Reblog – Confirmation Bias: Can trading psychology affect investment?

We’re all susceptible to confirmation bias – paying more attention to our own preferred data and largely ignoring contradictory evidence. For investors, this psychological blind-spot can be very costly.

In every-day life, we like to think that our decisions are logical, rational and objective but often they are anything but.

Balanced analysis frequently goes AWOL as our pre-conceived beliefs take over. Let’s take a General Election as an illustration of this point.

Voters often seek positive news that shows their favoured candidates in a glowing light while paying scant attention to information that casts the opposing candidate in a good light.

Objectivity

If their existing belief is that their party is always strongest on say, maintaining law and order, they may place greater emphasis on campaign speeches reinforcing this claim than independent figures showing cuts in police or army numbers.

By failing to take on board objective facts, the voter will interpret information in a manner that supports their existing beliefs.

A voter’s psychology can clearly affect where they make their cross on the ballot paper. A similar psychology can affect how traders invest.

Investors have a well-performing stock that has increased in value. They know it has made them a healthy profit but convince themselves that a good run must come to an end – and soon.

They read the message boards and broker reports and take more note of those advocating disposal rather than those suggesting a ‘buy’ or ‘hold’. They, therefore, decide to sell, despite abundant evidence that the rise will continue.

Finding the evidence

Confirmation bias can also occur when a share portfolio is too concentrated in the stock of a company where the investor is employed.

Given the investor’s ‘insider track’ on the company, it is easy for them to identify evidence of success at the company to justify their decision.

Being part of the operation, they will read internal news bulletins and take note of pay rises, expansion plans and earnings forecasts. They may not necessarily take an objective view of the company. How do earnings projections compare with rival firms? How is the sector itself positioned?

It may be that the investor is not only invested heavily in their own company but also in the broader sector. For instance, not just the construction company they work for but the construction sector itself.

Their share portfolio is biased towards the sector in which they work. There is a perceived comfort factor here in that they understand the industry in which their money is invested.

Little diversification

There is nothing wrong in investing is something you understand (in some instances it should be encouraged) however a highly-concentrated portfolio is much likelier to produce more volatile returns than a diversified one. The risk factor is much higher as investment is heavily skewed towards one area.

To address confirmation bias, investors need to appreciate when their selection policy has shifted into auto-pilot – favouring the same ‘evidence’ that they have always done.

For example, investors often stick with a falling stock longer than they should because they translate every bit of news about the business in a way that favours its prospects. They will actively seek out information that supports their case that the company remains a good investment.

We are all susceptible to this – even investment gurus such as Warren Buffett.

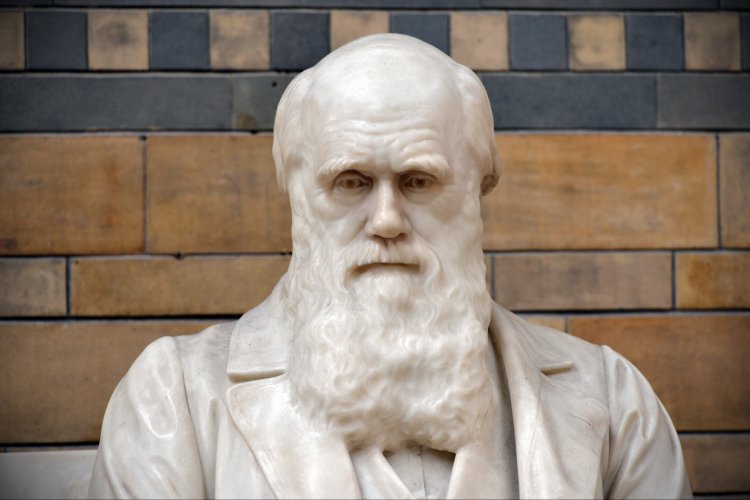

Darwin logged all contradictory ideas

Darwin logged all contradictory ideas

Darwin’s theory

Writing in Fortune magazine some years ago, Buffet pointed to Charles Darwin’s claim that whenever he ran into something that contradicted a conclusion he cherished, he was obliged to write the new finding down within 30 minutes. Otherwise, his mind would work to reject the conflicting information, much as the body rejects transplants.

Man’s inclination is to cling to his beliefs, particularly if they are reinforced by recent experience

“Man’s natural inclination is to cling to his beliefs, particularly if they are reinforced by recent experience–a flaw in our makeup that bears on what happens during secular bull markets and extended periods of stagnation,” Buffet wrote.

Buffets theory on how to counter confirmation bias – focuses on two action points.

- Be aware of confirmation bias, and accept that judgement can be blurred by it.

- Actively seek out and analyse information that disagrees with existing beliefs.

It may be that after following the process the investor continues to buy / hold / sell a stock but at least that decision is now based on rational evaluation rather impulse or bias.

The original article is penned by David Burrows and appears on capital.com. It can be found here.