Stocks slide to 5-month lows, Nifty ends below 10,000 on trade war fears

The BSE Sensex plunged by about 410 points to close at a five-month low while the broader Nifty crashed below the 10,000 mark for the first time this year following a global sell-off due to fears of a trade war as US President Donald Trump announced tariffs on Chinese goods.

The 30-share Sensex tumbled by 409.73 points or 1.24 per cent to close at a five-month low of 32,596.54, a level last seen on October 23 last year.

The 50-issue Nifty ended below the psychological 10,000-level by dropping 116.70 points or 1.15 per cent to 9,998.05, the lowest closing level in five months. The level was last seen on October 11 last year, when it had closed at 9,984.80.

Investors lost around Rs 1.57 trillion in market valuation on Friday.

For the fourth straight week, the flagship Sensex recorded a fall of 579.46 points, or 1.75 per cent, while the NSE Nifty lost 197.10 points, or 1.93 per cent.

Realty, metal, bankex, capital goods, healthcare, PSU, auto and oil & gas stocks recorded widespread losses.

Metal stocks led by SAIL, Jindal Steel, Vedanta, Hindalco Ind. Jindal Steel, National Aluminium, Hindustan Zinc, Tata Steel, NMDC and JSW Steel fell up to 6.58 per cent due to intense selling pressure.

Banking stocks took a hit after Totem Infrastructure was booked by the CBI for allegedly defrauding a consortium of eight banks led by Union Bank to the tune of Rs 1,394 crore.

The Nifty Bank index fell 471.10 or 1.95 per cent to close at around eight-month low of 23,670.40 as Axis Bank, PNB, Yes Bank, Canara Bank, ICICI Bank, IDFC Bank, SBI, Bank of Baroda, HDFC Bank, Kotak Bank, Federal Bank and IndusInd Bank dropped up to 3.87 per cent.

Union Bank of India also ended lower by 8.29 per cent to Rs 86.85 amid concerns over losses incurred in a Rs 13.94-billion loan fraud case.

IT and media stocks, however, posted gains. Adaniports, Infosys, Powergrid, M&M, Coal India and Asian Paints ended in the positive zone, gaining up to 0.99 per cent. The sectoral indices led by realty fell 3.31 per cent, metal 2.89 per cent, bankex 2.08 per cent, finance 1.73 per cent, capital goods 1.56 per cent, healthcare 1.48 per cent, PSU 1.30 per cent, energy 1.15 per cent, auto 0.85 per cent, oil & gas 0.85 per cent, infrastructure 0.84 per cent, power 0.68 per cent, FMCG 0.64 per cent and consumer durables 0.08 per cent.

While, Tech and IT indices ended in the positive zone with gaining up to 0.32 per cent.

In the broader market, the BSE small-cap index fell by 1.54 per cent while the mid-cap index shed 1.36 per cent.

Shares of Gitanjali Gems continued to be under selling pressure, falling 4.93 per cent to Rs 9.65.

Hindalco and Vedanta lost 5 percent each. Reliance Industries, L&T, HDFC, Tata Motors, Tata Steel and Maruti Suzuki slipped 1-2 percent while HCL Technologies and Bharti Infratel rallied more than 2 percent followed by Infosys.

Fortis Healthcare was down 7 percent after Delhi HC ordered attachment of all disclosed assets of Singh brothers.

Dilip Buildcon, meanwhile, has ended mildly higher after it was declared lowest bidder for NHAI project worth Rs 936 cr in Telangana.

Shares of Max Financial ended 1.4 percent higher after it acquired 0.74 percent stake in Max Life for Rs 153.3 crore from Axis Bank.

Bhushan Steel has ended over 5 percent higher after it said that it will submit resolution plan submitted by Tata Steel to NCLT for approval.

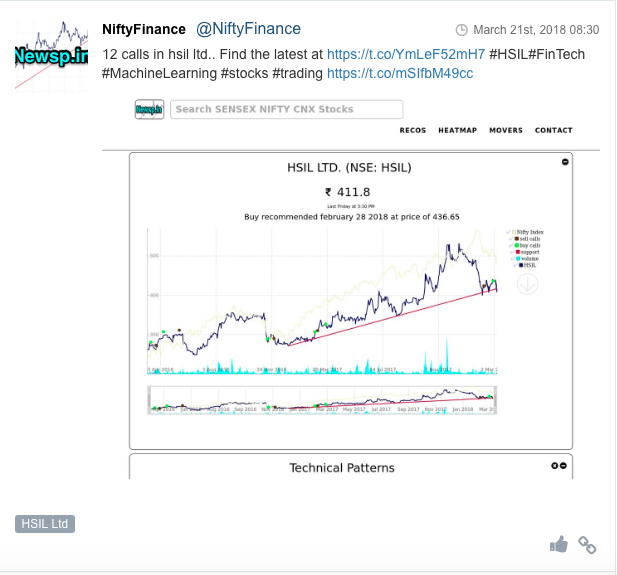

Here are some picks from the week gone by.