Reblog: What a Complacent Investor Looks Like

During three separate interviews this week I was asked if I was seeing any signs of complacency among investors, markets, or clients.

Here are some more examples of what I think a complacent investor looks like right now:

Other investors are screwed because of lower expected market returns but I’ll be fine.

Everyone else will panic during the next bear market and get crushed but not me.

There are no marginal sellers so the price of this asset will never go down.

It’s not the bull market that’s responsible for my gains; I’m a genius.

Markets are easy and so is making money.

Low volatility is here to stay.

I expect to see 10-15% returns every single year.

Why would I need to diversify when I’m making so much money on this one holding?

I’ve got it all figured out.

I’ll just never sell. Buy and hold is so easy.

I’ll be able to time the peak and get out before the next downturn hits.

I don’t need to rebalance my portfolio.

Why doesn’t everyone invest just like me?

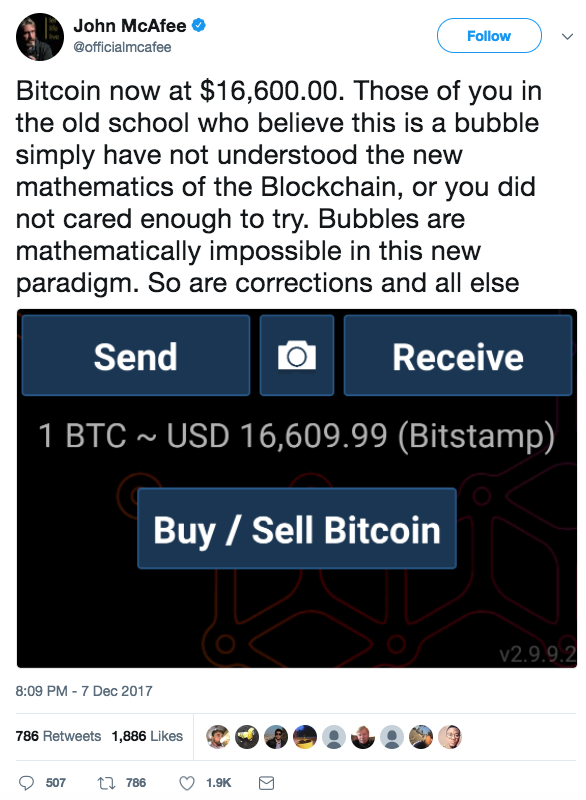

That person has made a lot of money lately. I think I’ll just blindly follow them into their next trade.

The truth is there will always be risks and unknown events that catch investors off guard whether they’re being complacent or not. There are always investors who are positioned the wrong way because that’s what allows markets to function.

Cash becomes an addiction to some during a bear market. Chasing yield is always a temptation during a low rate environment. Those trying to perfectly time tops and bottoms are almost always wrong. Sideways markets frustrate everyone.

During the next downturn, there are sure to be investors caught over their skis who have too much risk in their portfolios for their own good. I’m sure some of them will overcompensate and panic in the other direction.

I don’t know how many investors are complacent right now and I suppose it doesn’t matter for me personally. The best you can do as an investor is to create a portfolio that is durable enough to withstand most, but not all (that’s impossible), market risks.

From there, your best defense against complacency is a heavy dose of humility with a side of self-awareness.

The original article is written by Ben Carlson and can be accessed here.