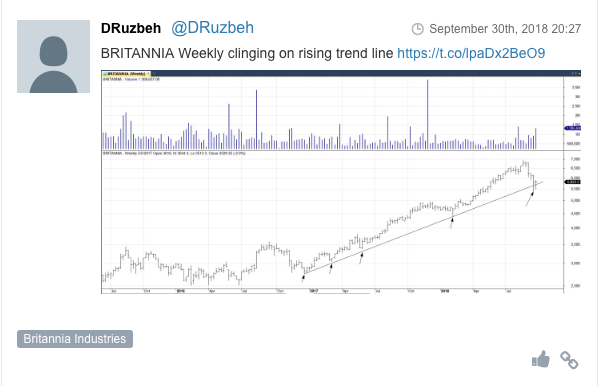

Company: Britannia Industries CMP: 5425.00 Mastermind