Indices decline for 4th session on Friday, Sensex down 301 points

Benchmark indices declined for a fourth straight session on Friday, amid caution over uncertainty over the formation of government in Karnataka, developments in US-China trade negotiations and firm crude prices.

In a major political development, the Supreme Court held a hearing in the Karnataka government formation matter, directing that the Bharatiya Janata Party (BJP) leader and the state’s new chief minister, BS Yeddyurappa, must conduct the floor test on Saturday at 4 pm.

The S&P BSE Sensex ended at 34,848, down 301 points while the broader Nifty50 index settled at 10,605, down 78 points

Among sectoral indices, the Nifty Bank index fell as much as 0.6%, extending its drop into a third session. ICICI Bank declined 2.9%, while HDFC Bank slipped 0.8%.

The Nifty PSU Bank Index also shed 1.6%, in what could be its fourth consecutive session of fall, on continued concerns about disappointing quarterly results due to a jump in bad-loan provisions.

Shares of Strides Shasun have tanked 25% to Rs 378 per share, also their 52-week low on the BSE after the company reported a consolidated net loss of Rs 44 million in March 2018 quarter (Q4FY18). The pharmaceutical company reported its first quarterly loss since September 2014 quarter. It had posted a net profit of Rs 916 million in Q4FY17. Revenue from operations during the quarter under review declined 1.9% to Rs 6.64 billion from Rs 6.77 billion in the corresponding quarter of previous fiscal.

Bajaj Auto share price gained more than a percent after reporting better-than-expected earnings for the March quarter. Profit for the quarter grew by 34.7% year-on-year to Rs 10.80 billion and revenue rose by 38.3% to Rs 67.73 billion. Operating profit jumped 45.2% to Rs 13.15 billion for the quarter and margin expanded 90 basis points to 19.4% compared to year-ago.

Biocon gained 1% after the company sold close to 2% stake in its research arm Syngene International for an estimated Rs 230 crore.

Avenue Supermarts, which operates the chain of D-Mart stores, dipped 8% to Rs 1,379 on the BSE in noon deal after the company said the promoter Radhakishan Shivkishan Damani propose to sell upto 1% stake in the company in the open market for achieving minimum public shareholding.

SRF dipped 11% to Rs 1,997 on the BSE in early morning trade after the company reported a consolidated net profit of Rs 1.24 billion against an average analyst estimates of Rs 1.41 billion for the quarter ended March 2018 (Q4FY18). The company had profit of Rs 1.29 billion in the same quarter year ago.

Bharti Airtel hit a 52-week low of Rs 356, down 3%, falling for the sixth straight trading days on the BSE, after Reliance Jio Infocomm (RJio) announced a new unlimited postpaid plan on Thursday May 10, with national roaming, international calling and international roaming plans among others. The stock of telecom services has fallen 13.6% in past six trading sessions as compared to 0.65% decline in the S&P BSE Sensex. Bharti Airtel has lost Rs 218 billion market capitalistion during the period.

Shares of Voltas have declined by 8% to Rs 539 per share on the BSE in early morning trade after the company reported 3% decline in its consolidated net profit at Rs 1.94 billion in March quarter (Q4FY18), due to poor performance of the engineering products and services business. The Tata Group company had profit of Rs 2 billion in the same quarter last fiscal. Gross revenue of the company during quarter under review remained flat at Rs 20.21 billion over the previous year quarter.

Shares of Reliance Communications (RCom) have rallied 25% to Rs 20.65 per share on the BSE in early morning trade, surging 108% from its Wednesday’s intra-day low of Rs 9.95 after a media report suggested that the Anil Ambani-led telecom services company and Ericsson inform National Company Law Tribunal (NCLT) in Mumbai that they are in settlement talks.

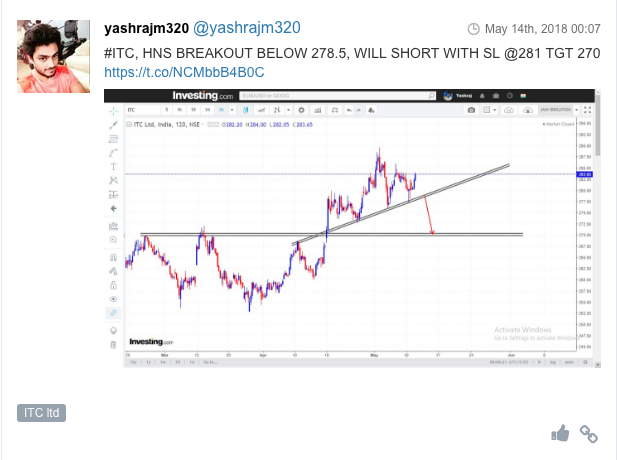

Here are some picks from the week gone by.