Markets settle on Friday flat ahead of Dec IIP data; TCS gains 2%

Benchmark indices settled the day flat even ahead of December factory output later today on hopes of reviving economy. The factory output grew by 5.7% in November even after the note ban announced by PM Narendra Modi.

Sentiment was also affected as Asian shares rallied to an 18-month peak on Friday, as investors cheered upbeat Chinese trade data.

Nifty 50 continued to hover around 8,800 levels, gaining for third consecutive week, led by TCS, Grasim, Tech Mahindra and Infosys.

The BSE Sensex index rose 0.4% this week while the NSE added 0.6% even after the RBI held rated for the second time and changed its stance to ‘Neutral’ from ‘Accomodative’

The S&P BSE Sensex settled the day at 28,334, up 4 points, while the broader Nifty50 ended at 8,793, up 15 points.

In the broader market, BSE Midcap fell 0.2% while BSE Smallcap added 0.1%.

IT index was the biggest sectoral gainer, up over 2% on BSE, gaining for a second straight session with TCS and Infosys gaining 3.2% and 2.1% respectively.

Bank of Baroda rose around 1.7% ahead of its Q3 earnings report.

SBI gained over 1% during intra-day but later pared gains to settle in red after the company reported its first jump in quarterly profit since mid-2015. The company reported a 134% rise in standalone net profit at Rs 2,610 crore in quarter ending December 2016 as compared to Rs 1,150 crore in the corresponding quarter a year ago.

Oil & Gas sector was the major sectoral loser dragged by IOC, GAIL and BPCL. GAIL fell 1.5% ahead of its Q3 earnings.

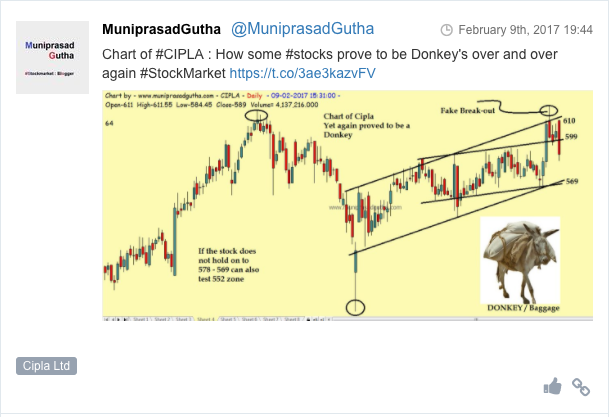

Company: Cipla Ltd. CMP: 579.95 Mastermind

Company: NMDC Ltd. CMP: 145.70 Mastermind

Company: Cipla Ltd. CMP: 579.95 Mastermind

Company: Max Ventures CMP: 82.35 Mastermind