Sensex ends flat on Friday after hitting record high on GST rates, up 1% for the week

Benchmark indices scuttled between gains and losses to finally settle the day marginally higher as 2-day GST Council meet ends where rates for various goods and services were decided.

The government today decided that most of the services would be taxed at the rate of 18% under the GST regime. Rates for more than 1,200 items under the GST were announced with products like hair oil, soaps and toothpaste down to 18% from 22-24%.

Earlier in the day, S&P BSE Sensex rose as much as 278 points to reach a fresh high of 30,712, surpassing its previous milestone of 30,691 hit on May 17 as FMCG surged on GST boost. The index has hit a new high for the fourth time in five sessions.

The S&P BSE Sensex settled at 30,465, up 30 points, while the broader Nifty50 ended at 9,427, down 1 point.

In the broader market, the S&P BSE Midcap and the S&P BSE Smallcap indices erased their intraday gains to slip 0.7% and 0.8%, respectively.

The NSE index has gained 0.3% so far this week, while the BSE index has risen 1.29%. Both the indexes are on track for a second straight weekly gain.

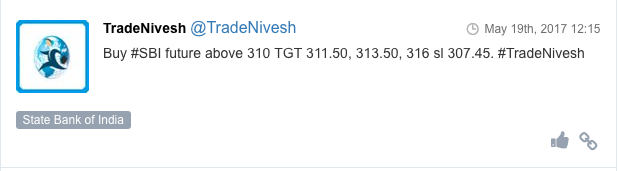

ITC, HUL, SBI, Axis Bank and Cipla gained the most on the BSE Sensex while Asian Paints, M&M, TCS and GAIL lost the most.

S&P BSE FMCG index rallied more than 3% at intra-day to a record high with ITC and Hindustan Unilever rising to their highest ever as well. Colgate-Palmolive was the biggest gainer in the pack, up nearly 3.5%.

BSE Auto index fell over 0.5% after reports that automobiles might get costlier, with cars likely to come in the 28% bracket, plus cess. Cummings India was the biggest laggard, down 8.3% while M&M, Maruti, Bharat Forge, Eicher Motors were down in the range of 0.5-1.5%

Among other gainers, State Bank of India (SBI) moved higher by 3.6% to Rs 314 at intra-day, its highest level since March 4, 2015 on BSE, after the state-owned bank reported a more than doubling of its fourth-quarter net profit as expected, while its bad-loan ratio narrowed on a quarter-on-quarter basis. The stock ended 1.6% higher.

Cummins India settled 8% lower after the company reported 5% drop in net profit at Rs 158 crore for the quarter ended March 2017 (Q4FY17), due to unfavourable product mix. It had a profit of Rs 167 crore in the same quarter year ago.

Laurus Labs fell 2% after its PAT for the quarter ended March 31 rose by 39% to Rs 74.3 crore against Rs 53.4 crore during the third quarter of the last fiscal, on the back of low finance cost. The company went public in December last year.