Sensex climbs 147 points as rupee firms; auto, metal stocks rally

The benchmark indices ended higher on Friday aided by strong gains in automobiles and metal stocks after the rupee firmed against US dollar. The S&P BSE Sensex ended at 38,390, up 147 points while the broader Nifty50 index settled at 11,589, up 52 points.

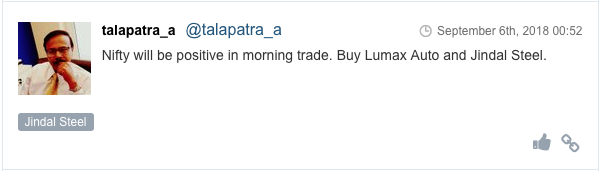

Among the sectoral indices, the Nifty Auto index settled 2.2 per cent higher led by a rise in the share prices of Hero MotoCorp, Bajaj Auto, Mahindra and Mahindra, and Tata Motors. Nifty Metal index, too, rose 1.9 per cent led by MOIL and Jindal Steel & Power.

The rupee was trading higher by 24 paise to 71.75 against the US currency in late morning deals on Friday due to sustained bouts of dollar selling from banks and exporters. Earlier, the rupee resumed slightly higher at 71.95 against yesterday’s closing level of 71.99 a dollar at the interbank foreign exchange market here.

Shares of YES Bank hit an over four-month low of Rs 322 per share, down 5% on the BSE on the back of heavy volumes. The stock was the largest loser among the S&P BSE Sensex and Nifty 50 index.

Shares of Motherson Sumi Systems have surged 5% to Rs 306 per share on the BSE in the afternoon after the company said its board approved bonus shares in the ratio of 1:2 on completing 25 years of the listing of its equity shares on stock exchanges.

The Zee Entertainment stock fell nearly 10 per cent intra-day on worries that its over-the-top (OTT) application Zee5 will weigh on margins. Analysts at Morgan Stanley, in a report, indicated that intense competition in the OTT space — especially from deep pocketed international players Amazon and Netflix, as well as domestic players such as Reliance Jio — would require Zee to spend on high quality content, thus impacting margins.

Shares of Texmo Pipes & Products have surged 20% to Rs 39 per share, extending their past three days rally on the National Stock Exchange (NSE) after the company received order worth of Rs 813 million from Larsen & Toubro (L&T). The stock of plastic products company trading at its 52-week high has zoomed 67% in past four trading days from Rs 23.35 on Monday.

Zensar Technologies rallied 5% to Rs 352 on the BSE in intra-day trade today after the stock turned ex-date for stock split in the ratio of 5 for 1. The company fixed September 10, 2018 as record date for the stock split. The board of directors of information technology firm at their meeting held on April 24, 2018 approved the sub-division of equity shares of the Company from one equity share of face value of Rs 10 each into five equity shares of Rs 2 each.

Shares of Aurobindo Pharma and Glenmark Pharmaceuticals from the pharma sector hit their respective 52-week highs, while KPIT Technologies, Mindtree and Zensar Technologies from the information technology (IT) sector touched new highs on the BSE in intra-day trade on Friday.

Prior to the recent correction among scrips of fast-moving consumer goods (FMCG) due to valuation concerns, the stock of Godrej Consumer Products (GCPL) had gained 56 per cent. This was on account of a strong June quarter performance and steps it was taking to boost volume revenue growth. In fact, GCPL has been registering better sales growth than many of its peers over the past two years. The strong performance was also visible in the June quarter, the first (Q1) of this financial year. Net sales rose 12.7 per cent over last year to Rs 24.5 billion, led by 14 per cent domestic volume growth. Net profit increased 80 per cent to Rs 4.1 billion.

Shares of Sun Pharmaceutical Industries dipped 5% to Rs 641 on the BSE in early morning trade on Friday on profit booking after the media report suggested that the U.S. drug regulator issued six observations on the company’s plant located at Halol for inspections carried out during August 27-31. Observations in the latest Form 483 point to issues relating to test procedures. Two analysts with an international brokerage, who also had access to the Form 483, indicated that the observations are not critical, and Sun Pharma will be able to resolve these issues soon, the BloombergQuint reported.

Shares of Bajaj Auto were up by 3% at Rs 2,875 per share on the BSE in an otherwise weak market after the company announced its plan to expand 3 wheelers & quadricycle capacity to 1 million per year as Government announced an end to permits. At the Society of Indian Automobile Manufacturers (SIAM) convention on Thursday, the Minister for Transport, Nitin Gadkari made a historic announcement moving to a “no-permit” regime for auto rickshaws powered by alternative fuels.

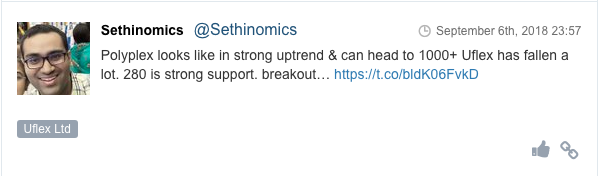

Here are some picks from the week gone by.